Exclusive: Raghuram Rajan explains how to fix the economy

Professor of Finance at the University of Chicago Booth School of Business and former RBI governor Raghuram Rajan offers his prescription to revive the distressed Indian economy.

Source:-IndiaToday

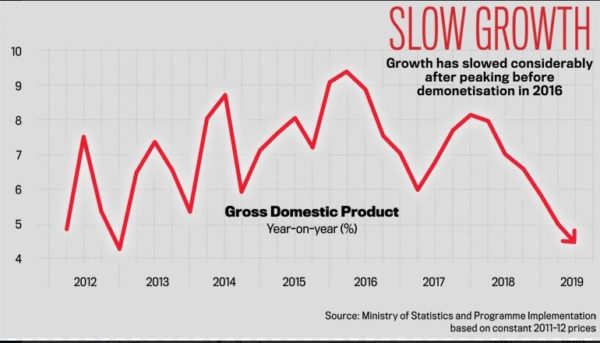

There are signs of deep malaise in the Indian economy. Growth is slowing significantly and there is currently little fiscal space available to the government to spend more. Corporate and household debt is rising, and there is deep distress in parts of the financial sector. Unemployment, especially amongst youth, seems to be growing, as is the accompanying risk of youth unrest. Moody’s just sounded the alarm on India’s credit rating. Given that in late 2017, even after the economically ill-advised demonetisation and the poorly implemented roll-out of the Goods and Services Tax (GST), Moody’s had upgraded India’s sovereign rating, it can hardly be accused of bias. Repeated government allusions to a $5 trillion economy by 2024, which would necessitate steady real growth of at least 8-9 per cent per year starting now, seem increasingly unrealistic. What is going wrong, and how do we fix it?

The government’s economic travails seem to contrast with its successes — until the recent debacle in Maharashtra — on its political and social agenda, including effectively abrogating Article 370 and building the Ram Mandir in Ayodhya. Yet these might be two sides of the same coin — the reasons why the government has succeeded in its political and social agenda may indeed also be why it has not delivered on its growth ambitions.

Legacy Problems

To be sure, Prime Minister Narendra Modi’s government inherited a number of problems when it took charge in 2014. A large number of infrastructure projects had stalled because of difficulties in land acquisition, lack of inputs like coal or gas, or the slow pace of obtaining government clearances. Existing power producers were running into difficulties as heavily indebted power distribution companies delayed payments or stopped buying. India experienced the absurdity of surplus power capacity even as power demand went unmet. As more promoters ran into financial distress, bad loans on bank balance sheets increased, slowing the flow of new credit.

The agricultural sector was also in a mess. In part, this resulted from decades of misguided government intervention such as distorted pricing and subsidies — which resulted in anomalies such as a water-short nation exporting water-thirsty rice. In part, this resulted from neglect; successive governments did little to eliminate the hordes of middlemen who took their cut as food travelled from the farm to the fork; instead, governments spent scarce resources on loan waivers, a form of misdirected cash transfer, rather than on improving farmer access to new technologies, seeds or land. Prime Minister Modi was elected, not just because his record in Gujarat suggested he would resolve these legacy issues, but also because he promised reforms that would enhance growth and employment.

The Need for Growth-Enhancing Reforms

And reforms were overdue. The liberalising growth-enhancing reforms in the 1990s and early 2000s, undertaken by governments from a variety of political leanings, focused on removing some of the shackles that constrained Indian growth, such as the requirement of hard-to-get licences to open businesses, the reservation of certain sectors for small businesses or for the state, and the high tariffs that kept Indian business uncompetitive. The NDA government under Prime Minister Atal Behari Vajpayee was the last steady reformer, but it was voted out of office before it could turn to the most difficult reforms, on the business environment, labour, land and the role of the public sector. The UPA coalition that was elected in 2004-2009 did not have the internal consensus to pass growth-enhancing reforms, while the one that followed in 2009-2014 was paralysed by scams and opposition non-cooperation. Cross-party consensus emerged only for redistribution-increasing reforms, such as the national rural employment guarantee scheme (NREGA) and the National Food Security Act. As growth slowed after the global financial crisis, the lopsided focus on redistribution put pressure on the government’s fiscal health. Starting in 2012 under finance minister P. Chidambaram, the UPA started refocusing on restoring macroeconomic stability.

As with the UPA, the successes of the Modi administration have been in redistribution. but enhanced spending without revenue growth has led to a deterioration in government finances

The Modi government initially continued this process, aiming to bring fiscal spending under control and halting the window-dressing that accompanied past budgets. It approved the RBI’s emphasis on arresting inflation. And as the mounting dud loans in the public sector banks dramatically slowed their lending, it supported the RBI’s clean-up by passing the Insolvency and Bankruptcy Code (IBC). The important GST reform, aiming to unify the Indian market and improve tax compliance, as well as the Real Estate (Regulation) Act, aiming to clean up practices in the real estate sector, were also genuine attempts to improve India’s institutional structure.

Yet, as with the UPA’s attempt to improve environmental regulation, the Modi government found that reforms that attempt to change existing practices have unintended consequences, which tend to slow activity. For instance, as promoters started recognising they could lose their firms in bankruptcy, they (rightfully) stopped treating bank loans as risk capital. Bankers, too, became more risk-averse as they saw they had to recognise losses, not just evergreen them and pass them on to their successor. That meant new sources of risk capital had to be found, not by abandoning reforms as suggested by the affected interests, but by reforming more; for instance, by improving corporate governance and attracting foreign investors or by enhancing the evaluation capabilities of Indian insurance companies and pension funds and allowing them to take more risk. It also meant the government had to de-risk projects by making it easier to acquire land and get the necessary clearances. In other words, growth-enhancing reforms needed follow-up. The government had to appreciate the unintended consequences of its actions and reform further.

The Modi government’s record here is decidedly mixed. For example, while it showed substantial political acumen in navigating the GST legislation through Parliament, the executive thoroughly mishandled the roll-out. The government creditably understood the need for remedial action. However, frequent changes to procedures and rates have undercut compliance and added to confusion and uncertainty-for instance, the prospect that GST rates for autos might be brought down has dampened auto sales recently. Moreover, follow-up tweaks have been in the wrong direction — inspectors have been given powers to stop and search vehicles, thus vitiating the intent of creating a system that provided its own incentives. Collections are far below what was anticipated, and the growth benefit less than it might have been. Given that the Centre has offered minimum revenue guarantees to the states to persuade them to vote for the Act, this is likely to add to its already onerous fiscal burden.

At least on GST, the government continues to try and improve the system, though what is needed is a clear medium-term plan based on experience, describing what will be fixed and when rather than constant short-term fine-tuning that adds to uncertainty. In other areas like banking sector reform, early attempts to improve governance of public sector banks, for example, by setting up an entity like the Bank Board Bureau, have been stifled by bureaucratic manoeuvring and lack of political will. Public sector bank boards continue to have little independence, and the new diktat on merging banks, delivered from the finance ministry, will occupy management energy which needs to be spent on cleaning up bad loans and resuming sensible lending. More problems are building for the future with the focus on Mudra lending and loan melas, even as banks are given the regulatory dispensation to overlook the rising non-payment on these loans.

As for the unfinished reforms on the business environment, land acquisition, labour and the role of the public sector, the Modi government has shown surprising timidity. Initially, it appeared to entertain the idea of reforms in these areas. However, these reforms were largely put on the back burner as soon as the Opposition alleged the government was in the pockets of business. The government did improve India’s ranking on the World Bank’s ‘Doing Business’ indicators, but while some procedures may have been simplified in Delhi and Mumbai (where the World Bank measures progress), business sentiment does not suggest that the fundamental difficulties in doing business have changed. With the growth benefits of the reforms in the Vajpayee era nearly exhausted, and with legacy problems unaddressed, growth has been slowing dramatically.

PSU bank boards continue to have little independence and the recent diktat on merging of banks will occupy management energy that needs to be spent on clearing up bad loans

As with the UPA, the successes in the five and a half years of the Modi administration have been in redistribution. So the Jan Dhan programme has rolled out bank accounts for all, the Swachh Bharat programme is building toilets for all, the Ujjwala Yojana is distributing gas connections to poor women, Ayushman Bharat is rolling out medical services to the poor, while the Mudra programme combined with loan melas is attempting to give business loans to anyone who has a need. The government has steadily increased spending on the UPA’s flagship NREGA programme.

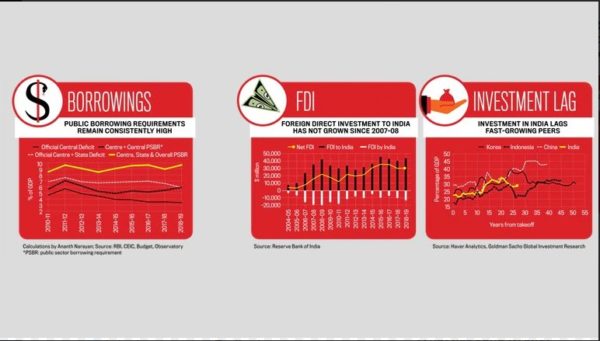

Redistribution is a worthy goal and many of these programmes have benefitted the poor. However, enhanced spending without strong revenue growth has led to a deterioration in government finances, especially as inflation is no longer available to erode the value of government debt. Even the Comptroller and Auditor General has had to call out the government for resorting to off-balance sheet fiscal irregularities once again. Indeed, the pressure is now falling on the private sector as many government entities stretch out payments so as to avoid recognising spending.

What has gone wrong?

To understand what has gone wrong, we need to start first with the centralised nature of the current government. Not just decision-making but also ideas and plans emanate from a small set of personalities around the Prime Minister and in the Prime Minister’s Office (PMO). That works well for the party’s political and social agenda, which is well laid out, and where all these individuals have domain expertise. It works less well for economic reforms, where there is less of a coherent articulated agenda at the top, and less domain knowledge of how the economy works at the national rather than state level.

Furthermore, somewhere along the line, the political and social agenda has assumed priority, perhaps because the centre of power has more comfort with it, and it has insufficient political bandwidth and space of mind to do both. In particular, implementing the political and social agenda requires the accumulation of political power, which is achieved by populist economic measures. Growth, although it is often a stated objective, has assumed secondary importance, especially if it requires actions that may have significant political costs.

Extreme centralisation might work if it was supported by a coherent economic vision at the Centre. Previous governments may have been untidy coalitions, but they consistently took the path of further economic liberalisation, withdrawing the government from tasks it did poorly and enhancing competition. The Modi government came to power emphasising ‘minimum government, maximum governance’. This slogan is often misunderstood. What was meant was that government would do things more efficiently, not that people and the private sector would be freed to do more. While the government continues the creditable drive to automation — direct benefits transfer to recipients is an important achievement — the role of the government in many spheres has expanded, not shrunk.

Extreme centralisation, along with the absence of empowered ministers and the lack of a coherent guiding vision, ensures reform efforts pick up steam only when the PMO focuses on them, and lose impetus when its attention switches to other pressing issues.

Such extreme centralisation, coupled with the absence of empowered ministers and the lack of a coherent guiding vision, ensures that reform efforts pick up steam only when the PMO focuses on them, and lose impetus when its attention switches to other pressing issues. Often, these efforts take the form of grand gestures because the problems are large and require significant response — so we get demonetisation, bank mergers, corporate tax cuts. However, such episodic moves are not necessarily well-timed or synchronised towards a larger vision, so any associated economic benefits are diluted. Moreover, the follow-up to deal with the unintended consequences is inadequate since the line ministries are disempowered.

The starting point will be to recognise the magnitude of the problem, to not brand every internal or external critic as politically motivated, and to stop believing the problem is temporary and that suppressing bad news and inconvenient surveys will make it go away.

So, for example, the Make in India initiative — which presumably is also meant to draw foreign direct investment (FDI) and global supply chains to India — is undercut by constant fiddling with tariffs and taxes, as well as rule changes intended to favour domestic incumbents. A case in point is the RCEP trade pact, where India’s refusal to participate seemed a sudden decision. If India does not participate (though it still might), it risks becoming an even less attractive investment destination. Foreign investors have not exactly been surging to invest in India — FDI today is not much higher in dollar terms than in 2007-2008, even though the economy is much bigger [see graphic: FDI]. Unfortunately, domestic businesses have not been investing either, and the stagnation in investment is the strongest sign that something is deeply wrong.

Well of uncertainty: Regulation such as RERA, though wellintended, has exacerbated the slowdown (Photo: Chandradeep Kumar)

What can be done?

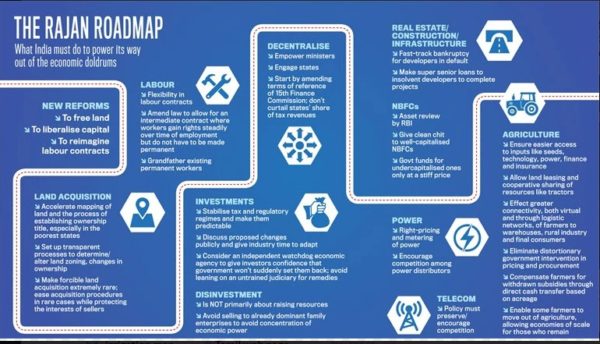

The starting point has to be to recognise the magnitude of the problem, to not brand every internal or external critic as politically motivated, and to stop believing that the problem is temporary and that suppressing bad news and inconvenient surveys will make it go away. Furthermore, even if some of the problems are legacies, the government, after five and a half years in power, needs to resolve them. A massive new reform thrust is needed, accompanied by a change in how the administration governs. Decentralisation is critical for economic growth. While the Centre has to give direction and political impetus to reforms, it cannot hold on to every rein. It has to start by empowering its own ministers, and also engage the states since many of the actions need state support. To regain the trust of the states, the Centre could start by amending the terms of reference of the Fifteenth Finance Commission, which seem to push for a reversal of the revenue devolution put in place by past commissions. A coherent agenda would include:

Put out the spreading fires

The construction, real estate and infrastructure sectors are in deep trouble, and so are lenders to it like the non-bank finance companies (NBFCs). In turn, this is hurting rural areas which relied on land sales and employment in construction for supplemental income. No doubt, some of the initial stress has mitigated, especially for well-managed NBFCs. However, a number of NBFCs still face problems, and the longer they fester, the bigger the eventual losses will be, and the more likely it will be to spread to banks that have lent to NBFCs as well as to construction projects.

Instead of pouring good government money after bad, the sector first needs to be cleaned up, starting with the NBFCs, but continuing into the big distressed developers. The starting point could be a quick asset quality review of the largest NBFCs by the RBI, with a clean chit given to those that are well-capitalised, while those that are undercapitalised should be asked to raise capital quickly, with a government-supported fund providing capital to those who cannot at a stiff price. The government is sensibly applying the IBC to NBFCs that are insolvent. In parallel, developers who are in default should be put into fast-track bankruptcy, with super-priority loans made available from the government-supported fund (if no other funding is available) so that they can complete projects. Some steady pressure should be placed on real estate developers, especially those that get financial help, to reduce the overhang of unsold properties. A full-fledged fire sale, however, is in no one’s interest.

“A massive new reform thrust is needed, along with a change in how the administration governs. decentralisation is critical for economic growth. the centre has to give direction and political impetus to reform, but it cannot hold on to every rein”

Similar attention should be paid to reviving stalled infrastructure projects. The power sector, where the government’s UDAY programme to reform power distribution companies has gone seriously off track, needs special attention — the muted investment and the distress amongst existing producers will put a ceiling on India’s future growth since power cannot be conjured up instantaneously. The Centre and states should come together to ensure power is adequately priced and metered, and that past contracts are adhered to so that producers have confidence they will be compensated. Best practices across states should be shared. There should be more competition within state-owned distribution companies, especially among units facing customers — for instance, by breaking up that function, and possibly privatising some of it. Competition could also be encouraged from other out-of-state distribution companies — including allowing producers to sell to the highest bidder on the national grid. As in the past, the Centre could offer bonuses for reforms, but unlike the case with UDAY, they should do so only when the results start coming in.

Finally, the telecom sector deserves special mention, for it is where a promising growing sector has morphed into a deeply distressed one, which is heading toward a monopoly or duopoly through much of the country. In the short run, the objective has to be to preserve sufficient competitors in the sector-once again, the Centre is creditably starting to move after disregarding mounting problems for a while. In the longer run, India should re-examine its regulatory process and ensure a level playing field within the sector.

Create an environment for investment and growth

India needs a re-energised reform programme that focuses on liberalising capital, land and labour markets. With the right attention, sectors that are distressed today, such as agriculture, construction and power, can become engines of growth.

Agricultural reforms should ensure easier access to inputs like seeds, technology, power, finance and insurance. They should allow for greater leasing of land and cooperative sharing of resources like tractors. They should effect greater connectivity, both virtual and through logistic networks, of the farmer to warehouses, rural industry and final consumers. As these reforms are implemented, constant and distortionary government intervention at every stage of production, including in pricing and procurement, should be eliminated. Much of it should be compensated by a direct cash transfer to farmers based on acreage. The broader intent should be to enable some farmers to move out of agriculture, allowing the remaining farmers to enjoy scale economies.

Land acquisition today is extremely difficult, which then impedes construction, not just of highways and railroads, but also of industrial plants, office parks and affordable housing. India needs to accelerate the mapping of land and the process of establishing ownership title, especially in the poorest states. It also needs to establish a more transparent process of determining and altering land zoning, as well as registering changes in ownership, recognising that some agricultural land will inevitably have to be used for development. Finally, while forcible land acquisition should be used extremely rarely, the Centre should draw on the best practices in states to modify the legislation on land acquisition so that it becomes easier to implement while protecting the interests of the seller.

As economist Arvind Panagariya has reiterated often, India needs to encourage firms of greater scale, which will have the productivity to make India competitive. An important element here is to allow more flexibility in labour contracts. Today, industrial firms are either forced to make their workers permanent after a year on the job, or keep them dangling on short-term contracts, where they are fired periodically so that they have no claims to permanence. Faced with this Hobson’s choice, employers ensure much of Indian labour is contractual and impermanent, so that firms have little incentive to invest in their training and workers have little job security. Government needs to amend legislation, after discussions with unions and employers, to allow for an intermediate contract where workers gain rights steadily over time (such as greater severance pay) but do not have to be made permanent. Existing permanent workers can be grandfathered.

Promote domestic competition

One spur to greater domestic efficiency is competition. India needs to increase internal competition steadily by reducing tariffs and joining free trade agreements judiciously. Exports today are import intensive, and India cannot make more in India if trade barriers are high. Indeed, one of the surest ways to take India back to the Hindu rate of growth is to reverse the steady trade and investment liberalisation begun in the 1990s. To those who argue that India is uncompetitive, its history should suggest that keeping barriers to competition high is the surest way to ensure it remains uncompetitive. As India brings down barriers, its business sector will cope, innovate and reinvent itself. This is not economic theology, it has been India’s own experience.

“Labour contracts need more flexibility. currently, indian labour is contractual and impermanent. so, firms have little incentive to invest in their training, while the workers have little job security”

To attract more investment, India has to become more predictable on tax and regulatory changes. Rather than making these changes in bureaucratic backrooms, based on dubious rationales and influence, these have to come out in the open. Proposed changes should be put out for comment, debated and, when implemented, should allow time for industry to adapt. Some regulatory agencies in India already follow this process, more need to. It may also be worthwhile having an independent watchdog economic agency (like the Competition Commission) that evaluates the impact of each new important regulation on costs, competition and productivity, and encourages rethinking where necessary. Investors will gain more confidence that regulatory changes are appropriate, and there will be less resort to an untrained judiciary for remedial action.

Labour contracts need more flexibility. Currently, Indian labour is contractual and impermanent. So, firms have little incentive to invest in their training, while the workers have little job security.

More generally, minimum government should mean reining in government where excessive, and making it more transparent and predictable where it is truly needed. Government should withdraw, where possible, from directly doing business. The recent announcement that a number of firms will be privatised is welcome, but this should not be seen primarily as a resource-raising exercise. Nor should government assets be sold to already-dominant family enterprises in the economy, exacerbating the concentration of economic power. Instead, the focus should be on creating a governance and incentive structure for the privatised firms so that their employees and assets can be used most productively for national development. That will require thoughtful design.

The government will not shrink everywhere. To improve governance, government may have to expand its capabilities, especially in areas like environmental regulation or regulating the quality of education, food and health. For India cannot overlook its service sectors, which could become new engines of growth, producing many jobs even while making its people more capable of doing those jobs. Reforms in education, healthcare, tourism and finance, easing the way for entry and investment while protecting the consumer experience, could be India’s new path to economic development. For instance, India’s doctors and hospitals could treat more of its own people, as well as the world, if India facilitated the opening of more medical colleges and hospitals. At the same time, it should make the accreditation process and the regulation of service quality transparent and rigorous so that quacks and the incompetent are ferreted out. Regulators should encourage the development of new technologies to collect information and assess customer experience, and should themselves make more use of these.

There are plenty of commissions and books that have opined on each of these issues, so the government does not have to look too far for advice. And there are plenty of Indian experts, some within the government itself, who can guide the reform process in specific areas. However, this requires the government to trust and empower expertise, including in its own institutions, as it manages the reform process.

An unconstrained government, bulldozing its way by empowering its investigative and tax agencies, will cow valuable criticism, paralyse officials and make businesses wary about long-term investment.

There is a tendency for those in power to want more control, and this government is no exception, especially given the social and political agenda it is focused on. Yet an unconstrained government, attempting to bulldoze its way by empowering its investigative and tax agencies, will cow valuable criticism that allows it to adjust course in a timely way, paralyse its own officials who fear similar actions by future governments, and make business wary about long-term investment. Our investigative and tax agencies should be professionally focused on true and egregious criminality — is it not worrisome that no large bank fraudster has been brought to book in recent years? However, professionalism also means agencies should not be permitted to go on fishing expeditions, should be wary of appearing to criminalise all business, and should certainly not give the impression that they are being used for political retribution.

On the tourist track: Tourism as well as healthcare, education and finance could be the new path to development (Photo: Shutterstock)

The immediate challenge

India is in the midst of a growth recession, with significant distress in rural areas. At the same time, economic commentators like Ananth Narayan place India’s true consolidated fiscal deficit at between 9 and 10 per cent of GDP. These are alarming numbers, especially as India’s debt is no longer being eroded by high rates of inflation. India needs fiscal space to deal with its legacy problems, as well as to target resources to its most needy citizens in rural areas. India has to cut back on unneeded spending, become more transparent on the size of the fiscal challenge, and put in place mechanisms that will get us back to fiscal health over the medium term.

Demand is weak, which ordinarily means more stimulus to encourage private spending. With the stress in the financial sector, monetary policy has limited effectiveness. On the fiscal side, recent corporate tax cuts, which were a short-term boost to stock prices, may not deliver much-needed business investment when there are so many other impediments. Given scarce resources, India should not jump immediately to a permanent tax cut for the urban middle class to boost consumer demand. Instead, while growth-boosting reforms are being put in place, scarce fiscal resources are perhaps best targeted toward supporting the rural poor — for instance, by bolstering the NREGA programme and by funding rural road construction.

Instead of building gigantic statues to national or religious heroes, India should build more modern schools that will open its children’s minds, make them more tolerant and help them hold their own in the competitive globalised world of tomorrow.

India can obtain more fiscal room today if it shows that it recognises the need to bring government spending in line with national savings over the medium term. It has to be careful about seemingly easy ways out. Privatisation, for example, is worthwhile if well-designed, but whether a mutual fund buys a government bond or stock sold by the government in a privatisation will not alter the fact that the government is absorbing scarce national resources for spending. Similarly, the government cannot endlessly take on contingent liabilities without recognising they will have to be paid for — recent proposals to boost bank deposit insurance to Rs 5 lakh per individual, while popular, will mean an enormous liability. The costs will be seen when weak cooperative banks, that will gain more deposits as insurance limits are boosted, fail. Instead, deposit insurance should be raised only in parallel with improvements in the governance and regulation of the cooperative sector. The broader point is that India needs a full accounting of its contingent liabilities, including on entitlements like food security and Ayushman Bharat, if it is to give a convincing picture of its fiscal health.

Finally, India needs to lay out a credible roadmap and time frame over which it will return to fiscal rectitude. As suggested by the FRBM committee, a commitment to bring public debt down to a target level over the medium term, and the creation of a watchdog institution like a fiscal council to limit creative accounting, will ensure India has some fiscal space to act today. Of course, India has consistently postponed fiscal consolidation when consolidation has required hard choices. Much as with inflation targeting, the government will have to think long and hard about how it can limit its own future flexibility. The rewards in terms of low interest rates and fiscal space will be well worth it, much as inflation targeting has brought India low inflation and a stable exchange rate. It does mean, however, that the government will have to accept institutional constraints on its own actions.

The Political and Social Agenda

Majoritarianism is popular across the world, and India is no exception. Apart from fomenting social tension, which India can ill afford, Hindu nationalism will detract from economic growth — which will exacerbate social tension further. Instead of allowing the government’s political and social agenda to crowd out its economic agenda, would it not be better if economic well-being was the route to political and social regeneration?

The best way to integrate our minorities is to give them a better pathway through good schools and excellent liberal colleges to the promise of India. The best way to integrate our peripheral states into the mainstream is to give them stronger justification to be part of India, to make full economic integration irresistible. But this means embracing a different path to the one India is on. It requires more political decentralisation even while India integrates economically. It also means different economic policy choices. For instance, instead of building gigantic statues to national or religious heroes, India should build more modern schools and universities that will open its children’s minds, making them more tolerant and respectful of one another, and helping them hold their own in the competitive globalised world of tomorrow.

The actuality of robust inclusive economic growth is a far better way of achieving the agenda of a strong united India. India has a powerful government today, with a charismatic popular prime minister. It can hope that growth will revive in due course and it almost surely will. But it will be far less growth than what India owes its youth. Hopefully, the government will read the writing on the economic wall.

No Comments