Noel News

There’s only one thing that stands in the way

of allowing our goals to become our reality: ourselves.

DAVID MELTZER

Source:Noel News

Welcome to our August newsletter. The two most unexpected things of the last month have been, first, the worsening situation in Victoria and, second, the strength of local and international share markets. What has happened in Victoria is a stark reminder of how bad things can get if they are allowed to get out of control. Of course, as I have said repeatedly, the aftermath of covid will be felt by us all for years to come.

My wife Geraldine and I have spent most of the last three months at our Sunshine Beach home as I’m furiously working to finish my new book, Retirement Made Simple, which will be released in time for Christmas.

The challenging thing about a retirement book is the massive amount of information that needs to be covered, including topics on investing, superannuation, tax, estate planning, downsizing, investor psychology, risk, and how to avoid scams.

I’m sure you’ll enjoy the final product because the right decision can save you enormous amounts of stress and hundreds of thousands of dollars in the process – it’s why I’m so committed to making the book as comprehensive and practical as possible. I’ll keep you posted when we get nearer to completion.

Anyone who owns property knows that maintenance is a major ongoing expense, and we recently had to replace our roof. As a result, our house has been covered in scaffolding for the last two weeks, but I enjoy chatting with the team who are doing the work and hearing their perspectives on the world – although I am amazed at how much many of them smoke. If I mention whether they had considered the financial cost of smoking, they always respond with, “I’m trying to give up.”

The renovation experience has also reinforced how difficult the building industry can be. One day it was too windy for them to be on the roof; on another day, they couldn’t work due to rain; and on a different occasion, the materials had not been delivered on time.

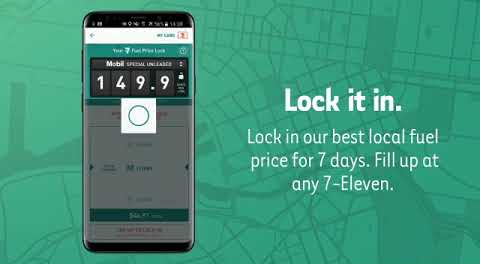

Speaking of wasting money, a lot of news outlets have reported the fluctuating fuel prices recently, yet most people I know can’t be bothered using the 7-Eleven Fuel app. Once you have it, you can ask it to search all available 7-Eleven petrol stations in your area and display the best price on offer.

If you like the price, you can simply lock it in for the fuel you require – that will be your fixed price for the next seven days. There is nothing to lose, because if the price at the pump on the day you fill up is cheaper than your locked-in price you can elect to use the pump price. After seven days, the locked-in price expires and you can start the process all over again.

This morning I needed fuel and noticed that petrol prices were very high. I punched in the “find best local price” and to my amazement I could lock in a price that was $0.40 a litre less than the pump prices. That saved me $15 on my fuel purchase. I asked the service station person if many people use the app and he said no.

In my books, I have said repeatedly that only 8% of people do it right. The older I get, the more I notice that so many people don’t seem to bother about making small savings because they fail to understand that its all those tiny savings that grow a fortune.

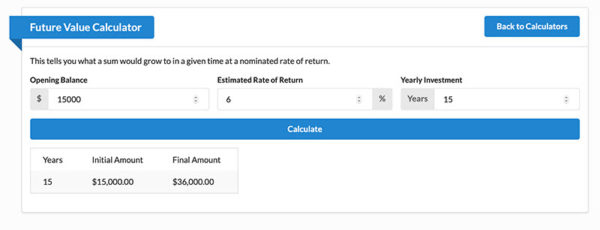

My New Calculators

There are chapters in my new retirement book about developing your own retirement strategy, but that requires calculations. I decided that the process needed to be simplified, so I’ve designed two new calculators that are incredibly simple to use, and they are live on my website now.

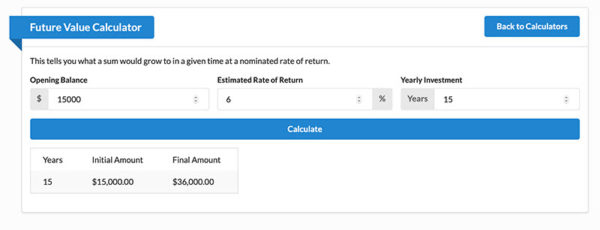

The first one is my ‘Future Value Calculator’ which is really a scaled-down version of my ‘Compound Interest Calculator’. It lets you enter an amount now, a rate of return, and a time period. The calculator then let you know the result in the set time.

This is how it is used in retirement calculations. After you do a budget today, you need to convert that to dollars in the year you retire. For example, you have calculated that you need $75,000 a year to live, inflation will be 2% per annum, and you are retiring in 10 years. Immediately, the calculator will tell you that, based on those figures, you will need $91,500 a year to live on in 10 years.

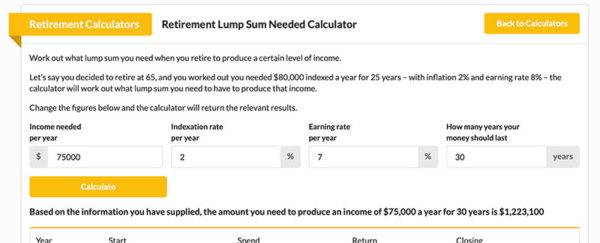

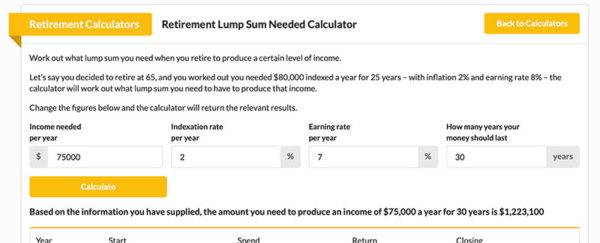

Now, let’s talk about the next calculator the ‘Retirement Lump Sum Needed Calculator’ – it has a lot of complex calculations behind it but is still simple to use. Let’s take that $91,500 a year, assume inflation is 2%, choose an earning rate of say 7%, and enter how many years you want your money to last. To keep it simple, let’s assume 30 years. The calculator will tell you that you will need $1.492 million in your portfolio to achieve those goals.

As I pointed out in the new book, that may seem a breathtaking figure, but you can use my ‘Superannuation Contributions Calculator’ to work out what your superannuation will be, and there may well be legacies down the track from family. That may make it even more complex because as your assets reduce you may become eligible for the age pension, which reduces the amount you will need, but if you keep drawing on assets the pension should increase. Under the present rates of pension, every decrease in assets of $100,000 increases your pension by $7,800 a year.

Once you start doing these calculations, you will see what needs to be done for a happy retirement.

Of course, don’t forget my Stock Market Calculator. It’s updated every month so as at today the data is available from January 1980 to end July 2020. It’s the perfect tool for modelling the behaviour of the Australian stock-market.

Understand Projections

I frequently receive emails asking me what I think inflation will be in 10 years and what forecast numbers they should use when doing calculations like the ones above. There is no simple answer, because the purpose of these calculations is to allow you to develop a strategy – you must revisit your assumptions every 12 months (or more) and revise your strategy as necessary.

For example, it’s probably reasonable to assume that forecast returns from growth assets should be inflation plus around 5 to 6% depending on your risk profile. This means if inflation is 2%, you should be running your numbers at around 7%. But of course, if inflation goes to 4% you may wish to run your numbers at around 11%.

The next challenge is to think about what is happening in the economy. If inflation did go to 4%, home loan rates may go to 6% or more. Imagine what would happen to all those overstretched homeowners in this country if rates did go to 6%.

|

Hedging against a market crash

Investing is not easy in these volatile times – the world is still in the grip of covid, and the outcome of the US presidential election is growing more uncertain by the day. Stock markets generally have been doing well, but it seems everybody I know fears that a big crash is just around the corner. Now, it’s a given that forecasting markets is a mug’s game, but there are now investment products available that can be used as a kind of a hedge.

On New Year’s Day 2020, an investor with $800,000 in blue-chip Australian shares has a premonition that there may be tough times ahead. He knows it’s important to keep at least three years planned expenditure readily accessible so he will never be forced to dump quality assets at a bad time. He does the numbers and decides an extra $100,000 would be useful to keep as a backstop. (For these examples, let’s assume his portfolio’s return matches the All Ordinaries Index.)

Option 1:

Withdraw $100,000 and bank it. The interest will be minuscule, but he has a satisfaction of knowing that there is no chance of capital loss, and the money is there when he needs it.

Option 2:

Buy some physical gold. In early January, gold was selling for USD $1,519 an ounce (AUD $2,267) so $100,000 would buy him 46 ounces. The AUD was then worth USD $0.67.

Option 3:

Try one of the relatively new hedging products, such as Beta Shares Australian Equities Strong Bear Hedge Fund (ASX code: BBOZ). It’s like an index fund except that it moves inversely to the All Ordinaries Index. And it has an extra twist – it’s designed to do double whatever the index does. So, if the index rises 5%, BBOZ should fall 10%. In early January the shares were trading at $9.69, so our investor bought 10,320 shares for his $100,000.

Let’s look at the next three months. The All Ords was sitting at 6,809 in early January, moved up to 7,230 on 21 February and then plunged to 4,564 on 23 March. The price of gold also fell – it went to USD $1,477, but our investor still did well. Because the Australian dollar had depreciated to USD $0.58, his gold was worth $117,100 Australian dollars. This is the benefit of owning assets in American dollars if our dollar falls.

Now let’s look at our new friend, BBOZ. Because its value is inversely proportional to the index, it hit a high of $20.15 when the market crashed, and then finished the day at $18.99. The original $100,000 had increased to $196,000. He now has some great choices available to him – he could choose to cash in all the BBOZ shares, bank $100,000 to restore his cash reserve, and spend the other $96,000 to restore his portfolio by buying into a market which has tanked.

As I have said repeatedly, every investment has an upside and a downside. If the market continued rising, BBOZ would have fallen at double the rate of the All Ords – but the investor would have achieved substantial capital gain, as well as an income stream, on the remaining $700,000 of the portfolio. BBOZ is a form of insurance, and, as we all know, insurance has a cost.

I’m told there are now other products available and more being developed. The other ones available now – both of which are listed on the ASX – have the codes BEAR and BBUS. The first one moves similarly to BBOZ, except its performance up or down matches the All Ords. BBUS tracks the entire American market, so it may be a reasonable punt for those who think the American market will go through turbulent times as the election in November gets nearer.

These are not products for everybody, but if you have a substantial portfolio now, it may be worthwhile talking to your stockbroker or financial adviser to see if they are right for your own situation.

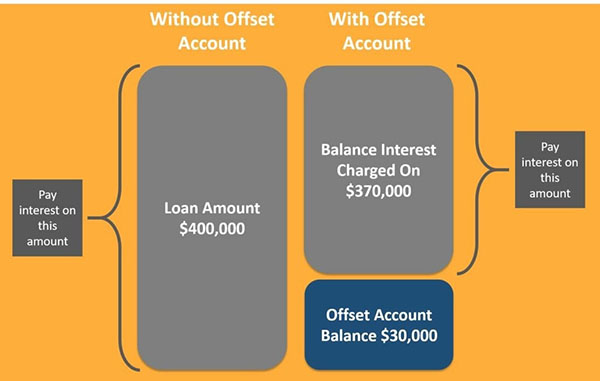

Home Loans

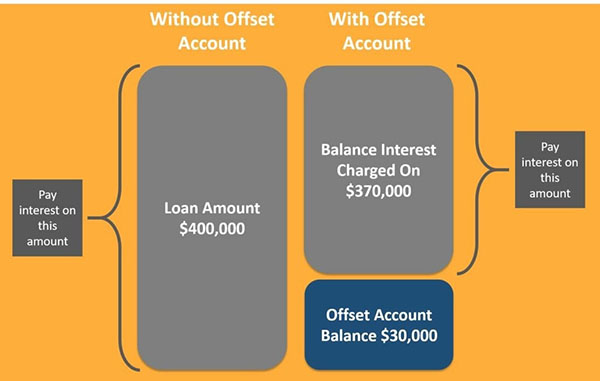

I was staggered to read in last Saturdays paper, 40% of borrowers had never heard of the term “comparison rate” or had any idea of what an offset account was. These terms are so familiar to me that I must confess it never occurred to me that they weren’t general knowledge. So here’s a brief rundown.

A useful guide is the comparison rate sheet that all lenders are required by government legislation to provide, but keep in mind that it is only a starting point. Even though it includes the basic loan costs such as set-up fees, interest rates and ongoing charges it does not include bank fees that are only charged in certain circumstances. These include fixed loan early termination fees and redraw fees.

But there is more to a loan than the interest rate and the fees and charges. One of the most important things to consider is flexibility. You might believe that a no-frills loan with low fees is perfect for you right now because your affairs are simple and your present intentions are to stay in the one house for many years, but keep in mind that change is always with us, and your present loan may not be appropriate if things change.

What happens if you decide to move house, or borrow some money for renovations or investment, or need to reduce your repayments when the kids are at high school? If you have a no-frill loans it may not have a redraw facility and you may be required to take out a second mortgage for the extra money. Naturally, the bank will be looking for a higher interest rate on the second mortgage.

Offset accounts are also a highly desirable feature. If you deposit money in a normal interest-bearing account, you will probably earn less than 2% per annum and then lose at least a third of that in tax. However, when you deposit money in an offset account the notional interest credited should be the same as that charged on the housing loan.

|

And Finally

Within hours of the news that Tesco’s ‘all beef hamburgers’ contained 30% horse meat, the following quips hit the Internet:

|

I hope you have enjoyed the latest edition of Noel News.

Thanks for all your kind comments. Please continue to send feedback through; it’s always appreciated and helps us to improve the newsletter.

And don’t forget you’ll get much more regular communications from me if you follow me on twitter – @NoelWhittaker.

Noel Whittaker

No Comments