Ralph’s Property Investing Newsletter May

In this edition of my newsletter :

Kevin Young’s banana theory

Macquarie Bank restricts lending on high rise and high density

Beware the (under-qualified) sharks

Overseas buyers good for Australia ?

Developers becoming pannicked

How to burn your credit rating

Banking & Interest Rate News

Westpac raises LVR

Where to for rates ?

Death spiral for off-plan purchases ?

Negative gearing arguments drag on

Property spruikers alert

45% have never re-financed

More news sources

Dates for your Diary in 2016

Sunday 17th July – Annual NSW State Conference – Cancelled

Property & Lifestyle workshop – July 2nd

There has been a late flurry of news in the past few days, which has made this newsletter a little longer than normal. However there are a number of important stories below that you should be aware of, so enjoy.

I’m off to Kakadu and Katherine for a couple of weeks this weekend, a walking/glamping tour of Kakadu followed by a canoeing adventure down the Katherine River. I’ll post some photos when I get back. Don’t expect a quick reply to your emails for the next couple of weeks.

Kevin Young’s banana theory

Regular readers of the club’s free bi-monthly club magazine would know that our founder, Kevin Young, likes to talk bananas.

He often uses the example of the Cyclone Larry back in 2006 which decimated the banana crops in far north QLD which led to shortages in the shops and sky-high prices for several months until new supplies came on-stream.

He says that houses are like bananas in that a shortage will force up prices due to scarcity.

Just another way of talking about supply and demand, really.

I read an article today (Click here to read), suggesting that efforts by APRA, the banks and the government through FIRB, are potentially going to affect supply, which could force up prices.

I think he has a point.

There is pressure from foreign governments, especially in China, to try and restrict capital outflows.

The Australian government is cracking down on foreign buyers buying existing property.

Banks are under pressure from both APRA and the RBA to cut off funding for foreign buyers who use overseas income as well as limits on total investor lending. Finally, there is the continued talk of negative gearing and CGT changes in the Australian press.

All of this is likely to curtail the ability of developers to get enough pre-sales of off-plan purchases to get new projects started, especially in the short term.

If that happens, then once the current glut of new building evident in our East Coast capital cities is finished, it could be a while before any new stock becomes available.

That would also have an effect on employment in the construction industry and put further pressure on the RBA to try and stimulate the economy and jobs by dropping rates or at least keeping them low for longer.

Too few bananas in the store – price goes up. Supply and demand. See also my story below titled: Death spiral for off-plan purchases ?

Macquarie Bank restricts lending on high rise and high density

I mentioned above that the banks are under pressure from APRA to be more conservative and this article in the AFR is the latest example of banks becoming more risk-averse.

In this case, Macqarie Bank has a list of 120 suburbs around the country, mainly East Coast capital cities, where they are no longer prepared to lend.

The article lists the affected post-codes.

Beware the (under-qualified) sharks

I am sure there are some well-qualified, ethical, experienced real-estate agents out there, but the public perception of real-eastate agents is up there with used car salesmen.

This article on News.com the other day suggests that some agents are taking just 5 days to get qualified and others just 18 minutes to do their annual on-going professional development.

I’d just like to point-out that as your personal property mentor, although I don’t have the formal qualifications of a ‘real’ agent, I do have over 15 years experience of buying 9 investment properties myself, 8 of those through the club, plus three houses that I have lived in, plus helped over 90 of my member over the course of the last 10 years, buy club property.

Overseas buyers good for Australia ?

I have a few members living and working overseas who have bought property through the club here in Australia.

However that is getting harder as most banks now say they will not lend to foreigners. It’s all to do with validating the information provided.

Bendigo and Adelaide Bank being the latest to cease lending to non-residents.

Citi group has a confidential list of currencies that it has black-banned “because of growing concerns about fraud and possible money laundering”

Bendigo say that they’ve:

had a Chinese property developer that came to them directly and not through a broker, but because we think the next series of bankruptcies is going to be Chinese developers, they declined the application.

You can read more here, here, and here.

NAB has also just joined the party announcing that as of next week, lending to Chinese buyers will be restricted to a max 60% LVR, (down from 70% today), plus only accepting 60% of overseas income as well as banning outright, sales in some ‘high risk’ areas, thought to be inner Melbourne and Sydney high-rise. Overseas investors can also no longer expect any discounts on the official mortgage rates. Read more here in the Australian Financial Review.

The concerns of Bendigo could be very precient if substantial numbers of overseas investors can no longer settle their off-plan sales, many developers, and their financiers, which could well include some Australian banks, could be in big trouble.

Change of rules by both banks and regulators is fast becoming a major worry and risk factor for off-plan purchases.

In other related news, Chinese international property website Juwai.com claims that interest from Chinese investors is up 87% over last year.

In some bizarre spin, Juwai claims:

“When offshore investors purchase off-the-plan, they give developers the security they need to start construction on the new buildings that will provide homes for Australians,” he said.

“The Property Council of Australia tells us that every Chinese buyer makes four homes available for local buyers.”

The majority of Chinese buyers, according to this article, are interested in Melbourne apartments, but the product being marketed to them tends to be city-centre high-rise and very small, by Australian standards, so most Australians, renters or investors, would not be interested in the supposedly 4 properties being made available. Many of these aprtments will never be rented. They are just a means of investing cash outside of China.

Developers becoming pannicked

Following on from the above, which I wrote a couple of weeks ago, comes this article in MacroBusiness.

Basically an exact re-write of my thoughts avove, but putting a dollar figure on the possible losses and to me, the arithmetic stacks up.

The outcome, says the article, would be an overall loss of around $100K on each apartment !

The article doesn’t really touch on the rental side of the problem, which is that assuming that they manage to sell these things at a $100K loss, your average Australian renter is not going to want to live in these shoeboxes, unless the rent being offered is substantially reduced.

That means that the losses the investor is now expected to cover could result in a second wave of selling as they bale out after a few months.

Also, if Australian banks are exposed to these developers in any meaningful way, it could have quite dramatic repercussions.

How to burn your credit rating

A very good article by Michael Evans in the SMH (Click here to read), discussing his personal experience with trying to beat the banks.

He explains that he moved his credit card to a new 12 months interest free provider each year for three years to help him pay down credit debt.

It worked well enough, expect that in the 4th year, he discovered that his credit rating was shot and the banks were questioning his ability to pay.

Something the banks don’t advertise very much.

For property investors, the same issue can arise if you make too many credit applications for loans, so doing it through a good broker is vital as they can get an answer prior to submitting a full application which then goes on your credit record.

Then only apply for the best loan for you.

Strongly recommended reading.

Banking & Interest Rate News

Banks are still passing-on the recent RBA cut. Most banks have now announced reductions with most passing on the full cut.

One bank, Bank of Sydney, actually reduced their headline rates by more than the RBA cut, passing on 27 points to owner occupiers.

At the other end of the scale, ME bank only passed on 5 points to it’s customers.

A couple of banks have also started to reduce their fixed rates, with ME bank now offering 3 year fixed rates to investors from 4.09%. You can read more here.

In other banking news, ANZ has announced big staff cuts with about 200 jobs to go. This article blames “lagging economic conditions” and comes on the back of a big drop in profits recently announced.

This is obviously not good news for those people about to lose their jobs, but just another sign that the recent crack-down on selling loans, particularly to investors, could be short lived as the the banks try and boost profits from a sector that is historically much less risky in terms of loan defaults, but also very profitable.

Watch this space.

Westpac raises LVR

Yet another of my predictions coming true, although quicker than even I expected. I wrote that last paragraph a couple of weeks ago and today comes news from Westpac (Click here to read), that they have reversed their decision taken just a couple of months ago, with the LVR for investors being raised from 80% back up to 90%.

The article also notes:

Aside from Westpac’s move on LVRs, banks are offering more competitive interest rates to property investors, with St George on Monday offering cut-price variable home loan rates of 4.24 per cent for investors.

Where to for rates ?

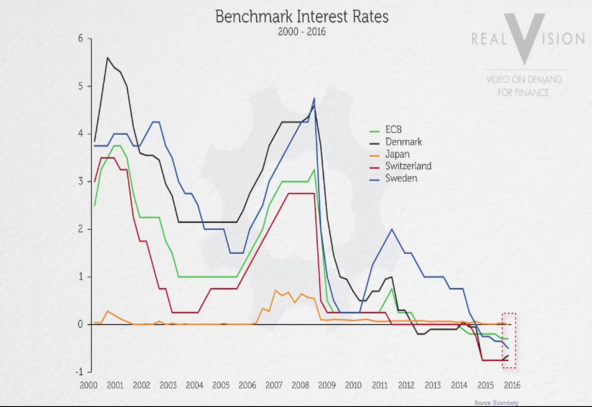

I watched a video the other day and this chart was included showing the level of interest rates around the world.

The buzzword here is ZIRP (Zero Interest Rate Policy), which is what 25% of the world economy is facing at present. Until December 2015, The USA was in that club too.

Global trade is also heading downwards and more and more economists are starting to use the R word, recession.

The reason for ZIRP is to try and stimulate some inflation.

Last months CPI came in way below expectations and that prompted the RBA to cut rates here with more cuts expected.

Low interest rates mean low returns for savers, so most people are tending to save, by paying down debt, which is why mortgage defaults are so low and bank profits so high.

Commercial lending is another story.

Kevin Young says he is not fixing yet, he expects more downwards movement from the RBA and the consensus seems to be that if there are more RBA rate cuts, the banks may seek to shore-up profits by not passing them on in full next time. You read above that some banks have already done that with the current cut.

Facebook group Invite

I know that only around 30% of people getting this email newsletter read it. I know that a lot more file it away in a folder to read later. I know that many readers just read one or two of the articles and are too busy to read through all of them.

For those of you on Facebook, and those that only have time to read one article at a time, or who want to hear the news as soon as it comes out, rather than a week or three later, you can now do that.

Here is a link to a new group that I have set-up: Property4Wealth Facebook group

I keep my personal Facebook Friends to ‘real’ friends and relatives generally and don’t accept Facebook invitations from people, including my PropertyClub members, unless I have known them for a long time and consider myself to be a friend, but this page is for the rest of you.

My intention is to post a maximum of only one thing each day and there may well be periods when I post nothing.

It means that you can always find old articles. You are free to share articles that you like with your friends on your Facebook page if you want. It is a Public group.

I won’t often provide the links in the facebook posts, as they tend to get a bit messy, but will copy them here and add links.

Death spiral for off-plan purchases ?

This story on ABC news pretty neatly sums up the risks of a couple of converging trends, both of which I have highlighted in my recent newsletters.

Number one is the possibility of oversupply of units, particularly high-rise city-centre units in SYD, MEL and BNE.

Many of these only got funding through off-plan purchases where investors, and owners, signed up anywhere up to 3 years ago to buy.

Over-supply issues alone may cause valuations to come in lower than expected and so purchasers will get less money from their banks and therefore have to find extra funds from savings to complete the purchase.

The second trend has only emerged in the past few months but appears to be gathering pace. The banks are cutting back hard against overseas buyers. They are either refusing to either fund them at all, or only lending less if they do.

That means that some/many/lots people may have difficulty in settling. That could mean even lower valuations and even forced sales which will also cut prices and therefore valuations creating a vicious cycle.

As a simple example, if you signed up to an off-plan purchase 3 years ago at say $500K, expecting to get an 80% loan from your bank based on a $500K valuation, you would have to come up with around $125K to cover the deposit and costs come settlement time.

If, for whatever reason, the bank under-values that property at settlement for even 15% less, then the buyer has to find an extra $75K.

If they can’t do it, then the purchaser will lose their deposit, usually 10% or $50K, plus will have to pay solicitors costs to date, plus will be hit with penalty interest until a new buyer is found, which could take weeks or even months depending on the market at the time.

If the new purchase price turns out to be lower, then the original buyer could also have to fund the difference between the new and old price. This could have a devastating effect on many buyers.

I am increasingly reluctant to let my members sign-up for an off-plan purchase because of these and other risks.

I much prefer smaller buildings, in areas away from these over-supplied city centre locations and which will be complete in a matter of months, rather than years. Those are becoming harder to find, but are still available.

I should also mention that a typical club property has special conditions in place in the contract that alleviate, but don’t totally negate, many of these risks. Contact me to learn more.

Negative gearing arguments drag on

Negative gearing is still an issue in the coming election, with a coalition of property interest groups, like the Real Estate Institute of Australia and major realtors, including LJ Hooker, Raine and Horne, Laing and Simmons, McGrath, Ray White and Century 21 coming out against any changes.

Well, they would say that wouldn’t they.

They have a vested interest in leaving things as they are because they make most of their money from selling existing properties.

Any policy which slows down sales is to be opposed. If the Labour proposal gets up, then existing investors will be reluctant to sell as they would lose their negative gearing deductions as well as have to pay an extra 25% CGT on any future properties.

That means that the volume of sales is likely to decrease and could also result in a slowing or even a fall in existing home values. That means less commission for real estate agents.

John Symonds and today Bill Moss, (Read more here and here), have both come out against the idea. Both have no data to back-up their arguments and continue to use discredited figures with Symonds suggesting a crash “of 10-20% or more” is possible and Moss going even further and touting a 30% figure.

Moss used to be with Maquarie Bank and is now an investor with Rent.com.au, so if some properties are taken up by owner occupiers as prices stabilise in the major cities, then obviously less rental properties available and so reduced profits.

Follow the money.

For Property Club Investors I think this policy makes no great difference as we have long advocated to buy new property for a variety of reasons.

We would still suggest good quality property in good locations. This type of investment may well become more expensive under the Labour plan, because many more investors who might have contemplated an existing property will now be looking for new property in order to continue to use negative gearing to reduce their tax burden. The free research provided by the club will become even more valuable over time.

For those worried about how their children will ever be able to afford a home to call their own, the Labour policy has a lot to commend it in terms of fairness. It is trying to skew investment away from existing property into new, which in turn will create more jobs in building and construction.

On the other side of the coin, the RBA, Treasury and various left leaning think tanks, as well as 90 of polled economists all support the proposed changes. The RBA thinks it would be good for financial stability of our finance sector.

Gavin Slater, NAB personal banking group executive has now come out and said :

Symond is wrong on negative gearing: the National Australia Bank is not anticipating a material impact on the business if negative gearing is abolished.

You can read more here.

Property spruikers alert

It would appear that there are old-style property spuikers in action again around the country and especially in WA, running get-rich-quick seminars.

Anyone who has been reading my newsletters for any length of time would know that I don’t consider myself or the club to be a spruiker. I also stress that property is not get-rich-quick, it is get-rich-slowly, over 10-15 years normally.

As the Youtube video below shows, most of these scams work by enticing people to pay big money to attend a seminar.

Most of the Property Club seminars are either free or cost a minimal amount to cover room hire.

The spruikers then try and talk attendees into shelling out more money for more information, or books or education courses. We don’t do that.

As your property mentor, my time and expertise is always available and always free.

They will often provide over-hyped and outlandish claims as to performance for their suggested property.

I provide a detailed, written cash-flow report which you can take to your accountant or advisor to have them check it for accuracy before making any decisions.

Finally, the average spruiker will try and sign-up attendees of their seminars with a property on the night.

Whilst we may sometimes have properties which we highlight at our meetings, our special conditions allow up to 14 days cooling off period. They are not hard-sell events like the spruikers.

Here is a link to the Youtube video produced by the consumer regulators around the country.

https://www.youtube.com/v/srb0wYnyyWI

45% have never re-financed

I read an interesting article recently in The Advisor, (Click here to read), which is an online publication for the mortgage broking industry.

They were reporting on a survey of more than 1,000 mortgage holders by Aussie Home Loans, in which 45% of participants said they had never refinanced.

29% said they have not done so because they did not think they would get a better deal; 18% had not thought about it or did not know where to start and 17% believed it was too time consuming.

The article went on to quote chief executive James Symond who said :

“Our survey shows that many home owners could be missing out on great deals and potentially big savings”

Well, as a broker, he would say that because the more people who re-finance, the more commissions he would earn.

However, he has a point.

I don’t make any money if you re-finance your loans, so I have no axe to grind. I’m in the process of re-financing 2 loans myself as we speak.

Just by completing our Property Club finance form, you can see if you could get a better deal and more importantly if you have the capacity to borrow more to fund an investment property or two.

Yes, if you re-finance, there is a certain amount of paperwork required, but it’s not hard, just a bit time consuming collecting all the documents the banks need to see these days.

Our brokers will help you and are mobile, so will come to you if required.

There is a form attached to this email if you’d like to have a go.

More News Sources

Please use the link below to visit our media centre. Here you will not only find the latest editions of our magazine, but also back copies, always with some interesting articles.

Click here to read on-line or even download a .pdf copy of the May/June issue for later reading.

You should all have recieved either your posted copy, or a direct email from Head Office with your email version. Let me know if you did not get this latest edition yet.

As usual, if you’d like a hard-copy posted out to you, please let me know.

Kevin Young has now produced over 45 video episodes of him answering questions from our members. You can go here to check it out. The latest few episodes feature interviews with the guest speakers from our March conference. They include Bernard Salt, Clifford Bennet and Gold Coast Mayor, Tom Tate.

Dates for your Diary |

Annual NSW State Conference – Cancelled

The date was to be 17th July, but has now been replaced with an all-new event titled Property & Lifestyle workshop.

It is to be held on Sunday afternoon July 3rd.

So celebrate the end of the election campaign with an afternoon out and hear top-quality guest speakers explain how you can purchase property safely to provide choices in the future for you and your family for the lifestyle that you want, not the one the government wants to give you.

This will now be our main event for the year for our NSW members, other than our National conference, which you have already missed because it was back in March.

The location is the same location for several of our past events at the Bankstown Trotting Recreational Club

178 Eldridge Rd, Condell Park, New South Wales, 2200

The afternoon will start at 1.00pm and should close by 4.00pm.

The agenda will feature Kevin Young there to share his experiences and give his predictions.

Economist Clifford Bennett will talk about economics and how a property portfolio fits into the bigger picture iof what is likely to happen down the track.

There will be at least three interstate researchers flying in to share their thoughs on which areas they are looking at as well as some current and up-coming listings that might be of interest.

This will be just 1 day after the election, so we’ll know by then which party has won and what, if anything, they intend to do about negative gearing and CGT, as well as superannuation. Kevin’s thoughts on this will be interesting to say the least.

This is a great chance to network with like-minded property experts.

If you’d like to come, let me know so I can pre-register you, but if it is a last minute decision, then just turn up on the day.

There will be a cost to this event, $50 per person, or just $35 if you are already a member. If someone has forwarded this newsletter to you and you’d like to come, join up as a member first through me and then I can get you in for $35 !

Existing PMC members should get an individual invite and will only be charged $20.

If you are not a PMC member yet, then joining now (at no cost), could save you $15 !

Ralph Cartwright

Property Mentor of the year 2015 – Runner-up

Your personal Property Mentor & Team Leader

0416 030 872

02 9548 1074

ralph.cartwright@propertyclub.com.au

Are you interested in more information about me and my investment journey ? You can download my story from a file on my Facebook Page via this link:Facebook Page – Go to Files

Forward this email to a friend

See attached Financial Wealth Check form if you would like an obligation-free assessment of your current position.

No Comments