Socio-Economic Forecast for Sri Lanka-by Dr. Harold Gunatillake

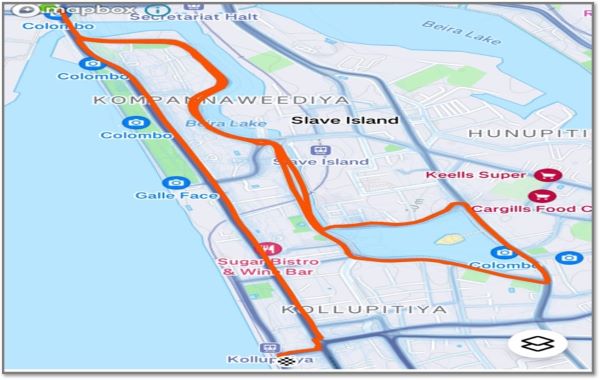

Image Source:Peek

Presenting the Socio-Economic Forecast for Sri Lanka, we’re excited to share insights into the country’s prospects. Let’s explore what lies ahead with optimism and hope.

Currently, Sri Lanka faces significant challenges in generating sufficient foreign exchange from exports and tourism to begin paying off its debts by 2028. While tourism and exports are critical to the country’s foreign exchange reserves, the current outlook indicates they may not be sufficient unless both sectors grow significantly. To turn things around, Sri Lanka can diversify its export portfolio, invest in value-added industries, and increase marketing efforts to attract more international visitors.

Additionally, implementing reforms to create a more business- friendly environment, improving infrastructure, and offering targeted incentives for exporters and tourism businesses can help boost foreign exchange earnings. With strategic planning and consistent policy execution, Sri Lanka can improve its chances of meeting its debt repayment targets by 2028.

Tourism is truly the gateway to our bright future. Instead of depending only on tea exports, other trade, or foreign employment earnings, let’s warmly invite more high-end tourists to discover the beauty of our island. By promoting sustainable tourism and sharing our unique culture, heritage, and breathtaking natural landscapes, we can foster steady economic growth and open up more jobs for our local communities.

Investing in high-quality infrastructure and encouraging responsible tourism will help keep our country a charming, authentic destination for travellers seeking memorable, heartfelt experiences.

Recent reports indicate that this statement concerns Dr Nandalal Weerasinghe, the Governor of the Central Bank of Sri Lanka (CBSL).

Here’s what you need to know about this development as of early 2026:

Foreign remittances from Sri Lankan expatriates exceeded **US.

8.076 billion.

In January 2026, Governor Weerasinghe expressed optimism for the year ahead, noting a 31.1% increase in remittances compared to January 2025.

Debt repayment and financial stability have improved following the removal of the parallel exchange rate, driven by increased remittances. This boost has strengthened foreign exchange reserves and enabled the country to make progress on its debt- restructuring plans.

The influx of funds is a crucial factor in Sri Lanka’s recovery from the 2022 economic crisis, providing much-needed stability to the

country’s financial outlook. This positive development is genuinely uplifting and underscores the value of additional support during tough times.

On January 2, 2026, the CBSL Governor shared encouraging news about the country’s growth prospects for 2026, celebrating progress in recovery following the cyclone. The update was shared at 3:13 pm and paints a bright picture for the year ahead.

Prof Ranjith Bandara, a caring economist and Member of Parliament, shares in a heartfelt Facebook post that the Central Bank Governor’s recent optimistic remarks about a 4–5 per cent growth in 2026, along with shining highlights like improving reserves, lower inflation, and steady financial stability, have been warmly embraced. After navigating Sri Lanka’s tough economic crisis, it’s completely understandable that any signs of returning to normalcy bring comfort. However, it’s important to approach this optimism with a gentle mindset. What’s being shared is mainly a story of stabilisation and recovery, using the familiar IMF language of macroeconomic management. While this is a positive step, it’s not quite the same as a clear path toward long-lasting growth.

If Sri Lanka maintains its IMF loan repayments on time, implements stronger anti-corruption measures, and adopts a cautious approach to government spending under the NPP, the outlook for the country’s economy appears cautiously positive. These positive changes could help stabilise the overall economic situation, rebuild investor trust, and promote better fiscal habits, all of which are essential for steady growth. Over time, such steps might attract more foreign investment, strengthen exports, and foster growth in local industries.

Focusing on self-sufficiency, Sri Lanka has the potential to decrease its dependence on imports, especially in farming and essential goods, which could boost its balance of payments and improve food security. While there are still challenges to overcome—such as ensuring policies are effectively implemented and maintaining a strong social welfare system—the combination of careful financial management and good governance offers hope for a brighter future. If these positive signs continue, we can

expect steady social and economic progress and a path toward greater self-sufficiency in the years ahead.

End