Did you know that you could virtually pay off your 30-year home loan in half the time? Imagine not having the worry of a mortgage payment every month! More importantly, have you ever considered just how much money you could save? Literally, it’s tens of thousands of dollars in interest.

Financial journalist and author of Smarter Property Investment, Peter Cerexhe, advises home owners to use online mortgage calculators to see how much difference a small repayment, or more regular payments can make to reducing the life of your loan. Cerexhe says, “What you’ll find is that if you can afford to pay a little extra, you can achieve a substantial reduction in the term of the mortgage.”

| Paul Ahearne, Managing Director, Locumsgroup Mortgage Group believes that the sooner you can start paying down your home loan the better you’ll be. He says, “As you know, today’s interest rates are at all-time lows and lenders are offering very competitive rates. If you’ve had your home loan for a while, talk to us about the possibility of re-financing to get a lower rate. If your circumstances have improved since you first took out your home loan, this could also help you get a better rate. What you should be seeking to achieve is to reduce the principal of your mortgage because this will save you money on interest and can significantly reduce your loan term.”

Here are three simple tips from Paul Ahearne to reduce your home loan faster. |

||

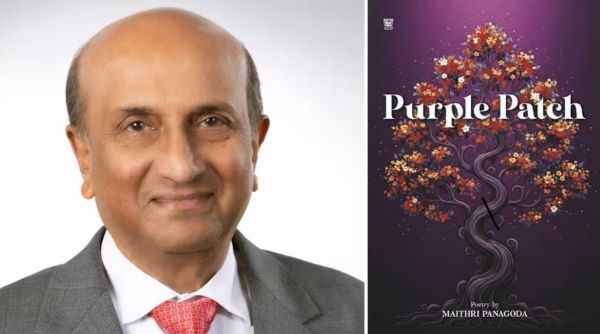

# 1 Do you have an offset account?A mortgage-offset account is simply a savings or transaction account that is linked to your home loan. However, it really can work in your favour by reducing the amount of interest you have to pay on your home loan. By directing all your income, and savings into your offset account it becomes the hub for all transactions. The real benefit is that it can greatly reduce the amount of interest you pay on your loan and also save years on your home loan term. For example, if you have a $400,000 home loan and can keep $100,000 in your offset account, you only pay interest on $300,000. If you were to have your wages paid directly into your offset account you will reap the benefits. Interest earned in a bank account is taxable but interest saved in an offset account is not. Let’s say you get paid $6,000 a month. If those funds sit in your offset account, even just for a few extra days per month, you could save a few hundred dollars in interest every year. It doesn’t sound like much, however it does all add up. Ahearne says, “This can greatly reduce the interest that you pay, as the interest is debited at the end of the month and usually calculated daily.” # 2 Pay your mortgage fortnightly instead of monthlyAnother very easy and convenient way to pay down your mortgage faster is to make your home loan repayments fortnightly instead of monthly. By splitting the payment in two, instead of one monthly repayment could cut years off your loan term and save a lot of money in interest. Although this may sound too good to be true, here’s how it works. If you pay monthly, you are only making 12 payments. However, there are 26 fortnights in a year. When you take this over a 30-year loan term, this could take about 4 years off your loan payments without affecting your cash flow. # 3 Increase your repayments while rates are stableWe are definitely living in a very fortunate period with interest rates at an all-time record low. While many people are enjoying the reductions, one way to take advantage of this is to choose to continue paying your repayments at the same level you were before the rate cuts. This simple method can reduce your loan terms by a couple of years. Remember, when the Reserve Bank eventually moves to increase official interest rates, causing the banks to increase theirs, you won’t have a choice, you will be compelled to make additional loan repayments. So why not make additional payments while rates are down and reduce the size of your loan. If you’ve had your home loan for a while, Ahearne recommends that you consider looking at the possibility of refinancing to get a lower rate. As you are aware, the experts are predicting that interest rates will fall even lower in the coming months. So, when you are talking to your broker ask him or her how you can reduce the principal of your mortgage. This will save you money on interest, and can significantly reduce your loan term. Your home loan is one of the biggest financial commitments you’ll ever make. While it’s easy to fall into the trap of a set and forget attitude for the next 30 or so years, if you want to get ahead, or are ready to build a property portfolio, you should set yourself the goal of paying off your mortgage within the next 10 – 15 years. William de Ora is the founder of IPNA – investment properties for new Australians. He was born in Sri Lanka and is a best-selling co-author of three business books. You can contact William on 0414 834 733 or email: William@ipna.com.au |

||

|

||

|

||

|

||