Am I eligible for the jobkeeper payment? Here’s everything you need to know to register

The Australian government has announced a $1,500 per fortnight wage subsidy to eligible employers amid the coronavirus. Check your eligibility, how much you’ll get and how it works with the jobseeker payment

Source:The Guardian

The Morrison government has announced a $130bn support package with a new jobkeeper payment – a wage subsidy to keep Australians in work.

So who exactly is eligible for this payment and how much will they receive?

How much is the payment worth?

The federal government will pay eligible employers $1,500 per fortnight for each eligible worker, about 70% of the national median wage.

Jobkeeper is about $400 a fortnight more than the $1,100 JobSeeker payment with the coronavirus supplement for those out of work.

Who is eligible for jobkeeper?

In order to receive a payment, both the employer and employee must meet eligibility criteria.

Eligible employers are businesses (including companies, partnerships, trusts and sole traders), not-for-profits and charities:

With a turnover of less than $1bn that have lost 30% or more of their revenue compared to a comparable period a year ago.

- With a turnover of $1bn or more and with at least a 50% reduction in revenue compared to a comparable period a year ago.

The big banks subject to the banking levy are not eligible.

Eligible employees:

Were employed by an eligible employer at 1 March 2020

- Can be sole traders, full-time, part-time, or long-term casuals employed on a regular basis for longer than 12 months as at 1 March 2020.

- Are at least 16 years of age.

- Are an Australian citizen, the holder of a permanent visa, a protected special category visa, a non-protected special category visa who has been residing continually in Australia for 10 years or more, or a New Zealander on a special category (subclass 444) visa.

The government estimates that six million workers will receive this payment. Gig economy workers will be covered, as they are sole traders.

What if I am on a temporary visa?

Scott Morrison explained that New Zealanders on 444 visas will get the payment because “they are part of an ongoing economy in Australia”.

“We are about keeping them part of it economy because they are part of what happens on the other side,” he told reporters in Canberra.

The government has announced it will allow backpackers to extend their stay in Australia and most temporary visa holders to access superannuation payments early.

Seasonal workers will be exempt from a rule that normally prevents them from staying with the same employer for more than six months.

Any seasonal workers will have to self-isolate for 14 days before they start working in regional communities.

How will it be paid?

Eligible employers will be paid $1,500 per fortnight per eligible employee from 30 March 2020, for a maximum of six months.

Eligible employees will receive from their employers a minimum of $1,500 per fortnight, before tax. Employers are able to top up the payment.

Employers will pay employees as usual and payments will be made to the employer monthly in arrears by the Australian Tax Office.

Will I receive $1,500 even if I ordinarily earn less?

If an employee ordinarily receives less than $1,500 in income per fortnight before tax, their employer must pay them, at a minimum, $1,500 per fortnight, before tax. It is therefore possible for a long-term casual or part-time worker to receive more than their ordinary pay.

What if I was stood down or sacked?

If an employee has been stood down, their employer must pay their employee, at a minimum, $1,500 per fortnight, before tax.

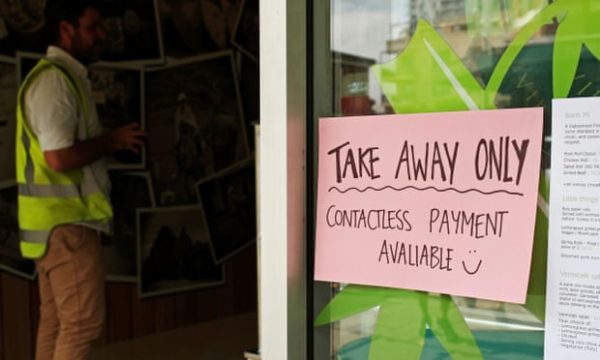

This means that employees of businesses that shut down due to various restrictions – such as cafes, restaurants, theatres, casino workers and the like – will continue to be paid even if they are not working.

If an employee was employed on 1 March 2020, subsequently ceased employment with their employer, and then has been re-engaged by the same

eligible employer, the employee will also receive, at a minimum, $1,500 per fortnight, before tax.

Treasurer Josh Frydenberg said this payment “changes the equation” and he expects employers who were forced to lay off workers may now “put them back on the books”.

When will it start being paid?

The subsidy will start on 30 March, with the first payments to be received by

employers in the first week of May. In the meantime, employers must continue paying their employees and then claim the money from the first week of May.

Businesses will be able to register their interest in participating in the payment from 30 March on the ATO website. At 5pm on Monday 8,000 had already registered.

What about superannuation?

Employers must continue to pay the superannuation guarantee on regular wages but it is up to employer whether they pay superannuation on additional job keeper payments.

For example, a worker who ordinarily receives $1,000 a fortnight plus superannuation will receive the $1,500 jobkeeper payment, with superannuation paid on the first $1,000 and the employer able to decide whether to pay it on the last $500.

Can I get the jobkeeper and other payments?

A person receiving the jobkeeper payment cannot also receive the jobseeker

payment (formerly Newstart). People who have already applied for jobseeker can withdraw and shift to jobkeeper payments if they are re-engaged by their employer.

A person cannot be in receipt of jobkeeper payments from two or more employers.

What about eligibility for jobseeker payments?

Eligibility has been expanded. At the moment, Australians out of work are not eligible for the jobseeker payment if their partner earns $48,000 or more.

Under changes made on Monday, people will be eligible for job-seeker payments unless their partner earns $79,762 or more.

Does this require legislation?

Yes. Morrison said parliament will reconvene “as quickly as possible” with a smaller than usual sitting in Canberra, as occurred for the last stimulus package.

Since you’re here…

… we’re asking readers like you to make a contribution in support of our open, independent journalism. In these frightening and uncertain times, the expertise, scientific knowledge and careful judgment in our reporting has never been so vital. No matter how unpredictable the future feels, we will remain with you, delivering high quality news so we can all make critical decisions about our lives, health and security. Together we can find a way through this.

We believe every one of us deserves equal access to accurate news and calm explanation. So, unlike many others, we made a different choice: to keep

Guardian journalism open for all, regardless of where they live or what they can afford to pay. This would not be possible without the generosity of readers, who now support our work from 180 countries around the world.

We have upheld our editorial independence in the face of the disintegration of traditional media – with social platforms giving rise to misinformation, the seemingly unstoppable rise of big tech and independent voices being squashed by commercial ownership. The Guardian’s independence means we can set our own agenda and voice our own opinions. Our journalism is free from commercial and political bias – never influenced by billionaire owners or shareholders. This makes us different. It means we can challenge the powerful without fear and give a voice to those less heard.

Your financial support has meant we can keep investigating, disentangling and interrogating. It has protected our independence, which has never been so critical. We are so grateful.

We need your support so we can keep delivering quality journalism that’s open and independent. And that is here for the long term. Every reader contribution, however big or small, is so valuable. Support the Guardian from as little as $1 – and it only takes a minute. Thank you.

No Comments