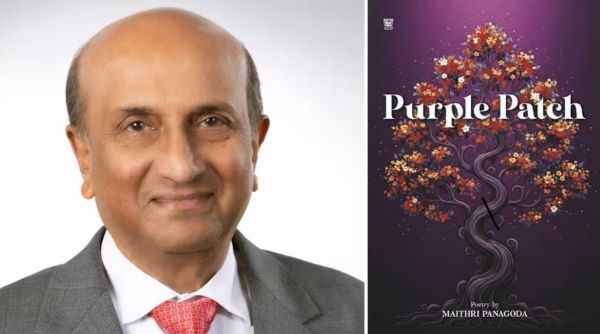

Stagnating Oil Prices: can OPEC+ ever provide the crucial spark? – By Hemantha Yapa Abeywardena

|

| www.oilfutures.co.uk |

Source : oilfutures

The members of the OPEC+, who met virtually last week, decided to leave the production cuts unchanged, perhaps in light of stagnating oil prices.

The members of the OPEC+, who met virtually last week, decided to leave the production cuts unchanged, perhaps in light of stagnating oil prices.

Having failed to shore up the prices by tinkering with the supply side of the oil equation, the de facto leader of the organization, Saudi Arabia, even the raised the price of its flagship Arab Light crude for Asian buyers for the third successive time, while inadvertently leaving the loyalty of the old customers in the region on the line.

Although the Kingdom had been in the habit of raising the price of oil for this particular domain in the recent past, only to bring it down a few weeks later, judging by the frequency of price rises, it may not happen very soon this time.

According to the latest IMF forecast, Saudi Arabia has to sell oil above $96.20 to make a profit, provided that it maintains its production at 9.3 million barrels per day(bpd).

As of 13:45 GMT on Monday 6, 2024, the prices of WTI and Brent were trading at $78.75 and $83.49 respectively, far below the threshold for Saudi Arabia; at present, there is a yawning gap to be bridged.

The OPEC+ alliance cut down the production by 1 million barrels a day in June, last year for what they used to call at that time, ‘stabilizing the markets’. Since it failed to do the trick – pushing up the prices – the Saudis, then, went for what most analysts believe, the Nuclear Option – raising the price of oil for its longstanding customers in Asia.

The measures, however, did not result in the desired outcome; the Asian customers, mainly China and India, the world’s top and the second leading importers of the commodity, found out a reliable source to turn to – Russian oil.

Although the post-Covid Chinse manufacturing recovery has been somewhat shaky, China still buys crude oil in large volumes, perhaps to bolster its own SPR, Strategic Petroleum Reserve. With Taiwan issue looming large that could potentially take the world’s second largest economy along an unpredictable tangent, China appears to be getting ready for any worst-case scenarios.

India, meanwhile, has not turned its back on discounted Russian oil either; the world’s second largest importer of crude oil is having a particular attraction for the discounted Russian Urals over other benchmarks, with the refineries of India in full swing.

In yet another blow against the optimism of both traders and investors, the US crude stocks recorded a significant build – by more than six million barrels last week.

|

Since the Biden administration has temporarily halted filling up the SPR, Strategic Petroleum Reserve, owing to the current high oil prices, the fluctuations in the US stocks clearly indicate the consumer demand for the commodity.

All in all, in the ongoing drama of oil prices, two key forces are playing a tug-of-war. On one side, rising US crude oil inventories are exerting downward pressure. On the other hand, a volatile Middle East combined with production cuts by OPEC+ are working to push prices higher. This delicate balance will determine the future direction of the oil market.