Noel News

The only common denominator of happy people…is gratitude.

DAVID MELTZER

Welcome to our May newsletter.

It’s only a few days to the election and right now the outcome is looking uncertain, but obviously with a swing to Labor. Everybody I know is sick of all the promises, and the continual staged media appearances. I’m also stunned by all the promises being thrown around. The reality is just so different.

Labor has promised to put a nurse full-time in every age care home, but nurses are in short supply now. Where will they come from and what will that do the cost of nursing home fees? The Coalition has promised so much I’ve lost track of it, while Labor and the Greens are promising to build thousands of affordable homes. This begs the question as how they will find the land, the tradespeople, and the materials. That won’t change on Sunday morning.

But on top of that is roaring inflation. Everybody wants a better deal for the worker, but that’s not as simple as it sounds. A pay rise of $20 a week is only $13.10 when tax is taken out which won’t even go close to catching up with rising prices. But the employer is faced with compulsory superannuation rising from 10% to 10.5% on 1 July – also casual wages of $450 a month are currently exempt from compulsory super. From 1 July superannuation must be paid on these.

This means the employer is faced with an increasing wages bill, plus more compulsory superannuation, and if they are a large employer more payroll tax. It’s a lose lose for everybody. But to make it worse, everybody I know is having trouble finding staff.

Superannuation as a house deposit

Just a week before the election the Coalition announced a controversial policy which would allow first home buyers to access 40% of their superannuation up to a maximum of $50,000 to use as a deposit for a home. Similar ideas have been floated for years, and I’ve always been strongly opposed to them. My reasoning has been that the goal of someone in superannuation is to get the highest return on their money possible, while a borrower for a home should be looking for the lowest interest rate possible I believe these ideas are incompatible. And I was horrified at allowing people to withdraw up to $10,000 from the super twice because of the pandemic.

There is no doubt that every single incentive for first home buyers pushes up the price of houses. But having said that I took the trouble to do the numbers and the outcome was much better than I could have ever imagined.

The assumptions I used are that the home costs $550,000, the purchasers are a couple both working, and both have $80,000 in super which I think could be on the high side. Stamp duty varies from state to state and you can do your own calculations on Google. I have used Queensland numbers.

Where Stamp duty is zero up to $500,000 or first home buyers – the trouble for them is finding a house at that price. Notice that stamp duty and mortgage insurance take $16,000 out of their deposit. I have used a 5% deposit which rounds up to $28,000. If they both draw 40% of the superannuation as a house deposit, they would have $64,000. Add this to their available deposit of $28,000 and they have $92,000 available. It’s a good sum to start off with and does enable mortgage insurance to be drastically reduced.

When mortgage insurance of $5000 is factored in, they need a loan of $474,000. Repayments of 4% per annum would be $2,263 a month (or $520 a week) over 30 years.

First home buyers normally live in a house for around eight years. If we assume the house increases by 4% per annum it should be worth $750,000 in eight years, by which time the debt should be down to $400,000. When they sell then they must repay the amount they withdrew from the super adjusted for the capital gain on the home. The $32,000 each they took from their super becomes $44,000 each if we use a rate of 4% per annum to match the house increase.

If they sell the house for $750,000, and repay the loan plus the amount back to their super, they should have $380,000 over. That means their initial stake of $28,000, which was their deposit, has grown to $380,000 over eight years.

The numbers work well because they are receiving 4% per annum in capital gain on the house, and the debt is reducing because the repayments are going to reduce it instead of paying rent.

True, the $64,000 deposit they withdrew from super would be worth $118,000 after eight years if their superannuation does 8% per annum. This means the superannuation is $54,000 less than they would have if the deposit was kept in super instead of being borrowed from it. But they are still miles better off.

Labor has a scheme for first home buyers whereby the government becomes a partner in your purchase. It’s means tested, and places are limited, but it could be quite a good option for people of lower means and who do not have a big chunk of money in superannuation.

The fact remains that housing affordability is a problem in most of the world. It was created by central banks winding down rates to ridiculous levels, even negative in some parts of Europe, which caused the boom in asset prices. This widened the gap between the haves and have-nots because those with assets saw their investments rise in value, while those with no assets saw prices climbing even more out of the reach. There is no easy answer.

Downsizing

Under current rules people downsizing can contribute up to $300,000 each into superannuation as a one-off contribution irrespective of their current superannuation balance. One of the requirements is that they must be at least 65 years of age. This was to be reduced to 60 from 1 July, but recently the government announced this would become 55 from 1 July – Labor immediately promised to match that if elected.

This is not a new concept – the downsizing provisions were announced in the May 2017 budget. In announcing the change, then Treasurer Scott Morrison said, “the measure reduces a barrier to downsizing for older people … It may also enable more effective use of housing stock – freeing up larger homes for younger, growing families.” At the time I wrote that it may be an ineffective measure as a home occupied by a downsizing couple would probably be quite different to the normal starter home.

In any event I just don’t see the point of reducing the age qualification to 55. From 1 July anybody can make non-concessional contributions to super until they reach 75 years of age. You don’t need any special provisions to put the proceeds from a house into super unless your superannuation balance is $1.7 million or over. In any event 55 is not when most people downsize – in my experience it tends to be more like 65.

And downsizing has its challenges. It would normally cost at least $150,000 to change from one home to another, and you could lose part of your age pension. Think about a couple with a $1.2 million home, with assessable assets $500,000 and who were receiving a pension of $601.90 each a fortnight. That’s $31,298 a year.

If they downsized to an $800,000 home and freed up $400,000 of funds their assessable assets would rise to $900,000 and they would lose almost all of the pension. That’s a loss of pension of $150,000 over five years. It may be possible to reduce the pain of this somewhat by investing part of that money in a lifetime pension were only 60% of the sum invested counts for the assets test.

I can’t stress enough how important it is to take expert advice before you get too committed to downsizing. Our book Downsizing Made Simple is a great resource. It’s available from my website.

Don’t miss out on these

Inflation is pushing up household costs, which can make it a tough road for seniors on fixed incomes. Yes, there are a wide range of concessions available, but the rules for eligibility can be complex, and in many cases retirees don’t even know the concessions exist. To make it more complex, the benefits vary from state to state and from local authority to local authority.

Enter a magnificent new resource from National Seniors Australia: the Concessions Calculator at https://nationalseniors.com.

Input some very basic details, such as the state you live in, and you can see at a glance the entire range of concessions you may be able to qualify for.

The best known concession cards are the Pensioner Concession Card, which is automatically issued to anybody receiving an age pension, and the Health Care Card, which is available to people of a younger age receiving some form of income support. Many people assume these cards offer the same benefits across Australia, but in fact the benefits of these cards are inconsistent. For example, a Pensioner Concession Card in New South Wales entitles you to a low income household rebate of $285 a year, plus a gas rebate of $121 and a council rates rebate of $425. South Australia instead offers a cost of living concession for homeowners of $217.20, an electricity concession of $233.60 and a rates concession of $320.30 a year.

The Seniors Card is a state-based concession card that is easy to obtain, because the main eligibility requirement is that you reach a certain age. Again, the benefits of the card vary by state. For example, in Western Australia the card gets you a cost-of-living rebate, a local government rebate and even a spectacle subsidy. In Queensland, benefits include 33% discount on your car registration, a $340.85 electricity rebate and a gas rebate (but only for reticulated natural gas). New South Wales and Victoria offer very little.

The Commonwealth Seniors Health Card (CSHC) is the card that is most prized by self-funded retirees, but given the number of emails I get regarding eligibility for it, it’s one of the least understood.

The first thing you need to understand is that the CSHC is not asset-tested, it is only income-tested. The income cut-off points are currently $57,761 for a single and $92,416 for a couple, and your income is calculated using your taxable income as per your tax return, plus any deemed income.

But this is where it gets confusing. Under the CSHC rules, Centrelink only deems superannuation that produces an income stream. Superannuation funds in accumulation mode are not tested at all, because they are not producing a taxable income, and you are not drawing an income from them.

The changes announced by the Prime Minister last week take the single cut-off to $90,000 and the couples cut-off to $144,000. These new limits will come into place on 1 July 2022.

Jack and Jill have a share portfolio of $900,000, producing an income of $34,000 a year, plus franking credits of $10,000, so their Adjusted Taxable Income is $44,000 a year. They also have very large superannuation balances, but since the Turnbull government restricted the amount that could be held in the tax-free pension mode to $1.6 million back in 2016, they are most unlikely to have more than $1.7 million each in pension mode, unless their super fund has been performing spectacularly well.

The deemed value of their super would be $74,720 a year which, when added to their ATI, gives them a total income for CHSC purposes of $118,720. So this year they are over the cut-off for the CSHC, but next year they – and a huge number of other self-funded retirees – will be able to pick up a CSHC and its generous concessions.

Many people are not aware of the proposed changes. You could be one of them, so don’t forget to check with Centrelink and use the deeming calculator on my website.

Browsing this calculator could be one of the best investments of time you make. You’ll be surprised at the range of concessions available, and how they vary from state to state. I picked up $400 a year in rebates that I never knew existed as I was researching this column. You can’t afford to miss out.

A great podcast for you

My son, James, recently visited us in Brisbane with his young family. He lives in Los Angeles so it was the first time we had seen each other in almost three years – and it’s such a timely reminder to cherish every moment you have.

Many of you subscribe to his podcast, Win the Day with James Whittaker. While in Brisbane, James invited me into the studio for an interview. The episode has just been released.

We spoke about my upbringing and what it was like feeling ‘stupid’ compared to my classmates. We then went into my career and journey to media contributor, which led to Making Money Made Simple and the formation of our business, Whittaker Macnaught.

In addition, I shared:

- The important handwritten message that’s been hanging in my office for 37 years

- What led to Making Money Made Simple becoming so popular

- My tips for a happy business (and marriage), and

- How to achieve financial freedom.

We covered a lot in this conversion and I’m sure you’ll enjoy it.

You can access it now wherever you listen to podcasts, or click the links below:

Apple Podcasts (audio)

Spotify (audio)

YouTube (video)

Be sure to leave a comment to let us know your thoughts on the episode.

From the Mail Box

Hi Noel,

In the late 1980’s, I bought your book Making Money Made Simple and read it cover to cover. It made a huge impression on me and changed me from someone who spent all of their income into a dedicated investor. I put in place a financial plan and followed it religiously. I am pleased to say that I retired last month, just before my 54th birthday with a multi million dollar portfolio of shares that more than comfortably meets my family\’s living expenses. I could not have done this without your advice.

Thanks

Paul

The other morning as we walked home from Pilates and passed a group of high school children waiting at the bus stop I remarked to Geraldine “I would love to be 16 and know what I know now.” And then it occurred to me – all the stuff I’ve learnt about finances and life have been written down in my books like Beginners Guide to Wealth, Making Money Made Simple and Retirement Made Simple. You don’t have to wait a life time to acquire the knowledge – it’s available right now.

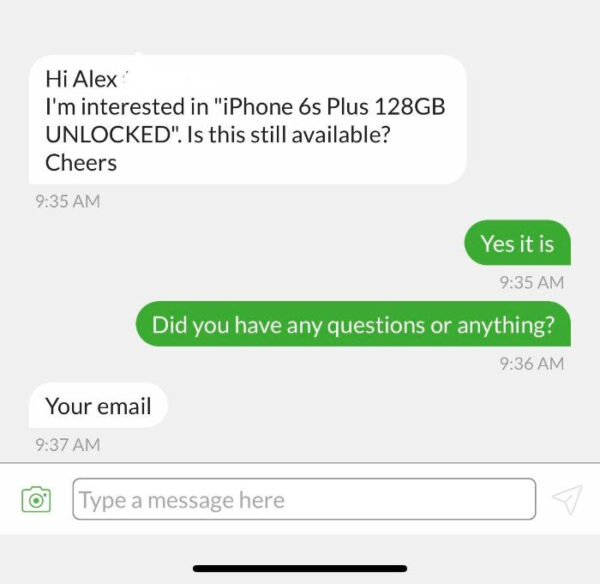

Another Scam

I am 70 years old and currently on leave from my job as a local Itinerant Support Teacher of Deaf and Hearing Impaired people aged birth to 18years. I consider myself “switched on” and very competent.

I almost got caught by a scammer when selling on Gumtree recently.

I advertised an item for sale on Gumtree, the fake buyer contacted me via my add on Gumtree wanting to purchase my item and requesting future correspondence via email. The buyer wanted to use PayPal to pay for the item and have the item shipped to “his son” via an independent “mover”. Correspondence pre-porting to come from PayPal followed. “PayPal” said the payment $2550 had been received into my account and would be released pending proof, from me, of a portion $950 (mover’s cost) being direct deposited into the “mover’s” business account, bank details were given. On receipt of proof of this deposit the $1600 (item’s cost) would be released by PayPal to me and the mover would contact me to arrange pick up of the item. I checked the details with PayPal and discovered it was all fraudulent.

I deleted the add and then reposted it. Within an hour I had two more offers of purchase and both requested that I correspond via personal email. I replied via Gumtree that I would only correspond via Gumtree. No more correspondence occurred.

And Finally

ARBITRAITOR

A cook that leaves Arby’s to work at McDonald’s.

BERNADETTE

The act of torching a mortgage.

BURGLARIZE

What a crook sees through.

AVOIDABLE

What a bullfighter tries to do.

COUNTERFEITER

Workers who put together kitchen cabinets.

LEFT BANK

What the bank robbers did when their bag was full of money.

HEROES

What a man in a boat does.

PARASITES

What you see from the Eiffel Tower.

PARADOX

Two physicians.

PHARMACIST

A helper on a farm.

RELIEF

What trees do in the spring.

RUBBERNECK

What you do to relax your wife.

SELFISH

What the owner of a seafood store does.

SUDAFED

Brought litigation against a government official.

I hope you have enjoyed the latest edition of Noel News.

Thanks for all your kind comments. Please continue to send feedback through; it’s always appreciated and helps us to improve the newsletter.

And don’t forget you’ll get much more regular communications from me if you follow me on twitter – @NoelWhittaker.