Ralph’s Property Investing Newsleter April 2016

| Ralph Cartwright Property Mentor & Team Leader P 02 9548 1074 M 0416 030 872 F 02 9548 5714 Property Club | Smith Branch |

Ghost Houses – A National Scandal

Well, that is the tack taken by the mainstream media who, as usual, like to scare people with their headlines, however innapropriate.

Here is a link to the ‘story’, which broke on Easter Monday in the SMH and was reported in most news outlets the following day.

A couple of researchers from the The UNSW’s City Futures Research Centre wrote a report claiming that based on 2011 census data, there were 90,000 vacant properties. They then tried to draw a link by claiming that “perverse” tax incentives were encouraging investors to leave tens of thousands of homes empty in Australia’s most desirable suburbs, adding fuel to the housing affordability crisis.

They were correct in pointing out that:

“Losses against a rental investment can be offset by negative gearing and resulting capital gains taxed at a reduced rate when the property is eventually sold.

but went too far by suggesting that:

“Leaving housing empty is both profitable and subsidised by government. This is taxation lunacy and a national scandal.”

As others have pointed out, the figure of 90,000 covers a whole range of scenarios, not just the fact that a property may be deliberately empty.

Owners away overseas on holiday. Visiting friends elsewhere in the country. A newly built property not yet rented. A serviced apartment with no customers that night. A second home for the wealthy only used occaisionally. A genuine rental, but between tenants. A newly constructed dwelling looking for an initial tenant or owner.

Yes, there would also be a proportion owned by overseas investors who have deliberately left it vacant. One recent estimate has suggested that obver the next 5 years, 10,000 homes will be purchased and then left vacant by overseas buyers. I think that figure must be nation-wide, but a sizable chunk to be sure.

Trying to link it to negative gearing though is patently absurd. As no less an authority than Scott Morrisson pointed out, the ATO will not let you claim any negative gearing benefits if the property is not available for rent.

So even a rich investor is unlikely to turn down a $30K-$40K tax deduction each year. In fact if thet were rich to start with, even less chance of forgoing that much of a benefit – they didn’t get rich by being stupid !

Interest Rate News

There has actually been quite a bit going on in banking circles over recent weeks and months, so I thought I’d attempt to make sense of it for you.

Basically, it is now harder to get money out of the banks and if you do, they will lend you less and charge you more.

This is being driven by a couple of trends. APRA (Australian Prudential Regulation Authority) is the main bogeyman, but they are being driven to introduce new rules by both the RBA and the Switerland-based Basel Committee on Banking Supervision. This article in the Brisbane Times outlines many of the current issues and also reports that:

The Basel Committee secretary-general Bill Coen will address The Australian Financial Review Banking and Wealth Summit in Sydney on April 5 and 6 on the next steps for Basel regulation.

This article in The Age newspaper, reports on comments by APRA to the draft Basel IV program where they note that:

housing investor loans in Australia receive the same capital treatment as owner-occupier loans, and that this would be the subject of future review.

The big four banks here have somewhere between 35%-45% tied up in investment loans, so this is a big deal and means that it is likely that banks will be charging investors more for their loans than owner occupiers. There is already a two-tier system in place and this is set to not only continue, but to widen in the months/years ahead.

Time to fix ?

My reading of the economy is that with official interest rates around the world still dropping and negative interest rates in many countries increasing, this is putting more upward pressue on the Aussie dollar and so if this continues, the RBA will be forced to cut interest rates here.

They are loath to do that because that would make investing more attractive and saving less attractive, so they are happy for APRA/the banks to be doing the heavy lifting for them to dampen down the investment market without causing a crash.

In this article, it is APRA again suggesting that banks need to continue to make it harder to get loans and in particular investment loans. Some banks will discount the total rental income by 10% or even 20% to take account of vacancy periods and other expenses. That is something that I automatically do with my cash-flow reports that I prepare (free of charge) for my members who may be considering a purchase. APRA are now suggesting that:

More prudent practice is not to rely on negative gearing to get a borrower over the line.

That could be read as suggesting that none of the projected rent or tax savings be considered by the banks. That would make it much, much harder for investors to get a loan.

Here is another article along similar lines suggesting 2018 and even earlier in 2017 may be crunch years and these new measures may be the start of the next global financial crisis.

This article is looking at the construction industry, which is also being hit by the application of these new rules.

With the banks now limiting their exposure to the construction sector and pricing risk far more keenly than in the past

Another day, another APRRA warning of impending doom. This article in Monday’s SMH reports on a speech last week by the APRA executive general Manager.

He bsically warns that not only are our big 4 banks too big to fail, which refers to the willingness of the government (read you, the tax paying voter) to underwrite the banks if they should get into touble, but says that they are “almost too big to get sick”

He is flagging the certainty that APRA will be requiring our banks to hold more capital against their loan books, which will be higher than that demanded by the Basel committee and will be outlined to them before the end of this year. That means the banks will be increasing their interest rates, probably out-of cycle, especially if the RBA sists on it’s hands.

It’s a global issue

This article makes it clear that similar measures are happening all around the world citing NZ, Hong Kong, Singapore and the UK as examples. In the UK, the Council of Mortgage Lenders has questioned the advisability of increasing capital controls, but that is only to be expected from such a body. Read more here.

So what do I make of all this ?

Well, there are still banks around that will offer investors 3 and even 5 year fixed rates at 3.99%. Here is Suncorpjust last week offering investors a 3 year loan at 3.99% and LVR at 90%.

Until a few months ago, I was agreeing with Kevin Young that now was not the time to fix and rates would be coming down further. I now think that although official RBA rates will come down further, there is next to no chance of them being passed on in full, certainly not to investors.

Kevin looks into his crystal ball and says that you should try and fix so that when the term ends, rates would have gone higher and then be on the way down again. I think my crystal ball is too cloudy to look that far ahead any longer and so am thinking of locking-in some low rates. I’m not doing it to try and beat banks at their own game and come out ahead, but to know with certainty what my repayments are going to be on any particular loan for the next few years.

Kevin has had some of his lenders tell him that his portfolio LVR is too high and he is being forced to sell some properties to get his LVR back to an acceptable level for the bank. With a portfolio of 160+ at last count, that is not so bad, but when I’ve only got 8 to choose from, I have much less room to move so don’t want that to happen to me.

I’ve never been in default and have my loans spread over 5 banks, so it is much less likely that my loans will be scrutinised as carefully, but locking in a loan with a fixed rate means that there is even less chance of being picked-on by one of my banks.

ANZ Closing branches and tightening criteria

This article in The Advisor the other day suggests that ANZ are closing their branch network and using brokers to grow their business and market share.

At the same time, this article and also this one, note that ANZ has become the last of the big 4 to announce changes to their lending criteria, as noted above. Lending to borrowers using overseas income is now also restricted and they have a lower LVR of 70% max.

Laurayne Walkenden is the broker that I am currently using for most of my new members and she is an ex Branch Manager for one of the major banks. Has been in banking for 30 years and has been a broker for the last 8 years. She owns her own home and has an investment portfolio of 4 properties.

She writes:

From my experience these types of entrants to the industry are good with Vanilla deals, straight forward types of transactions with one security. Once the deals gets more complexed then you need a broker that understands Finance through and through so they can source the better deal and structure. These entrants rely on computer systems to guide them to a lender and product.

As an example. I had a member the other day, quite a seasoned one with a number of properties. All existing loans were all low doc so you could imagine he had been dealing with a Broker of experience. The Broker had advised they he could not assist them with restructuring their loans to reduce a LOW DOC RAMS loan. The Member was referred to me by a Property Mentor. I looked at the Wealth Check together with their financials. I spoke to the Members Accountant as there were a number of questions I needed answering. After much calculating I have gone back to the Member with a plan of action to reduce not only 1 loan but the whole portfolio reducing interest rates from btween between 6.59-8.25% down to 4.49% & 4.59%.

Hence, to have a broker working with you that thoroughly understands not only Finance but Portfolio Management and Investment lending, together with a good understanding on how to read and understand Tax returns and Financial Statements plus knowing the right questions to ask the Accountant, is far better than having a Broker who is new to the Finance Market or one that does not deal with or understand creating structures that assist members with growing wealth through Property.

If you’d like to have Laurayne look over your current situation to check that everything is in order and maybe suggest ways to save money, at no cost to you and no obligation to do anthing, just complete the attached finance form.

Banks black-list oversupplied postcodes

AMP has a list of 140 suburbs on which they will be subjecting prospective borrowers to more stringent checks, or saying no altogether. Other banks have similar lists.

Most of the suburbs are in CBD areas of our capital cities, plus mining towns and around Cairns.

Docklands, pictured here is one of those suburbs where apartments have resulted in oversupply whith many stuggling to source tenants which has seen a drop in rents and re-sale values.

I have a couple of members who purchased in this area before luckily finding the club and they are unable to sell without incurrring a big loss.

You can read the full list in this article.

Pepper is a specialist lender and a recent article in The Australian (Click here to read) says that they have been pulling out of the Melbourne unit market over the past several months. They say that now 90% of their loan book is in free-standing, owner occupied houses.

Too much news is not good

This article in the Age newspaper a while ago suggests that the constant stream of news is making us less adept at making good decisions.

I think it is aimed more at share traders than property investors, but I know some of my members have similar issues.

They have a constant stream of news (mostly bad news) and they are in a permanent state of apprehension and so end up doing nothing.

There are now phycological terms for people suffering mental conditions relating to their smart phones and computer screens where they become anxious if not able to keep in touch 24/7.

The article suggests that people have shorter attention spans and so only remmebr recent events. They are unable to take a broader view and a longer term perspective and think throiugh iissues.

The reserve bank governor no less, has suggested recently that people are too gloomy because of the incessant bombardment of (bad) news that most people get.

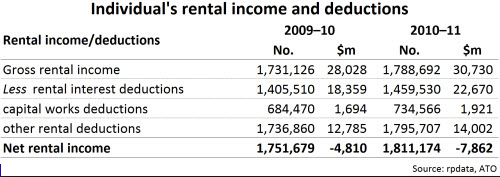

How to read between the lines

As I have pointed out in these pages numerous times, most reports are not worth the paper they are written on, especially if the author is not known.

Property related reports in particular seem to suffer from this more than other sectors of the economy.

This article in Crikey takes the same tack and has put together a brief guide to how you, too, can take up the fight against the tide of stupid.

Question, be critical, and if you can’t see who wrote it or how they got their data, then bin it.

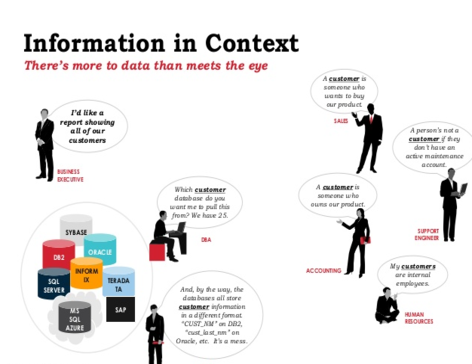

The day after I wrote the above article, I came across a good example of the type of stuff that they are talking about, ie deliberately massaging the figures to make them look better or worse.

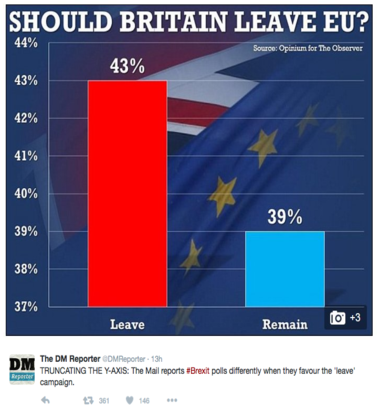

This example from the Daily Mail in the UK reporting on the battle for the hearts and minds of those who want Britain to leave the EU and those who say they should stay. BREXIT.

The Mail is on the side of those who advocate to leave. Look at these two graphs of poll results published recently.

Land Tax coming ?

Curerently, the state governemnets collect a huge amount of money from stamp duty, which all agree is an in-efficient tax. It puts up the price of housing and discourages people from moving to other housing which might be more suitable both for them and the economy. Older people downsizing, for example, people moving closer to jobs, or family. It is also volatile. When the market is booming, as in Sydney and Melbourn at present, they make out like bandits, raking in $billions. When the market goes flat and sales drop off, so does revenue.

With a land tax, everyone, including the ultra rich who may pay no income tax, would be caught and would pay an annual amount based on the value of their land. Hard to avaid, equitable and very efficient. Governments would know how much they were going top collect years ahead and can budget accordingly.

There was a report by the McKell Institute a couple of weeks ago arguing for this and another by KPMG which was commissioned by the NSW Council of Social Service and the NSW Business Chamber.

These reports argue that $billions would be saved. Collecting stamp duty is very inefficient, as I said. These reports say it costs around $0.72 to collect each dollar of stamp duty. A land tax would cost only arouynd $0.10, they say. You can read a few articles on these proposals here, here and here.

It should be noted that the ACT is well down the road opf phasing this in and the SA governemnet has also started, so it will come. Probably when the richer states see their revnue falling as the current property cycle winds down.

How might this affect investors ? Well it should make the initial purchase cheaper and the subsequent annual charge will still be a tax deduction like all other expenses. According to my initial calculations, in the first year, because you are borrowing around $15,000 less, it would actually work out around $600 more on an average club purchase.

However in the following 4 years, you would save around $600 or more, each and every year.

So as long as you purchased your property before July 2017 and the current system of negative gearing/CGT was grandfathered, there would be nothing to worry about.

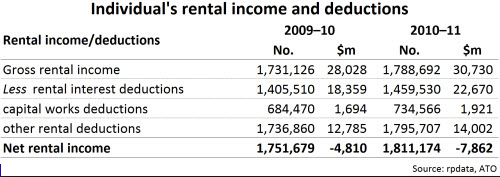

Rental property losses

You may have seen the recent release of data by the ATO relating to negative gearing losses.

You wouldn’t really call them current, because they relate to the tax years 2013- June 2014, so nearly two years old already.

As we know, a lot has changed in that time. But interesting in the light of the coalition attack on Labours negative gearing proposals.

This article by Cameron Cusher for CoreLogic RPData published in Property Observer points out that there was a substantial decline in net rental losses claimed. In fact, net rental losses haven’t been this low in close to ten years.

The main reason will be lower mortgage rates which are likely to remain low for a while and even with a surge in investors over th epast couple of years, as the article points out, “the financial benefit to the Government from such changes is likely to be limited”

Free money – $1.2billion !

Every now and again, the government likes to remind people that they have over $1.2 billion in unclaimed bank accounts that revert to the treasury if left unclaimed for more than 7 years.

Last year, over 25,000 people made successeful claims to claw back lost money.

If you are fighting to find that deposit for a property, this could help !

Here is a link to the ASIC run, MoneySmart website where you can do a simple, free search.

www.moneysmart.gov.au/

I had no idea there were so many Cartwrights around !

234 of them have been pretty careless with their money, but none from my family, thank goodness.

More News Sources

Please use the link below to visit our media centre. Here you will not only find the latest editions of our magazine, but also back copies, always with some interesting articles.

Click here to read on-line or even download a .pdf copy of the Mar/Apr issue for later reading.

You should all have recieved either your posted copy, or a direct email from Head Office with your email version. Let me know if you did not get this latest edition yet.

As usual, if you’d like a hard-copy posted out to you, please let me know.

Kevin Young has now produced 38 video episodes of him answering questions from our members. You can go here to check it out.

He also wrote a Capital City Round-Up last week which some of you may have seen already, with his comments and 2016 predictions for growth prospects. Please let me know if you’d like a copy.

Rooty Hill- Property Investment Information Day

The date will be Sunday afternoon, 17th April from 1.00pm until 5.00pm

There will be an entry fee of just $10 ($15 per couple), to cover the hall hire and will include afternoon tea.

The venue is the Rooty Hill RSL & Resort at 33 Railway Street, Rooty Hill , NSW 2766

Every property on our stock-list will be up on the wall for you to read about. Our mentors will be available to run cash-flow reports using your inputs so you’ll understand how holding such an asset would affect you. Brokers will be on-hand to discuss your finance options.

Kevin Young will be in attendance sharing with you his predictions, plans and insights.

At the same time, there will be on-going presentations on a variety of subjects including:

How our Researchers can save you months/years in searching for the ‘right’ property

Current Hotspots

Landlord Insurance

Recordkeeping

Interest Rates

Depreciation Reports and Accounting

Space is limited, so contact me to get you registered.

Ralph Cartwright

Property Mentor & Team Leader

P 02 9548 1074 M 0416 030 872 F 02 9548 5714

Property Club | Smith Branch

www.propertyclub.com.au

No Comments