The latest blow to the oil markets: Chinese manufacturing activity slows down again! – By Hemantha Yapa Abeywardena

With the latest manufacturing data from China that shows a relative slowdown, compared to March, both the traders and investors have been compelled to accept the inevitable; it is neither easy nor feasible to shore up the oil and gas prices in the current circumstances.

With the latest manufacturing data from China that shows a relative slowdown, compared to March, both the traders and investors have been compelled to accept the inevitable; it is neither easy nor feasible to shore up the oil and gas prices in the current circumstances.According to China’s National Statistics Bureau, the manufacturing manager’s PMI for April was 50.4%, a drop of 0.4% from that of March; having been below 50% since September, 2023 – the threshold – the key Chinese manufacturing index rose above the latter in March.

Investors, not just in oil and gas sectors, breathed a collective sigh of relief, when they noticed a growth in the manufacturing sector in the world’s second largest economy, China.

The evolving volatility in the Middle East, coupled with China’s encouraging manufacturing data, did push the price of oil in April, only to come down as the days wore on.

In this context, the latest Chinese manufacturing data is hardly going to be a catalyst for the energy markets, when it comes to attracting investors.

Of course, the relative contraction in the Chinese manufacturing sector in April, is related to both local and global demand for the Chinese goods. That means, the global economy is not out of the woods yet, despite the shifting indices and over-the-top optimistic forecasts by various global bodies.

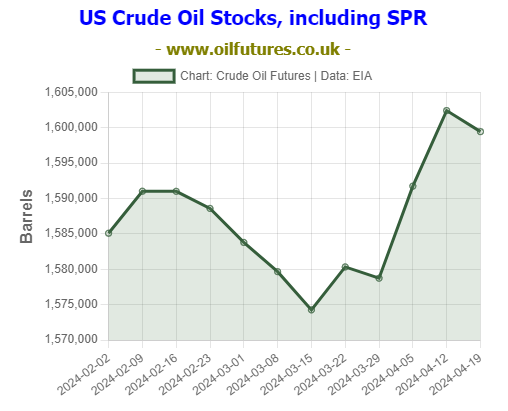

The inflation in the US, for instance, is a lingering concern for the investors in the energy sector: it goes without saying that the higher the inflation, the lower the spending power of consumers; two weeks ago, the crude oil stocks in the US rose sharply, partly due to economic worries in the world’s top economy; it fell down last week, but not steep enough to excite the traders and investors.

With just seven months to go before the US presidential elections, yet another hike in interest rates by the Federal Reserve, in this context, cannot be ruled out – as a crucial step to taming the seemingly uncontrollable inflation that keeps defying the remedial measures.

In addition, Iran and Israel came perilously close to an armed confrontation with the endgame of a full-blow war. Yet, the price of oil stubbornly refused to move upward in proportion to the rising, obvious anxieties.

In light of these developments, investors in both oil and gas sectors, thought some encouraging manufacturing data from China would lift the mood up; the latest manufacturing data from China, however, put a damper on that prospect.

Meanwhile, China’s conflicts with its neighbours – for instance, the Philippines – do not create a conducive atmosphere to repair the strained diplomatic bridges between the Asian giant and the West; on the contrary, the relations are at an all time low, despite the frantic efforts on both sides not to let them deteriorate.

In uncertain times, the OPEC, used to step in and use the leverage at its disposal to shore up the falling – or stagnating – oil prices. Since the only measure that they often go for is cutting down on the production, whereby creating an inflated dip in the commodity in the markets, the decision making makers of the cartel does not appear to be having anything up their sleeves to push the oil prices up and then, make them stay that way.

Even if the members reluctantly agree on production cuts, as it happened in 2023, the implementation of the former adhering to quotas has become an ever present challenge: Saudi Arabia, the de facto leader of the organization, for instance, cannot read the riot act against those who find loops in the collective agreement to creep through, because they desperately need revenue from oil; any heavy-handed approach could potentially cause irreparable fissures in the cartel.

In this context, a potential meeting of the OPEC+ in May is unlikely to result in a change in ground realities.

Of course, oil producers have understandable issues to be addressed: the break-even price of an oil barrel as far as Saudi Arabia, the world’s top exporter, is concerned, according to the IMF is above $90.

|

| www.oilfutures.co.uk |

As of 10:15 GMT, the prices of WTI and Brent were at $80.88 and $85.85 respectively – far below the threshold.

The OPEC+, in this context, can engage with the major consuming nations to highlight their ‘side’ of the oil story while exposing the genuine issues facing the industry; demonizing the speculators as the main culprits behind the falling oil prices hardly is neither helpful nor effective.

A collaborative approach, a fresh thinking of this kind, is an ideal for striking a balance between producer revenue and consumer affordability; it is something, in my opinion, long overdue.

At least, the producers can stop themselves from becoming the sacrificial lamb for the current global economic woes in the realm of amplified sentimentality.