Ralphs Property Investing Newsletter March

Conference Update

Well, that’s another year gone and another conference. I’ve now been to at least 7 that I can remember, all around the country so have heard a lot of stuff more than once.

However it’s always good to catch-up with old friends and get the latest information from experts, builders and researchers as to what is happening where and why.

This conference was on the Gold Coast this year and among the speakers was the Gold Coast Lord Mayor, Tom Tate who gave us an insight into planned projects and strategies to grow the area.

We also heard from demographer Bernard Salt who gave us an insight into which areas are going to have the best growth prospects over the next 30 years and also from Clifford Bennett looking at things from a global finance point of view.

Combined, these differing viewpoints gave me confidence that many areas in Australia will continue to grow for many years to come and that my exisiting properties will also do well long term.

I’m now more bullish about the Gold Coast than I was this time last week and would be directing my interests towards the area around Southport and surrounding Northern suburbs within easy walking access to the new light rail. It has already pleasantly surprised everyone involved in terms of how it has been embraced, particularly by locals. Stage two, connecting to the heavy rail at Helensvale has already been announced and approved and Stage three from Broadbeach out to the airport is on the drawing board. A cruise terminal is also back on the drawing board along with more emphasis on education and health precincts to grow the economy and transition away from tourism as the main driver.

The ABS released their latest overseas arrivals and departures dataset yesterday, click here to read it, and some of the data is very relevant to my comments here.

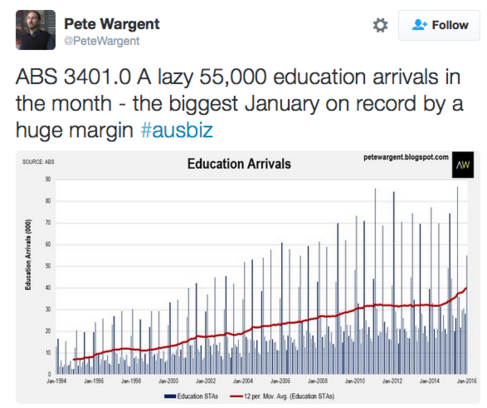

In relation to education, the Gold Coast has three universities and the number of students is growing. Peter Wargent produced this graph from the ABS stats and posted it on twitter.

The majority of students, both overseas and Australian, will be adding to the rental pool, which for investors is a good thing.

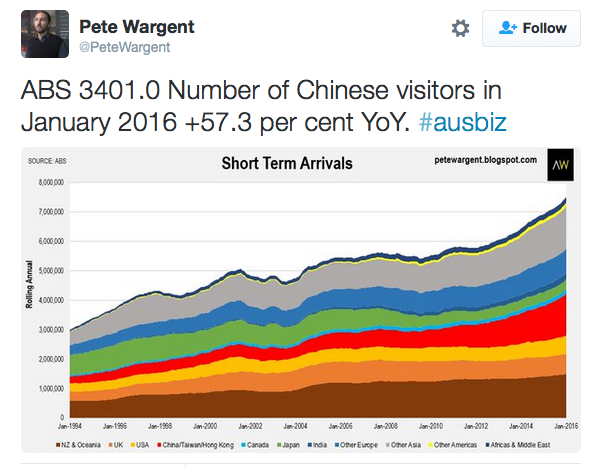

Our hotel had several groups of Chinese tourists come while we were there. They are coming for a couple of reasons, lifestyle and fresh air, combined with shopping and golf are the main drivers. The Gold Coast now has direct flights from China and the city of Wuhan, which has a population of 20 million alone, while Australia as a whole just ticked over 24million in total. Middle class Chinese are eager to appreciate our clean, fresh air and are investing heavily in the area with resorts and hotels aimed at their citizens.

This article from May last year describes what is happening and details the investments being made. The graph below shows the number of Chinese tourists who are coming here.

The Gold Coast has a lot of rivers, lakes, parks and green spaces with those planned to stay. Another 100km of walking/cycling paths are planned and new developments are planned along the route of the light rail to increase the density, rather than sprawl outwards.

In Brisbane, planning is underway for a new river crossing for trains and buses to ease congestion with inner city suburbs to benefit from greater and easier access into the city. This is the so-called BaT tunnel.Upcoming projects worth a look

There are a number of projects that I heard about at the conference that look good including the following:

Cannon Hill is a suburb I have mentioned in previous newsletters and is about 9km from the CBD, but close to the Trade Coast with the airport, port and major industrial areas nearby. A new project under way and due for completion before Xmas consisting of only 17 apartments which are larger than average with good sized balconies priced from $460K caught my eye. Only 900m to the Cannon Hill KMart Plaza.

Beenleigh, like Cannon Hill, is an area undegoing huge changes and set to provide excellent long-term growth as it changes character. I mentioned this in my last newsletter. Only 200m to major shopping and priced from just $334K.

In a leafy residential street just a short walk from the Southport CBD is another attrractive looking block of 26 units with views out over the Broadwater and an easy 5 minute stroll to the light rail. Very large with some equally large balconies, these will be priced from just under $500K and are due for completion by Februray 2017.

Finally, a new quality complex of just 11 units is going up in a quiet Stafford street, just 600m from the Stafford Centre. Again, these will be larger than average with many having city views.

Keep watching this space for more details as these get listed in the coming weeks.

Interest Rate News

Despite what you hear in the press, there are still some good rates around, especially if you go through one of our club brokers.

This story says that Suncorp are now offering investors a 3 year fixed rate of 3.99%.

I also heard from one of our branch Managers at the conference that they refinanced a couple of weeks ago at 4.1%

Low rates have now been around for a little while now and are tipped to stay low for at least another year or so. Many people have been using the low rates to keep their payments going at previous levels and so this story reports that NAB customers are 56 months ahead, 4 out of 5 CBA customers are on average 7 months ahead, 25% of ANZ customers are 6 months ahead and Westpac report that 10% of their customers are 2 years ahead !

This article reports on comments by Shane Oliver from AMP Capital who says he doesn’t see a crash coming as reported on 60 minutes recently and he disputes the claims by some that banks are not checking paperwork carefully enough.

Here is one of the articles looking at those claims. From what I know from my members and club brokers, this type of behaviour has to be very limited and I find it hard to believe this is widespread. APRA and the banks are being more careful about who they lend money to, than I can remember for years.

Flight attendants flocking to mortgage broking industry

This article in The Advisor the other day caught my eye with the above headline and then started off with this:

An experienced broker and industry coach says most new entrants to the profession now have “no banking background whatsoever” and are often former flight attendants, police officers and athletes.

I consider the finance part of investing to be the most important component of the whole package and so only introduce my members to experienced people who I can trust.

Laurayne Walkenden is the broker that I am currently using for most of my new members and she is an ex Branch Manager for one of the major banks. Has been in banking for 30 years and has been a broker for the last 8 years. She owns her own home and has an investment portfolio of 4 properties.

She writes:

From my experience these types of entrants to the industry are good with Vanilla deals, straight forward types of transactions with one security. Once the deals gets more complexed then you need a broker that understands Finance through and through so they can source the better deal and structure. These entrants rely on computer systems to guide them to a lender and product.

As an example. I had a member the other day, quite a seasoned one with a number of properties. All existing loans were all low doc so you could imagine he had been dealing with a Broker of experience. The Broker had advised they he could not assist them with restructuring their loans to reduce a LOW DOC RAMS loan. The Member was referred to me by a Property Mentor. I looked at the Wealth Check together with their financials. I spoke to the Members Accountant as there were a number of questions I needed answering. After much calculating I have gone back to the Member with a plan of action to reduce not only 1 loan but the whole portfolio reducing interest rates from btween between 6.59-8.25% down to 4.49% & 4.59%.

Hence, to have a broker working with you that thoroughly understands not only Finance but Portfolio Management and Investment lending, together with a good understanding on how to read and understand Tax returns and Financial Statements plus knowing the right questions to ask the Accountant, is far better than having a Broker who is new to the Finance Market or one that does not deal with or understand creating structures that assist members with growing wealth through Property.

If you’d like to have Laurayne look over your current situation to check that everything is in order and maybe suggest ways to save money, at no cost to you and no obligation to do anthing, just complete the attached finance form.

NT looking at Insurance for builders and consumers

In many areas of business, it seems to be consumers and workers that get the rough end of the pineapple when things turn bad.

Seems from this ABC story that in the NT at least, they are trying to do something about it with all the ususal suspects saying it is a bad idea. This related article too.

Interesting that some of the arguments against doing anything are the same ones being trotted out about doing anything to negative gearing. That argument being housing is too big a part of the economy to risk touching anything to do with it.

Top Ten suburbs for rental Yield

This report from CoreLogic highlights the best performing suburbs around the country for units rent return.

Of the ten suburbs in this report, 6 are in Cairns and 4 are in SA, with 3 of those in Payford which is near Elizabeth.

I wouldn’t be touching any of these suburbs with a barge-pole as an investor, despite the rent return. Elizabeth, for example has a vacancy rate of 1%, which is why rent return is looking good, but has an enemployment rate of 33% and with the car plant due to shut down next year with the loss of a further 1,600 jobs.

The economy of Cairns on the other hand is having a bit of a resurgence due to tourism on the back of the Australian dollar against the overseas currencies. However, the main reason for low vacancy rates there has been the lack of supply over the past several years. There is now a large number of new projects coming on line and so this area will be a typical boom-bust story with oversupply the inevitable outcome.

Negative gearing arguments

As I forecast when this policy was first announced, every man and his dog has had their say and I won’t bore you with a great deal more, but couldn’t resist a couple more stories:

There was the recent BIS Shrapnel report fiasco where a very dodgy report was published which was seized on by those who thought it bolstered their case. Many others denounced it as rubbish. Within a day or so, most were distancing themselves form it as fast as they could. BIS still refuses to tell us who commissioned it.

The assumptions used make no sense to me either, but here is a link to the full report, so if you have the time, feel free to download it and make up your own mind.

Rob Burgess, Economics commentator wrote this piece in the New Daily and seems very discouraged that nothing will change.

He wrote this just a day or so after the announcement was made and said:

The biggest losers under Labor’s plan would be the rent-seekers, powerful interests able to earn and politically protect returns above free market rates.

These include the banks, insurance companies, real estate firms, financial advisers, mortgage brokers, and a heap of smaller related occupations.

These industries will lobby the government, and the voting public, to leave the laws unchanged.

He finishes by saying that he expects:

……. their lobbying will succeed, at this election at least.

Terry Ryder wrote this piece explaining why he didn’t think it was a good idea, but disagreeing with many on his side about why. He is in the club that says prices of new property will rise. He also points out that The Federal Government, after two very long and expensive parliamentary inquiries which achieved little, has decided to make foreign investors the scapegoats for un-affordble housing and that now Labour’s idea to make negatively geared Australian investors the scapegoats is equally as dishonest.

John Symons the Aussie Home Loans founder made headlines with the claim that prices will drop by 20%. You can read more here. I don’t agree with his logic either, seeing him as one of the typical rent-seekers who wants to see no change, but he does have a good point at the end where he says:

“Unfortunately the tax system has been busted for decades and it hasn’t been addressed.”

“I think we’re in no different position than we’ve been in for the last 20 years with a flawed tax system that just doesn’t work.”

Finally, an article by John Daley, CEO, and Danielle Wood, fellow, at the Grattan Institute (read it here), who make similar points to Rob Burgess that :

…….this poses a serious test for Australian democracy. Does our system work in the public interest? Or is it ultimately hostage to vested interests adversely affected by any policy change?

Vested interests have three main levers to influence policy: advocacy for media coverage, access to decision makers, and paid advertising.

When change really threatens they call on all three.

They finish their article with the thought that:

But politicians are easily spooked by public advertising campaigns. The media can report the viewpoints of those who have something to lose with appropriate and overt scepticism. This can help voters to understand the issues. Voters can then remind their representatives about what’s in the interest of the quiet majority. Ultimately, if politicians advance policies to appease vested interests at the expense of ordinary Australians, the ballot box is the only way to get their undivided attention.

Finally, we had news crews form both Channel 7 and Channel 10 at the conference doing a spot for the nightly news and the audience was keen to show that we thought prices of properties would rise if changes were made. As an investor I have no issue with that – bring it on. I expect I’ll be able to share video of that in due course.

Why me ?

I don’t usually like to blow my own trumpet, but at the conference this year, I was awarded the silver medal for Property Mentor of the Year, 2015.

That means that you are pretty lucky to have me as your mentor and can take advantage of my experience, passion and dedication in helping my members buy wisely and safely.

Rentsafe explanation

I have talked about some of the benefits of being involved with the club in the past in these pages, but I don’t think I have ever spelt out the full benefits of our Rentsafe program.

Rentsafe basically ensures that from the date of settlement, if we can’t source you a tenant for your property within 14 days, we’ll start paying you half of the profile rent until we do.

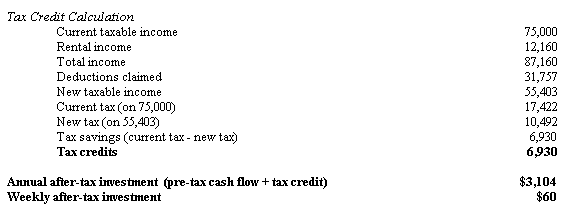

On the left is the worst-case scenario of you being without a tenant for 6 months !

The most I have ever had one of my members wait for a tenant, has been around 6 weeks.

This sometimes happens when a complex is completed and all of the properties come onto the market at the same time. Rents tend to drop a bit from the expected level as the stock takes a few weeks to be absorbed and new owners can get a bit worried that they have no tenant.

The example above is from the Beenleigh listing I talked about in my last newsletter.

So the scenario here is that the expected lower-end rent in our profile is $320 per week. The property settles and no tenant is found. After 14 days, Rentsafe kicks in and the Club will start paying you $160 per week. In this example, I have assumed it takes 6 months to find a tenant. Then the tenant moves in and pays $320 per week and the Rentsafe payments at $160 cease.

So instead of rental income of around $16,640 per annum, you would only collect a total of $12,160.

As you can see from the calculations, your expenses are still claimable in full and so at the end of the year, you’d be out of pocket by just $3,104.

It’s not ideal of course, but it is also very unusual to be without a tenant for that period of time.

What would happen if you had decided that you knew better than me or the club and decided to purchase on your own ? Do you think your real estate agent is going to put his hand in his pocket and pay you nearly $4,000 while you are searching for a tenant ? No, I don’t expect they will.

This is a completely free service. It costs you nothing and is available for all club properties for the first tenancy only. Terms and conditions apply, of course, but it is a system that works well and provides our members with peace of mind.

Who pays for this, I hear you cry ? Well, it is paid for out of the referral fees that we get from the builder or developer for introducing you to them.

More News Sources

Please use the link below to visit our media centre. Here you will not only find the latest editions of our magazine, but also back copies, always with some interesting articles.

Click here to read on-line or even download a .pdf copy of the Mar/Apr issue for later reading.

You should all have recieved either your posted copy, or a direct email from Head Office with your email version. Let me know if you did not get this latest edition yet.

As usual, if you’d like a hard-copy posted out to you, please let me know.

Kevin Young has now produced over 30 video episodes of him answering questions from our members. You can go here to check it out.

He also wrote a long newsletter last week with his comments on the economy and his 2016 predictions. Some of you may have received that, but if not and you’d like a copy, let me know.

Dates for your Diary

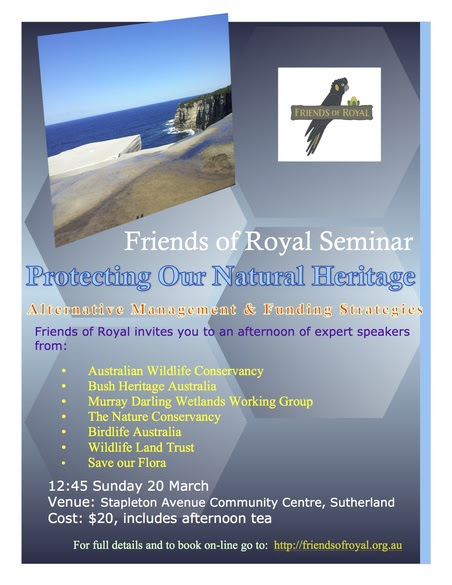

Friends of Royal seminar invite

When I am not helping my members build their wealth through property, or going on holiday, I have a number of other interests, native plants and my local National Park where I enjoy bush-walking being a couple of them.

With that hat on (I’m treasurer of the Friends group), I’d like to invite you to an afternnon seminar that we are running later this month.

The date is Sunday afternoon, 20th March from 1.00pm at Sutherland. You can go to our Website to book and pay.

Seating is limited and places are starting to fill fast. We are just over half full now.

The seminar has a world-class lineup of speakers from well-known organisations including Bush Heritage, BirdLife Australia, Australian Wildlife Consevancy, Environmental Water Trust, Wildlife Land Trust and others.

There is an associated expo with information from other organisations such as Save Our Flora, Bushcare, Wilding Australia and several others. The cost is just $20 which includes a nice afternoon tea.

You can also email or call me for more info.

Rooty Hill- Property Investment Information Day

The date will be Sunday afternoon, 17th April from 1.00pm until 5.00pm

There will be an entry fee of just $15 to cover the hall hire and will include afternoon tea.

The venue is the Rooty Hill RSL & Resort at 33 Railway Street, Rooty Hill , NSW 2766

Every property on our stock-list will be up on the wall for you to read about. Our mentors will be available to run cash-flow reports using your inputs so you’ll understand how holding such an asset would affect you. Brokers will be on-hand to discuss your finance options.

Kevin Young will be in attendance sharing with you his predictions, plans and insights.

At the same time, there will be on-going presentations on a variety of subjects including:

How our Researchers can save you months/years in searching for the ‘right’ property

Current Hotspots

Landlord Insurance

Recordkeeping

Interest Rates

Depreciation Reports and Accounting

Space is limited, so contact me to get you registered.

No Comments