Blue Ocean Group acquires 60 per cent stake in Kelsey Development – By Hiran H.Senewiratne

Source:-island

Leading real estate company, Blue Ocean Group, yesterday acquired a 60 per cent stake in Kelsey Development PLC for Rs. 257 million, on Tuesday, stock market analysts said.

The stake amounting to 10.457 million shares was done at Rs. 24.60. The sellers were the Schaffter brothers, Praksah and Ramesh, who held 30% each.

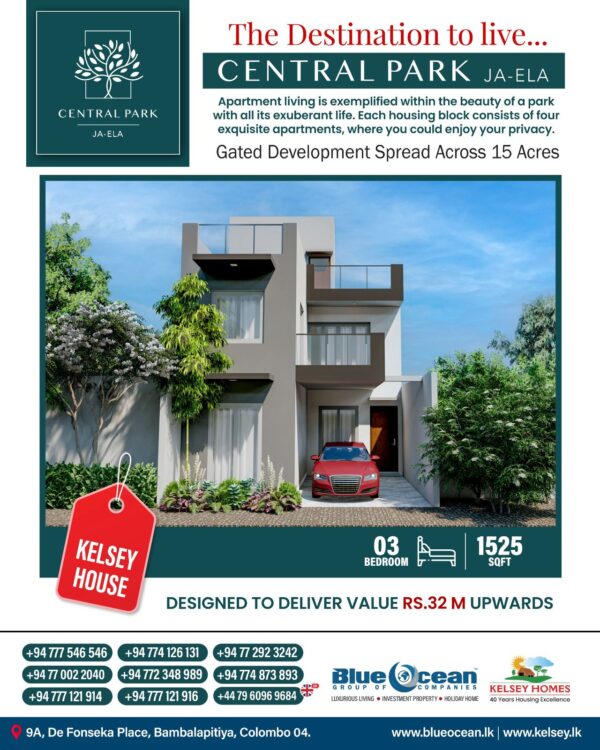

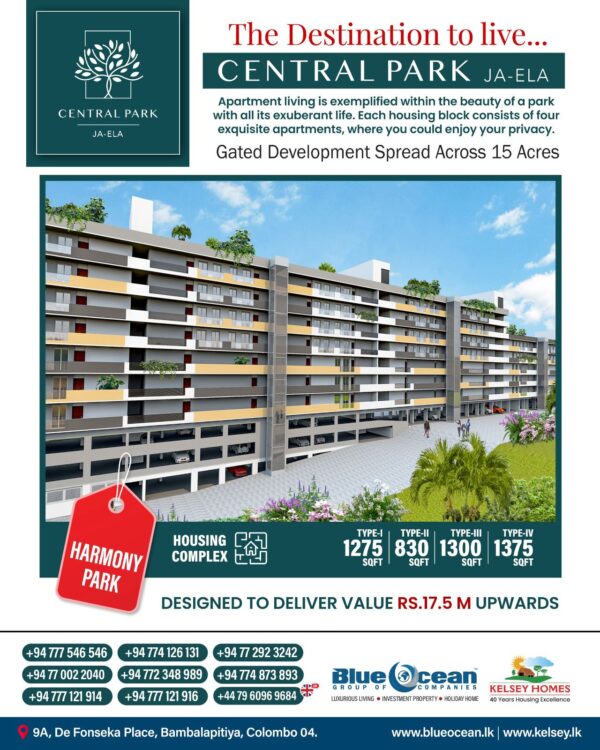

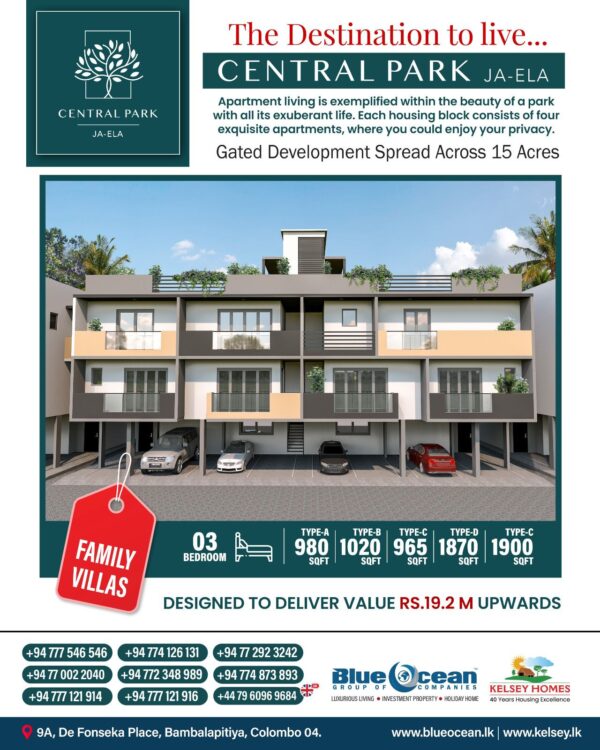

With the acquisition of control, Kelsey will be a member of the Blue Ocean Group, a pre-eminent real estate conglomerate with a well-balanced portfolio, founded by top professional cum business leader Sivarajah Thumilan who is also the chairman and CEO.

Control of Kelsey was held by Janashakthi Ltd. and related parties. In September the parent, Janashakthi Ltd., sold its entire stake of 85.24 per cent or 14.85 million shares to Kelsey, to its ultimate shareholders Prakash and Ramesh with a view of restructuring the internal balance sheet of the Janashakthi Group. The transaction was done at Rs. 24.60 per share.

Yesterday, CSE witnessed panic- selling of shares mainly in blue chip counters due to worries on margin call in spite of overall positive sentiment following the Central Bank Governor Dr Nandalal Weerasinghe’s comments at a post budget panel discussion.

Dr Weerasinghe said that the current situation in the country is now getting better and manageable.

The turnover level was quite satisfactory; however, shares slipped over 2.5 per cent in mid-day trade dragged down by index heavy shares, market analysts said.

“Earnings reports of big counters are not so impressive this time and that’s bringing the market down,” market analysts said.

Both indices moved downwards. The All Share Price Index went down by 155.9 points and S and P SL20 went down by 62.2 points. Turnover stood at Rs 1.6 billion with a single crossing. The crossing took place in Central Finance, which crossed 2.2 million shares to the tune of Rs 140.8 million and its shares traded at Rs 64.

In the retail market top seven companies that mainly contributed to the turnover were, Expolanka Holdings Rs 452 million (3.4 million shares traded), Lanka IOC Rs 183 million (1.1 million shares traded), Browns Investments Rs 64.7 million (12.5 million shares traded), LOLC Holdings Rs 63.6 million (181,000 shares traded), ACL Cables Rs 54.3 million (779,000 shares traded), JKH Rs 47.2 million (336,000 shares traded) and LOLC Finance Rs 46.8 million (7.21 million shares traded). During the day 69.8 million share volumes changed hands in 20000 transactions.

It said high net worth and institutional investor participation was noted in Central Finance and Browns Investments. Mixed interest was observed in Sunshine Holdings and Sri Lanka Telecom, whilst retail interest was noted in LOLC Finance, First Capital Holdings and Prime Lands Residencies.

The Capital Goods sector was the top contributor to the market turnover (due to Hemas Holdings) while the sector index lost 0.71 per cent. The share price of Hemas Holdings recorded a gain of 50 cents to close at Rs. 56.

The Telecommunication Services sector was the second highest contributor to the market turnover (due to Sri Lanka Telecom and Dialog Axiata), while the sector index increased by 5.51 per cent. The share price of Sri Lanka Telecom gained Rs. 8.20 (12.83 per cent) to close at Rs. 72.10. The share price of Dialog Axiata appreciated by 10 cents to close at Rs. 8.50.

Yesterday, the Central Bank- announced US dollar rate buying rate was Rs 360.98 and the selling rate Rs 371.77.