NOEL NEWS

“Poor government comes about when good citizens

sit on their hands instead of standing on their feet”

ROBERT BAKER

PODCAST

Making Money

Made Simple

with Noel Whittaker

Renowned broadcaster John Deeks and I discuss all the big topics covered in this newsletter in detail each month.

Welcome to 2026

This newsletter is a little later than usual, but for good reason. We have several major events coming up, and I wanted to make sure all the details were locked in so you can plan ahead and, hopefully, come along.

Looking back, 2025 was anything but dull. Interest rates finally started to fall, only for markets to begin pricing in the possibility they may rise again. Cryptocurrencies delivered another reminder of just how volatile they can be. Precious metals such as gold and silver traded in a wide band, keeping believers excited and sceptics unconvinced. The proposed tax on unrealised capital gains in superannuation was quietly watered down and share markets around the world delivered solid returns, particularly in the United States.

Image by Bob Rich for Hedgeye

Australia did its part as well. Our share market returned about 9 per cent for the year once income and capital growth were combined. Roughly 6 per cent came from capital gains and around 3 per cent from income, which historically is about par for the course. Just bear in mind that volatility is part of the deal with share markets. Don’t get too upset when the market has one of its normal bad days — it’s simply the price you pay for liquidity. Long-term history tells us that over any ten-year period there are typically six positive years and four negative ones. That’s why it pays to stay in there.

Upcoming Events

Gold Coast Seminar – Thursday 12 February

Chris Carradous from the Evidentia Group will open with a sharp market update, highlighting the key trends and opportunities shaping today’s investment landscape. Hugh Robertson, CEO and founder of Centaur Financial, will then dive into behavioural finance — why emotions derail investors, and how to stay disciplined when markets turn volatile.

I’ll wrap things up with practical insights into retirement and super planning, focusing on the strategies that really matter for securing your financial future.

WHEN

Thursday 12th February 2026

9:30am – 11:30am

WHERE:

Robina Events Centre

Level 4, TAFE Queensland, Robina Campus

94 Laver Drive, Robina QLD 4226

RSVP: Register Now

Tasmanian Trip

Geraldine and I are really looking forward to our Tasmanian book tour. We went there on our honeymoon 45 years ago and still think it’s one of the best places in the world. There will be five events in total — four organised by bookshops and one at Wrest Point Casino, organised by Shadforths, the most respected financial planning firm in Tasmania.

Just keep in mind that bookstore events usually don’t have large spaces for audiences, and the bookstores are already promoting them through their own mailing lists. Some venues are limited to around 40 people, so please get in early if you’d like to come.

I always enjoy these events because they give me the chance to meet so many of you who have been subscribers to this newsletter for years — and I get to hear plenty of funny stories along the way.

The bookstore events will be more like fireside chats, which allows maximum audience interaction. I’ll be talking about the state of the markets, where to invest, and all the usual topics covered in my books. Geraldine and I can’t wait to see you.

If you have any problems registering email me straight away at noel@noelwhittaker.com.au

Monday 16 February – Burnie

Bring your questions. Numbers are strictly limited so book early.

Tickets available via the link below or in store.

WHEN

Monday 16 February | 10:30am – 12pm

WHERE:

Burnie RSL

36 Alexander St, rear entrance off Little Alexander St opposite the museum.

TICKETS:

$5

Tuesday 17 February – Devonport

WHEN

Tuesday 17th | 5:30pm – 7pm

WHERE:

Devonport Library | Level 1

Paranaple centre | 137 Rooke Street, Devonport 7310

Wednesday 18 February – Launceston

Wills, Deaths and Taxes book launch.

WHEN

Wednesday 18th February | 10:30am – 12:00pm

WHERE:

Launceston Library (room capacity 100)

71 Civic Square, Launceston TAS 7250

Thursday 19 February – Hobart

I’m partnering with the team at Shadforth to host an event at the Wrest Point Casino on Thursday, 19 February 2026.

Shadforth have been looking after the wealth and retirement needs of Australians for over 100 years.

Come and hear from me, meet the Shadforth team, and learning how expert financial advice could you help you grow your wealth and plan the retirement you deserve.

Hurry – places are limited.

WHEN

Thursday, 19 February | 5.30pm – 8.30pm

WHERE:

Wrest Point Casino

410 Sandy Bay Road, Sandy Bay | Wellington Room | Ground floor

RSVP:

Friday 20 February – Hobart

WHEN

Friday 20th | 10am – 11am

WHERE:

Rosny Library (capacity 40)

46 Bligh Street, Rosny Park TAS 7018

RSVP:

Getting your finances in order

The New Year is here and many of us are making resolutions to lose weight and straighten up our financial affairs. Unfortunately, 90% of these resolutions don’t survive January. Willpower alone is rarely enough. Getting your finances under control doesn’t require special skills – it needs an understanding of human nature. Inertia stops many of us from starting and even when we do, life gets in the way.

If possible, do this with a financial buddy, someone you can talk to regularly and who will help keep you on track. If you’re a couple, this should be a joint effort, and you could schedule a regular date night to review progress and celebrate your successes. If there are children, so much the better – the whole family can be involved, and it becomes a perfect opportunity to teach kids financial literacy. If you’re single, find a friend with similar values and goals. In the right circumstances, I recommend a long-term relationship with a financial adviser: someone who can map out a strategy and help you stick to it. One of the biggest benefits of an adviser is the discipline of regular reviews.

Today, I’m going to show you how to get back on the right track. Because of space limitations, I’ll focus on three major issues:

your cash flow,

your home loan and

your super.

Get these right and the rest will follow. You can also download my free step-by-step guide to optimising your entire financial situation from my website noelwhittaker.com.au’s Resources > Free Downloads section. It’s called Noel’s Action Plan.

Cash Flow

Managing cash flow is critical. You must be operating at a surplus, so you’re not living on credit cards and other debt. This means you need to spend less than you earn. If you are not, you have to increase your income or cut your expenses. Most people find reducing expenses is the most practical strategy, so start by listing them. Once you see them all listed, you can take action to change them.

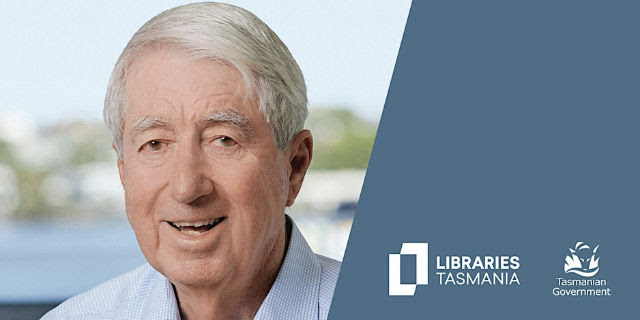

This is the foundation of a budget. The word frightens most people, but it’s actually very simple: write down your income and your expenses and analyse them. One of the best tools to help you is the Budget Planner on ASIC’s MoneySmart website (moneysmart.gov.au). It includes an online template you can fill in bit by bit, save between sessions and return to whenever you want.

I love the way it prompts you for every conceivable expense, including mobile phones and bakeries and lets you choose weekly, fortnightly, monthly or annual figures. It then analyses them in categories, with great graphics.

Saving interest on your home loan

When you have your cash flow sorted out, it’s time to look at your home loan. The aim is simple: pay less interest.

Saving interest on your home loan

When you have your cash flow sorted out, it’s time to look at your home loan. The aim is simple: pay less interest.

Image by pch.vector on Freepik

Begin by getting a realistic valuation of your home – you may be surprised how much it has gone up in the past two years. If your loan is under 80% of the property’s value, you won’t have to pay mortgage insurance, which could make this an ideal time to refinance into one of the cheaper loans now available. Use a mortgage broker. Every lender has different rules, and a good broker can identify the loan that best suits your situation.

Refinancing could easily save you $5,000 a year, and that’s after-tax money. If you’re a couple, split the tasks: one organises the valuation, the other engages the broker. Sharing the load makes it far more likely the job will get done.

Maximising your Super

Now let’s talk about your super. It’s a sad reality that three of the most important assets in your life – your health, your relationships and your superannuation – are often the most neglected, and the long-term cost of that neglect can be enormous. The good news is that super is one of the easiest parts of your finances to improve. In simple terms, what you retire with depends on just three things: the money that goes in, the return you earn and how long your money stays invested.

Image by pch.vector on Freepik

Start with the basics. Check how many super accounts you have. The easiest way is to log in to your myGov account, where you can see them all if you have linked myGov to the ATO. If you have more than one, consider consolidating them, but don’t close or transfer any account with life insurance until you’re sure the cover is no longer needed or can be easily replaced.

Next, make sure you’re in an investment option that suits your circumstances and gives you the best chance of long-term growth. For most people, that means a growth or balanced option. Over the past seven years, growth options have returned around 9.2% a year on average, balanced options about 7.7%, while capital-stable options have managed just 4.3%. If you are young and invested in such a low-return option, you are throwing money away. In pension mode, returns are typically about 1% higher because earnings are tax-free.

Time matters enormously. Delaying your retirement from age 60 to 65 can increase your superannuation by around 40%. Keep a close eye on costs as well: fees and unnecessary insurances quietly erode your balance year after year, and fixing this can be worth tens of thousands of dollars over time.

Increasing your inputs helps, of course, so don’t overlook salary sacrifice. If you’re earning $100,000 a year, your employer is paying $12,000 into super, which leaves room to add another $18,000 by salary sacrifice before you hit the concessional contributions cap. The end result is $15,300 in your super at a cost of $12,600 in take-home pay – one of the most effective saving mechanisms there is, particularly as you get closer to retirement.

Image by pch.vector on Freepik

Does this all sound daunting? It shouldn’t. Like any major task, the hardest part is beginning. Just grab a piece of paper and start listing your assets and loans. You’ll be surprised how easy it becomes once you take the first step. Automate your changes so that they require no further work. The results will far exceed your effort.

From the Mailbox

“I have just finished reading your book Retirement Made Simple and felt compelled to write to you.

Image by Freepik

I’m 57 and planning to retire this year, in 2026. I’m deeply grateful to have that option, and I’m very clear that it exists because of many decisions made over time – moments where I zigged when I could have zagged, times when I went for it and others when I chose to be conservative. Much of my success is also due to my beautiful partner and her steady, level-headed approach.

The real reason I’m writing, though, is to let you know the impact you had on me much earlier in life. In my 20s, I purchased your book Money Made Simple along with your audio tapes. Those resources had a profound effect on me and genuinely lit a fire to learn, to act and to take responsibility for my financial future.

One of the clearest lessons that stayed with me was compound interest. Even if I didn’t fully grasp its power at the time, it is compound interest that has taken me from having “not a pot to p in” to being a man of means – and allowed me to retire years earlier than I otherwise might have.

I believe I’ve gained as much from Retirement Made Simple as I did from your earlier work, which is a remarkable thing to be able to say decades later.

Thank you very much for the clarity, encouragement and lasting influence of your work.”

Books

I think this is a good segue into what has happened to our book sales over the past six weeks.

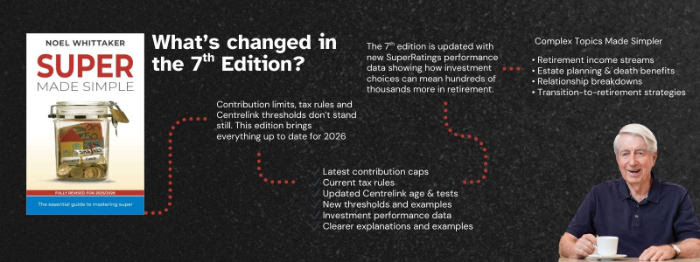

As you all know, we launched a new edition of Super Made Simple in early December, and the response from you was extraordinary. The downside of success was that we quickly ran out of stock in Brisbane.

My publisher is Simon & Schuster, a large international publishing house. Distribution is handled by HarperCollins, which is owned by News Corp. They had thousands of copies of the new Super book sitting in warehouses. The challenge was getting them to Brisbane quickly enough to meet the surge in orders.

Image by aleksandarlittlewolf on Freepik

I’ve always regarded myself as a can-do person, someone who will go the extra mile to get things done. I discovered, once again, that this mindset does not translate well inside large corporations. I asked whether 100 cartons could be sent urgently by express courier. The reply was crisp and final: “We don’t do express couriers.”

I suggested an alternative: “Then set the boxes aside and I’ll organise the courier myself.”

The answer was just as firm: “We don’t do that either.”

Undeterred, I asked if my order could be expedited. I was politely informed that I was just one of many booksellers. It was Christmas, orders were being processed strictly in sequence and nobody received priority.

And that, in a nutshell, is the difference between small operators and large organisations. When demand explodes, entrepreneurs look for solutions. Corporations look for policy manuals.

There was also a huge demand for Retirement Made Simple, so much so that we ran out of stock everywhere. It gave me the opportunity to update it with the latest superannuation Centrelink figures.

The good news is that stock is now flowing again, orders are being filled, and Super Made Simple is back on the move. The less comforting news is that if you ever wondered why big systems struggle to move quickly – even when everyone agrees they should – you now have a front-row seat.

Ebooks – guidance in your pocket.

If you want to start reading the new Ebook editions of Super Made Simple 7th Ed and Retirement Made Simple 6th ed on your computer, Kindle or phone, you can find them in the Noel Whittaker Ebooks Store.

If you have previously purchased the Super Made Simple 6th Edition Ebook or Retirement Made Simple 5th Edition Ebook, you can upgrade to the latest editions for just $3.95. Your discount will be automatically applied at checkout, or use the discount code “RMSPrevious” for the Retirement Made Simple upgrade or “SMSPrevious” for the Super Made Simple upgrade. (Note it will only work if you are a purchaser of the previous edition).

Gold Fever

I recently did a broadcast on ABC Radio about gold, and it was a lively discussion. There were three of us. I spoke first, followed by a gold dealer and then a gold prospector. You could hardly ask for a wider spread of views.

Cartoon by Bob Rich for Hedgeye

I’ve never owned gold. To me, it sits firmly in the category of something you buy in the hope that someone else will later pay more for it. It produces no income, and if you buy it in physical form you then have to worry about storage, transport and theft. In that sense, you might as well buy Bitcoin.

I did point out that you can avoid some of those issues by using ETFs – exchange traded funds – that invest either in physical gold or in gold shares. Personally, if I were forced to choose, I’d rather have the funds that invest in gold mining companies because at least they pay dividends. The downside, of course, is that they won’t track the gold price as closely as physical gold does.

The dealer had a very different take. She said things went mad in October when the Indian festival of Diwali began – it’s traditional to buy gold – and demand hasn’t slowed since. According to her, there’s now a queue outside her shop most days, with people waiting to buy. She dismissed my comments about ETFs and told me she was more than happy to store any gold her clients bought, safely locked away in her own warehouse.

The prospector had another perspective altogether. He said finding gold is a bloody hard job but very rewarding if you succeed.

Listening to all this reminded me of an old saying from Wall Street: When the shoe-shine boy – or these days, the bellhop – starts giving you stock tips, it’s usually time to be cautious. When everyone is suddenly excited about the same asset, whether it’s tech shares, Bitcoin or gold, that enthusiasm is often a warning sign rather than a green light. As I’ve said many times: you pay your money and you place your chances.

The headline of the year.

I’ve always loved the creativity of newspaper headlines. The most famous example has to be the classic “Headless corpse found in topless bar”, which appeared in a Miami newspaper, proving that even the bleakest story can be told with dark, unforgettable wit. I think this one, from the West Australian, is the winner for 2025. And it’s certainly topical.

Facing the future with optimism

As we head into the new year, there’s a palpable sense of unease. From violent incidents close to home, to wars and instability overseas, the news flow has become increasingly grim. At the same time, hopes of early interest rate cuts have faded, inflation remains stubborn and share markets have run so far so fast that nervousness is creeping in. Add the relentless advance of artificial intelligence and it’s easy to see why many people feel unsettled.

And yet this is nothing new. The world has been repeatedly reshaped for over 300 years, and each wave of change conjures the same anxieties. Over the holidays, it’s worth talking with children and grandchildren about the “good old days”. Most can’t imagine life without smartphones or social media, yet these “essentials” are very recent inventions. Many are astonished to hear that, as children, some of us had to ask a telephone operator to connect a call.

Image by Freepik

The Industrial Revolution began in the late 1700s, shifting economies away from small-scale production by hand, and towards factories, machines and mass production. Further upheaval arrived in the late 1800s with running water, electric power and motor vehicles transforming daily life. Since then, innovation has been almost constant – and regularly dismissed at the outset.

In 1903, investors were warned not to put money into Ford Motor Company: “The horse is here to stay; the automobile is only a novelty.” In the 1920s and 1930s, money continued to pour into railways while sceptics scoffed at commercial aviation. A Harvard economist declared in 1937 that no sane person would choose to fly instead of taking the train.

Entertainment and communication were no exception. In 1927, Harry Warner of Warner Brothers asked, “Who the hell wants to hear actors talk?” – a question that now sounds comical. Two decades later, Darryl Zanuck, one of Hollywood’s most influential producers, predicted that “Television won’t last because people will soon get tired of staring at a plywood box every night.” But those boxes now connect billions of people, deliver news and entertainment instantly and support entire listed industries. Once again, investors who followed the trend rather than the sceptics came out ahead.

Old ways of thinking linger for decades. In 1977, Ken Olsen, founder of the hugely successful Digital Equipment Corporation, insisted: “There is no reason anyone would want a computer in their home.” Olsen was no fool – he was a pioneer. But like so many others, he was trapped by the assumptions of his era.

Image by Freepik

Even the humble dishwasher attracted criticism when it first appeared more than 60 years ago. Washing dishes together was seen as valuable family time, a space for conversation and bonding. Critics feared that machines would rob us of human connection. Advertisers were quick to respond, pointing out that if a dishwasher handled the chores, families would actually have more time to talk, play games and enjoy each other’s company. They were right.

Once colour television arrived, the next step was the personal video camera. Early models were big, clunky and a burden to take on holidays. Then came the ability to record television programs and watch them later. Two formats – VHS and Betamax – fought a fierce rivalry, but within 40 years, both were obsolete. Today, televisions record themselves.

When I was a boy, music came on vinyl records, usually the old 78s. You needed a gramophone to play them and a steel needle that had to be changed regularly. Each side lasted about three minutes, which is why early pop songs were so short. Then came the smaller record with the big hole in the middle, the 45. After that we graduated to compact discs, which felt wonderfully modern at the time. Today I can carry millions of songs in my pocket on an iPhone, streamed instantly through Spotify. The formats changed, but the joy of music never did.

I remember attending a lecture at Bond University in 1993 to learn about a strange new thing called “the internet”. We were told it could search information all over the world. The obvious question at the time was: search for what? No one really knew. Then came email. Almost overnight, communication became instantaneous. My legal and business friends weren’t celebrating – clients now expected immediate replies and the pressure has never switched off. What had once been measured in days was suddenly measured in minutes.

Think about the mobile phone. Early models were the size of house bricks. The first question anyone asked when you rang them was, “Where are you?” That alone felt revolutionary. Even after the iPhone launched in 2007, the prevailing wisdom was that BlackBerry would crush it – because “real businesspeople need keyboards”.

Microsoft CEO Steve Ballmer declared, “There’s no chance the iPhone is going to get any significant market share.” Apple didn’t just gain market share – it launched the smartphone revolution, which has created the app economy and reshaped industries from photography and taxis to banking and media. Companies that adapted became giants. Those who didn’t were left behind.

The big question now is what to do about our investment portfolios. Is there going to be a crash? Share markets are always volatile. In any single calendar year there will be positive months and negative ones. That is simply the price we pay for liquidity.

Image by Freepik

I’ve lived through many decades of booms and busts, and one thing I know for certain is that share markets have an upward bias over the long term. Australia’s All Ordinaries Index has averaged about 9% per annum for more than 120 years, and the positive years have far outweighed the negative ones.

But much of today’s innovation, particularly in artificial intelligence, is coming out of the United States. Companies such as Tesla, Palantir and Microsoft dominate the space, and they are listed on US stock exchanges. Picking individual winners is extraordinarily difficult, so most investors are better off using a good international share fund or simply sticking with the balanced option in their super fund, where asset allocation is done for them.

What we can be sure of is that AI will play an increasing role in our lives; it is already the world’s fastest-growing user of energy. Some jobs will disappear, but history tells us they will be replaced by new ones elsewhere. At the same time, most developed economies are facing labour shortages as birth rates fall. In that context, fears of AI “taking all the jobs” look badly overstated.

Just remember: every coin has two sides. Artificial intelligence is remarkable, but it has also become a powerful weapon for scammers. Fake websites, cloned voices and messages that look entirely convincing are now everywhere.

Enjoy the benefits AI can bring but be on your guard. Never take an unsolicited call, never click an unexpected link and never act in haste. If it looks too good to be true, it is.

And finally

I’m having a great day. Woke up, got out of bed, made it to the bathroom — in that order!

Growing old is tough; not growing old is worse.

Common sense is like deodorant — the people who need it most never use it.

You know you’re getting older when you bend down to tie your shoelaces and wonder what else you can do while you’re down there.

I’m at the age where my back goes out more than I do.

Image by Freepik

Retirement: where every day is Saturday, but somehow you’re still busy.

I used to think I was indecisive. Now I’m not so sure.

There’s a fine line between a numerator and a denominator. Only a fraction of people will find this funny.

She got her good looks from her father — he’s a plastic surgeon.

She looks like she was poured into her clothes… and forgot to say “when.”

We can repair what somebody else tried to fix.

Nostalgia isn’t what it used to be.

You’re never too old to learn something stupid.

I don’t do drugs anymore. I get the same effect just standing up these days.

The worst time to have a heart attack is during a game of charades. ~Demetri Martin

A big thank you to all you good people who read my newsletter.

If you were forwarded this newsletter by a friend and you would like to subscribe, you can do so here:

You can also find the subscription box in the footer of all website pages.

For more Noel News:

Download recent Noel News as a PDF

I hope you have enjoyed the latest edition of Noel News.

Thanks for all your kind comments. Please continue to send feedback through; it’s always appreciated and helps us to improve the newsletter.

And don’t forget you’ll get more regular communications from me if you follow me on X – @NoelWhittaker.

Noel Whittaker