Noel News

Everything already exists.

It’s our job to develop awareness to access it.

DAVID MELTZER

We’ve got a pretty comprehensive newsletter for you today, and I know you’re going to enjoy it. I am writing this from home in Brisbane and am so excited to see a bright sunny sky once again after days of some of the heaviest rain I have seen in my lifetime.

Last Wednesday, on the recommendation of some golfing friends, I visited the Nundah Village Family Practice to get a Covid vaccination. I got the text from my friends at 6 AM that morning, and got a 9:25 AM appointment on the same day. I’ve never been to this practice before, but they have certainly got their act together.

At 9 AM, I arrived and went straight to the receptionist who checked me in within two minutes. Another two minutes later, I was in the room where two nurses were giving the vaccines, which took about three minutes. So five minutes after arrival, I had the vaccination, and was then sent to a waiting room to sit for 15 minutes to make sure there were no adverse reactions. The vaccination was painless – and I have had no adverse reactions so far. It just goes to show what can be achieved by a good operator. The second appointment is booked in June.

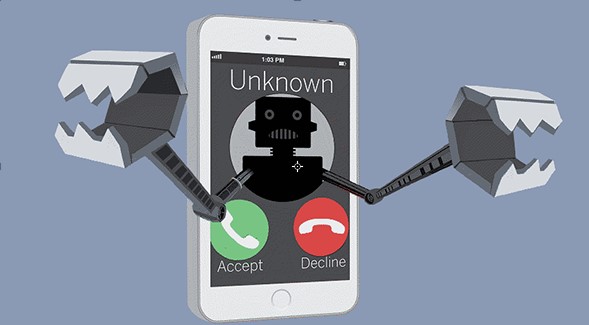

To shift gears, please beware of scammers. Recently my phone rang from a number I did not know. The caller’s name was Luke and he told me he that he was returning a call he had received from my number. He was not happy as the call was obviously a scam. I quickly assured him I had not rung him but it’s a great worry when conmen are able to use a person’s real mobile number when they are making scam phone calls.

The day after this happened Geraldine got a similar call from a different person – in neither case did our phone show that we had made a call to these people. The lesson here is to be extremely careful with text messages and phone calls.

Also, let me reiterate previous warnings about invoices. These days almost every account you receive contains the merchant’s bank details. Scammers now have the ability to intercept these account emails and change both the BSB number and the account number so the money goes into the scammers’ account.

This is why every time I pay an account online, I check that the account details on the invoice match what I have paid in the past with that person. If not, I ring them and verbally confirm the details over the phone. Once you lose money like this, it’s almost impossible to get it back.

Super as a house deposit

The prize for the most ill-conceived idea of the year must go to Liberal MP Tim Wilson for very publicly campaigning for first home buyers to be allowed to access part of their superannuation for a house deposit.

Not only would it drive up house prices, the plan has other major faults: it subverts the purpose of superannuation, it has tax problems, and it fails to account for the extraordinary effect of compounding over time.

Think about a person who started work at age 20 on $35,000 a year. Suppose the employer contribution remained at 9.5% per annum and the fund earns 8% per annum. By the time they were 30 and earning $50,000 a year, their fund should be worth $54,000.

Fast-forward 40 years, when the retiring age may well be 70. Their fund should be worth just over $3 million if the assumptions in the example are unchanged. However, if they withdrew $50,000 from that balance at age 30 for a house deposit, their superannuation would be worth just on $1.9 million. Withdrawing $50,000 at age 30 would cost them $1.1 million when they retire.

Now think about the tax implications. Under the current rules, money withdrawn from superannuation before your preservation age incurs a tax of 22% or your marginal rate, whichever is the lowest. If we assume anybody buying a house would be earning more than $45,000 a year, which is where the marginal tax rate of at least 32.5% rate cuts in, it’s obvious that 22% would be deducted from most sums withdrawn early.

Or imagine the rorts that would happen if early withdrawals were tax-free! If Jack and Jill earnt $100,000 year each, their employer contributions of $9,500 would enable them to contribute a further $15,500 as a tax deduction, losing only 15% contributions tax. No government in its right mind could tolerate a situation where they could withdraw that money in a few years with no exit tax.

Every strategy designed by governments to make entry to the housing market easier pushes up the price of houses. To get an idea of what would happen to the housing market if billions of dollars were released tax-free from superannuation, think about what the $10,000 withdrawn per person during Covid did to the second-hand car market. Most dealers ended up out of stock.

A major plank of the arguments put forward by Liberal MPs such as Tim Wilson is that it’s “their money”. Well, actually it’s not – it’s trust money contributed by the employer using generous tax concessions provided by the government with the sole purpose of reducing the cost of welfare at retirement.

There is also the argument that we need to prevent people entering retirement without a roof over their heads. That is unquestionably true, but there are so many reasons people end up not owning their own homes. Many who have bought, lose the house they had because of relationship breakdowns or bad financial choices. The proposed scheme would have no benefit to them.

Tim Wilson needs to remember that the genesis of the global financial crisis was President Clinton’s belief that every American was entitled to home ownership, irrespective of income or assets. This led to billions of dollars of bad debts, repossessions, and plunging real estate prices. Australia can’t afford for that to happen here.

Housing in New Zealand

Just to keep in mind that the housing affordability problem is not just confined to Australia. In New Zealand low interest rates and rising demand have pushed house prices up 23% in the last year. New Zealand is now the least affordable housing market among developed nations, and investors have become the biggest property buyers in the country. To make it worse 40% of the sales in the final quarter of last year were made to owners of multiple properties.

The New Zealand government has just announced steps to try to make housing more affordable, but their track record is not good. They were elected in 2017 with the promise that KiwiBuild would change the face of the housing market by building 100,000 affordable homes within 10 years. In 2019 a review found that the interim goal of building 1000 homes in the first year was scrapped when it was found that KiwiBuild had managed to build less than 100 homes. But that’s what happens when government gets into the act.

In the much-anticipated announcement, Prime Ministe Ardern doubled the so-called bright-line test – the time that investors need to hold onto a property to avoid paying tax on selling – to 10 years. Other measures will prevent investors from offsetting interest on loans as an expense against their rental income.

There is a wealth of material about the NZ housing crisis on that great show The Money by Richard Aedy and I urge you to go to the ABC listen app and play it for yourself. The program was broadcast on Thu 25 Mar 2021. Topics include how a container ship wedged in the Suez Canal adds to global supply chain disruptions, what will happen when the JobKeeper wage subsidy comes to an end, and new measures to cool New Zealand’s housing market and build more homes. The running time is 30 minutes.

The key message for me was the claim that to restore housing affordability in New Zealand, the average home would have to drop in price by 25%. Just imagine the implications for the entire economy if that happened.

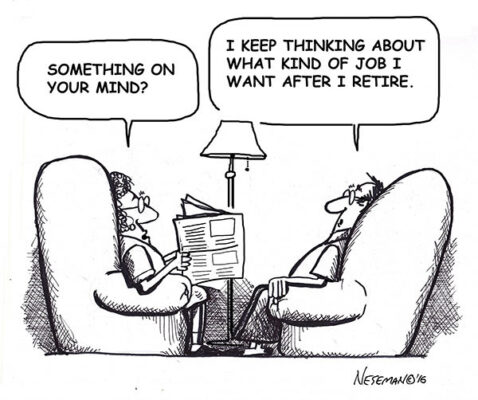

Superannuation Returns

In my new book Retirement Made Simple I point out that the biggest factor that determines how much you need when you retire, and how long your money will last, is the rate of return you can achieve on your portfolio. Unquestionably, superannuation is the best vehicle for saving in a tax effective manner – the only drawback is lack of access until you reach your preservation age – but many people either have no faith in superannuation, or they start a self-managed fund and think they can do better themselves. Sometimes they do, but often they don’t.

The latest returns for superannuation have just been released and they are shown below. As you can see, the returns for each period have been extremely good, but Growth is little bit in front of Balanced, and they are both way ahead of Capital Stable.

This is why anybody under 50 should have the bulk of their money in super in high growth, and even why retirees aged, say, 65 to 70 should keep a good proportion of their superannuation funds in growth or at least in balanced.

Thanks to rising life expectancies, a person now 70 will most likely get to age 90. That’s 20 years of investing ahead of them – a long view is essential.

Pension Updates

The latest six-monthly age pension adjustments have taken place and are effective from 20 March 2021. The main changes are a slight increase in the amount of the age pension, which also leads to an increase in the cut off points for both the assets test and the income test. The maximum pension for a single person is now $952.70 a fortnight, and for a couple $718.10 a fortnight each.

Everybody is allowed a certain base level of income and assets, but once you exceed the base level the pension reduces. For income test purposes the pension reduces by $0.50 for every additional dollar earned over the threshold, and by three dollars a fortnight for every $1000 of assets over the bottom limit.

The lower asset limits are $268,000 for a single pensioner and for a couple $401,500. Once these levels are exceeded the pension tapers until it reaches the upper cut off point where no pension is payable. The base income threshold is $316 a fortnight for a couple and $178 fortnight for a single.

The cut-off point for a homeowner couple has gone up to $880,500 and for a single pensioner $585,750. For non-homeowners the numbers are $1,095,000 and $800,250 respectively. The income test cut-off points are now $82,898.40 per annum for a couple and $54,168.40 for a single.

Each year on 20 March and 20 September, Centrelink values your market-linked investments, such as shares and managed investments, based on the latest unit prices held by them. These investments are also revalued when you advise of a change to your investment portfolio or when you request a revaluation of your shares and managed investments. If the value of your investments has fallen, there may be an increase in your payment. If the value of your investments has increased, then your payment may go down.

The rules are in favour of pensioners. If the value of your portfolio arises because of market movements, you are not required to advise Centrelink of the change – it will happen automatically at the next six-monthly revaluation. However, if your portfolio falls you have the ability to notify Centrelink immediately.

You can reduce your assets by giving part of your money away but seek advice before you do it. The Centrelink rules only allow gifts of $10,000 in a financial year with a maximum of $30,000 over five years. Using these rules, a would-be pensioner could gift away $10,000 before June 30th and $10,000 just after it, and so reduce their assessable assets by $20,000.

The rules are prima facie simple, but there is devil in the detail. If a member of a couple has not reached pensionable age it’s prudent, if appropriate, to keep as much of the superannuation in the younger person’s name because then it is exempt from assessment by Centrelink. However, the moment that fund is moved to pension mode, it’s assessable irrespective of the age of the member.

Furthermore, a debt against an investment asset is not deducted from the asset value, unless the mortgage is held against the investment asset. It is not uncommon for people to have a large mortgage secured by their house, for an investment property – in that case Centrelink assess the gross value of the property and do not deduct the loan.

My website has some great resources for anyone planning retirement, especially the age pension. There is a deeming calculator, an age pension calculator, and in the Resources section is a downloadable PDF of the actual pension charts. They have been prepared by MyPension Manager and are brilliant. I keep a copy on my desk laminated, and refer to them all the time. It gives you a fantastic overview of pensions.

Help with your sleep

As many of you know, my son James – now based in Los Angeles, California – has a podcast called Win the Day™ with James Whittaker where he interviews some of the world’s leading experts in a whole variety of different fields. The episode he released last week was with the world’s #1 sleep doctor, Dr Michael Breus, and I highly recommend it.

We spend about one-third of our lives sleeping; therefore, we need to make quality sleep a priority, but unfortunately modern technology and the stress from covid has meant we’re sleeping worse than ever.

Dr Breus has appeared on Oprah, The Dr Oz Show (more than 40 times), and is a three-time bestselling author. What he shares in this episode is incredibly valuable to ensure you’re operating at your peak each day.

Topics include:

A five-point plan to improve your sleep right now

The latest hacks in sleep science to help you perform at your best

How people with PTSD and depression can sleep better

The celebrity transformations Dr Breus is most proud of

What sleep myths need to be busted

The best way to wake up energized

And many more.

You can access the full episode below:

Podcast

YouTube

Blog

I’m sure you’ll enjoy it. Geraldine and I learned so much from listening to it.

Event for those in Brisbane

I’ll be appearing at Riverbend Books (Bulimba, QLD) on 19th May at 6:30pm where I’ll be talking about my new book Retirement Made Simple and helping all those in attendance to navigate the complex route to retirement.

If you’d like to join us, register here. It would be great to see you.

And finally…

Paddy says “Mick, I’m thinking of buying a Labrador. “Bugger that,” says Mick, “have you seen how many of their owners go blind?”

The Grim Reaper came for me last night, and I beat him off with a vacuum cleaner. Talk about Dyson with death.

I went to the cemetery yesterday to lay some flowers on a grave. As I was standing there I noticed four grave diggers walking about with a coffin. Three hours later and they’re still walking about with it. I thought to myself, they’ve lost the plot!!

I was at an ATM yesterday when a little old lady asked if I could check her balance, so I pushed her over.

Statistically, 6 out of 7 dwarfs are not Happy.

My neighbour knocked on my door at 2:30am this morning, can you believe that, 2:30am?! Luckily for him I was still up playing my bagpipes.

Local Police hunting the ‘knitting needle nutter’, who has stabbed six people in the rear in the last 48 hours, believe the attacker could be following some kind of pattern.

Bought some ‘rocket salad’ yesterday but it went off before I could eat it!

My girlfriend thinks that I’m a stalker. Well, she’s not exactly my girlfriend yet.

Just got back from my mate’s funeral. He died after being hit on the head with a tennis ball. It was a lovely service.

I hope you have enjoyed the latest edition of Noel News.

Thanks for all your kind comments. Please continue to send feedback through; it’s always appreciated and helps us to improve the newsletter.

And don’t forget you’ll get much more regular communications from me if you follow me on twitter – @NoelWhittaker.

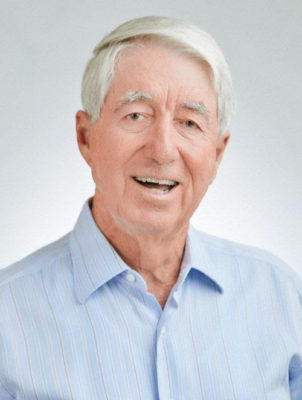

Noel Whittaker