The Reserve Bank has cut interest rates to a record low. Is this your opportunity to reap the benefits?

Here’s what others are saying about this record low interest rate cut, and what’s possible. Property analyst Tim Lawless from CoreLogic RP Data says, “Lower mortgage rates have the potential to add some fuel to what are already strong housing markets.” In a recent blog article Mark Bouris from Yellow Brick Road elaborated on a number of strategies for debt reduction. He says, “This is a great time to consolidate and pay down your debts.”

So, what does this really mean for you?Could this be the right time to investigate the benefits of consolidating your existing loans? Could this lower interest rate make a difference to your short-term cash flow requirements? Could this be a sign to look at your long-term financial objectives and begin to explore how to create an investment property portfolio? One thing is for sure, if you don’t make time to get these questions answered, then it may just pass you by.

| Where to start and who to speak with

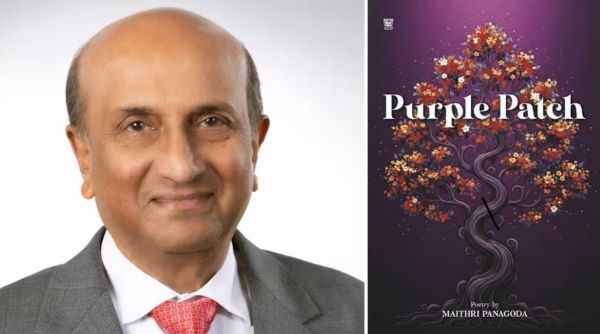

Your starting point is to clarify whether or not you feel there’s value for money to dedicate a few hours of your time to review what benefits you could reap from this record low interest rate. Maybe, and just a maybe, what if the Reserve Bank was on your side – how might you take advantage of this decision? If you see value in this then here’s what’s next. Consolidate and reduce your debts Consolidating is a type of refinancing that usually means getting a new loan to pay out a number of other loans. Any good mortgage broker will advise you on how best to maximise your borrowing capacity. In looking at how to consolidate your finances, the best place to start is to take stock of where you are. List out all your current debts. Then, look at what your most expensive high interest debts are such as credit cards, and personal loans. Imagine the money you might save by getting a consolidation loan, with a lower interest rate, to pay off debts. Building your wealth If you’re reading this article, then I’m thinking you are interested in building wealth correct? At the same time, you may be trapped in a mindset of “I can’t afford to invest at this time.” With such low interest rates on mortgages, this is your opportunity to think about using your home loan to build wealth by leveraging investments. The secret to building wealth is using the equity that you have already built up in your property to assist you to invest in an asset that appreciates in value. By looking to invest in neutral to positive cash flow investments there are many benefits in terms of your investment strategy.The house essentially pays for itself – with money left over. These types of real estate opportunities increase your serviceability, making you more attractive to banks and lenders. In short, if you can find the right investment property, and increase your income you are able to borrow more. However, in making the time to review your current circumstances, it’s also prudent to ensure that you have a strong plan for the future to adjust, accommodate, and work with any potential rate rises. Considering and planning for all possible scenarios is just wise management. Some day one day, you will need more than your job to generate your income. Therefore, if ever there was a time to rethink how you’re managing your money, and having your money work for you, hopefully it’s now.I encourage you to set aside some time as a priority so that you can find out how to create a future that truly works for you. The writer is the founder of www.IPNA.com.au—Investment Property for New Australians. He was born in Sri Lanka and is a best selling co-author of three business books |

||

|

||

|

||

|

||