NOEL NEWS

“The best investment you can make is in yourself”

WARREN BUFFETT

PODCAST

Making Money Made Simple

with Noel Whittaker

Renowned broadcaster John Deeks and I discuss all the big topics covered in this newsletter in detail each month.

Welcome to our October Newsletter

As always, there is much to talk about.

The Albanese Government’s First Home Guarantee, which I covered in detail in our last newsletter, has just begun. It allows first-home buyers to buy a new home with just a 5% deposit and no lenders’ mortgage insurance, with taxpayers guaranteeing 15% of the loan.

On the surface, it sounds like a gift. But Lateral Economics predicts it will push national home prices up another 3.5% to 6.6% by 2026, and even more – 5.3% to 9.9% – in the price ranges most targeted by first-home buyers.

Image by karlyukav on Freepik

In the last newsletter I mentioned a two-bedroom unit in Morningside, Brisbane, which I sold for $740,000 in July last year. The price then exceeded my expectations. The agent tells me the price is now close to $790,000, thanks in part to the scheme.

The scheme drives up prices. It’s not rocket science – house prices are determined by supply and demand. As Reserve Bank Governor Michelle Bullock pointed out, we’re stuck with a structural shortage of housing supply, and that won’t be solved easily. To me, it’s one of the worst pieces of government policy I’ve seen in my lifetime.

Notice too how talk about interest rates is shifting. I’ve been saying all year that I don’t see rates falling much further. Economists at most of the big institutions disagreed – until the governor’s recent statement. Now consensus is growing that rates won’t drop this year. And with construction everywhere, tradies impossible to find and costs rising, it’s hard to see how inflation does anything but increase.

Self-driving cars

Last month was exciting for me in the motor vehicle space. I traded in my old Tesla 3 for a new Tesla 3 to get the benefit of Hardware 4, which is needed to install Full Self-Driving (Supervised) (FSD). I’m delighted that FSD has exceeded my expectations.

Last weekend I drove from Sunshine Beach to Maroochydore, which is about a 35-minute drive, without once touching any of the controls. It did the whole thing itself. My wife, Geraldine, handed down the final verdict. She said she would much rather drive in the Tesla with FSD than with me driving.

As economist Noah Smith wrote:

Self-driving cars are proving much safer than human drivers. In 2023, Europe had 20,000 road fatalities, while the U.S. had double that. Saving those lives should be a priority.

The solution is clear: get humans out from behind the wheel. Waymo’s peer-reviewed data shows dramatic reductions in crashes compared to human benchmarks: 96% fewer intersection injuries, 92% fewer pedestrian incidents, 82% fewer cyclist and motorcyclist crashes and 74% fewer side impacts.

Because self-driving cars also reduce the severity of unavoidable crashes, deaths fall even more sharply. Neurosurgeon Jon Slotkin estimates that if every U.S. vehicle matched Waymo’s performance, 33,000–39,000 lives would be saved annually, along with up to $1.25 trillion in costs. Even partial adoption at 27% could save 10,000 lives each year – the equivalent of eliminating all pedestrian deaths.

This isn’t incremental; it’s transformative. Self-driving cars convert serious crashes into minor bumps. As adoption increases, vehicles will communicate directly, avoiding more accidents altogether. We could be on the brink of eliminating one of America’s leading causes of death – with massive gains in life expectancy.

Thank You Sydney

Thank you all for coming to our presentation in Sydney last month. It was so great to make acquaintances with many subscribers to our newsletter. I really appreciate the involvement of the audience.

Upcoming Events

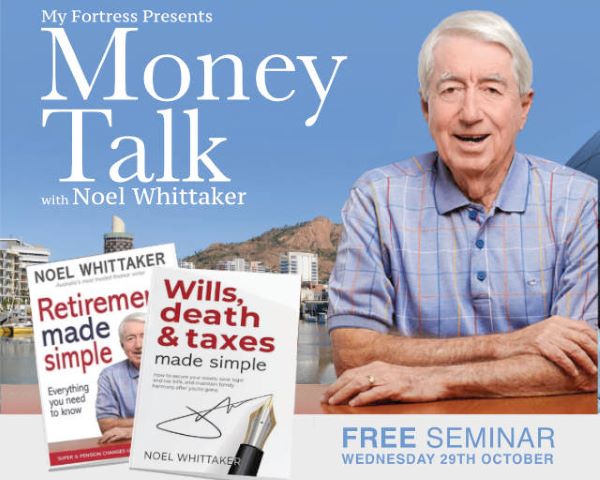

Next presentation will be in Townsville on 29 October. Details are below.

My Fortress is hosting this special event where I’ll be covering:

• The importance of professional financial advice

• The differences between asset classes – cash, property & shares

• How to achieve a comfortable retirement

This will be explained in easy-to-understand principles which will help you to build a lifetime of wealth.

Attendees receive a FREE copy of one of my books.

WHEN

Wednesday 29th October

WHERE:

Fit For Life Financial Services Centre

62 Charters Towers Road, Hermit Park

REGISTER NOW

(scroll down to find the event)

Call 07 4771 3800

Future Events

We’re also making arrangements for presentations in Melbourne and the Yarra Valley early in December and then in Tasmania late in February.

Full details will be in forthcoming newsletters.

Getting the right advice

Getting a grip on your finances is relatively simple when you’re young: spend less than you earn, avoid consumer debt and learn to budget and set goals. But it’s a different story for seniors. They’re navigating a jungle – superannuation, tax minimisation, estate planning, powers of attorney, age pension rules – plus the big lifestyle questions like downsizing and aged care.

At this age you need a team. Your solicitor, accountant, financial adviser and various specialists may all play a role. But most are experts in only one area, and they rarely see the whole picture. The following email from a reader is typical:

When we were updating our wills, the lawyer advised us never to take out a reverse mortgage, stating, ‘You would lose the house in the interest repayments.’ But what will we do for money if our super runs out and we can’t live on the age pension? If we did take out a reverse mortgage, how would our age pension be affected?

This lawyer’s tip was way off track, but sadly I’m getting more and more emails in this vein as professionals in one field try to comment on areas that they know little about.

It’s a fact of life that most retirees won’t be able to enjoy the lifestyle they want without tapping into the equity of their home. And there are only two practical ways to do that: move to a smaller property or borrow against the one that you have. Both choices have advantages and disadvantages.

Many people are tired of a big old home that requires ongoing maintenance. For them, downsizing is the obvious option. But this has costs such as sales commission, stamp duty (if applicable), and possible loss of pension because you’re moving an exempt asset (your home) to assessable assets such as superannuation. Costs can easily run over $200,000.

So for the many people who love where they are but still need to access the equity in their home, a reverse mortgage lets them stay in their home and avoid the costs and disruption of moving. It can be an excellent solution when used appropriately.

Reverse mortgages have traditionally been used to top up retirement income. The government’s own Home Equity Access Scheme is designed for this, enabling a fortnightly drawdown of funds. This has no effect on your pension and keeps interest costs low, as the loan size only increases gradually. For example, if you began drawing a small reverse mortgage in your early 80s on a home worth around $2 million, the impact would probably be minimal, as the increase in value would more than compensate for the cost of the reverse mortgage.

But more and more retirees are finishing work with an outstanding balance on their home loan or credit card, and a reverse mortgage can be used to refinance this debt without depleting retirement income. Another common use is to renovate the family home, thus enjoying another 20 years of lifestyle and improving the value of a capital-gains-tax-exempt asset. The risk here is that the debt increases over time, as no repayments of principal or interest are required. However, the impact can be minimised by starting the loan as late in life as possible, or by choosing to pay the interest on the loan, thus preventing it from compounding.

Reverse mortgages can be a very effective tool in your retirement strategy. Just make sure you take advice about their application to your specific situation from someone who is properly equipped to advise you.

From the Mailbox

“I read your articles and followed the steps in your book Making Money Made Simple.

I first found it in the local library – the red book with the $20 note photo. I migrated from Fiji in 2001 and that book changed my life. Over the next 24 years I studied and worked my way up: enrolled nurse, registered nurse, clinical nurse specialist, associate nurse unit manager, and now hospital supervisor. With each promotion came knowledge, wealth, and achievement. I invested wisely and made sure every dollar had a job – simple index investing and two quality properties.

Now, at 49, I’m helping my kids in their 20s buy their first homes. I generate enough passive income that I could slow down, but I love my job. I’ve also built a healthy superannuation balance of $492,589, thanks to your advice on concessional contributions. I will forever be grateful for your guidance. Thank you, thank you. May God bless you with good health.”

Teaching kids about money

People are always asking why financial literacy isn’t taught in schools. The usual excuse is that the syllabus is too crowded – yet demand is overwhelming. A survey by Ecstra Foundation found 98% of parents, 95% of teachers and 93% of students want it included.

Maths and physics are important, but financial literacy doesn’t need a semester. I could teach the basics in an hour. Once you’ve got the principles, applying them is simply a matter of staying on course.

Image by fabrikasimf on Freepik

This is what I’d say to a class of high school students if given the chance.

Welcome to the world of financial independence. Right now you own something Warren Buffett, for all his billions, can never buy: time. Time is your secret weapon. It lets you harness the magic of compound interest, the most powerful wealth-building force, available the moment you start investing.

So how does it work? Compounding means you make an investment and you don’t spend the earnings – you keep them with the original money, re-investing them both. Each year your capital base grows, producing even more earnings the next year. Eventually your money is working harder than you ever could, earning interest on interest until it snowballs beyond imagination. That’s the point where money starts working for you, not the other way around.

Think about Kerry and Alex, both aged 15. Kerry gets the message and immediately starts investing $2,000 a year into an index fund, continuing until the age of 30 before stopping to buy a house. Alex delays until 30, then invests $2,000 a year without fail right through to 65.

Who’s better off at 65, with a 9% return? The surprise winner is Kerry, who invested just $30,000 and finished with $1.2 million. Alex contributed more than twice as much – $70,000 – but ended up with only $430,000. That’s the magic of starting early and letting time do the work. So let me ask you: who would you rather be?

Before you can invest, you need to earn. One of the best moves is to get a part-time job early. When you earn your own money, you learn independence, responsibility and discipline. You discover how to turn up on time, serve customers and be relied on. You realise money doesn’t just appear – it’s exchanged for effort and skill. The earlier you learn this, the better prepared you’ll be.

Most people who become financially secure follow one golden rule: never spend more than you earn, always save a little. It sounds simple, but the habit is what matters. At first it’s not how much you save but the discipline of saving something. Habits compound just like money, and over time the saver always beats the spender. That’s why buy-now, pay-later schemes are so dangerous: they mortgage tomorrow’s income for today’s wants. Do you really want to trade your future for something you don’t need right now?

The next principle is to set goals. Without them, it’s easy to drift through life. When you write goals down, you turn vague wishes into concrete plans. Goals give direction, motivation and purpose. They keep you on track when distractions come and remind you why you’re putting money aside, whether it’s saving for something special, building a business or investing.

It doesn’t matter if you’re 15 or 55; there’s always something new to learn. The more skills you gain, the more valuable you become. Your income is the engine that drives wealth. Compounding is powerful, but it’s your ability to earn – and to keep increasing your earnings – that fuels everything else.

So here’s my message to you:

· first, never spend more than you earn

· second, save something from every dollar

· third, start investing young and use your greatest asset – time – to make compounding work for you;

· and fourth, keep learning.

Do those four things and money will give you freedom, security and choice for life.

How deeming affects aged care charges

Aged care has been in the headlines lately, with emphasis on the long time it takes for an assessment for aged care to be conducted, and then the long wait for what has been approved to happen. At the same time, the deeming rates have been changed. While there has been much publicity about their effect on the age pension, very little has been written about their effect on aged care fees.

And this is where the real story lies: deeming affects everyone receiving aged care, whether it’s a home care package or residential aged care. The biggest impact is likely to fall on self-funded retirees, because they usually hold more financial assets than full pensioners.

With home care packages, everyone pays a basic daily fee (BDF) of about $12 a day. What you pay beyond this depends on your income, so it is called an income-tested care fee. Full pensioners don’t pay it, because the thresholds are set at the maximum income a full pensioner can have. But part pensioners can pay up to $6,862 a year, while self-funded retirees can be slugged up to $13,724 a year.

What comes as a surprise to many retirees is that their ‘income’ is not based on taxable income, or even actual investment earnings, but on Centrelink’s deeming rules. And on 20 September, the deeming rates were increased by 0.5%. Until then, singles were deemed to earn 0.25% on the first $64,200 of financial assets and 2.25% above that threshold. For couples, it was 0.25% on the first $106,200 and 2.25% above that. Now the deeming rates are 0.75% up to the threshold and 2.75% above that.

Aged Care Guru Rachel Lane gives the following examples. John, a self-funded retiree receiving a home care package, has $3 million in investments. With the old rates, he was deemed to earn $66,216 a year and paid $20 a day – almost $7,300 a year – as an income-tested care fee. From September, his deemed income has risen to $81,216 (an increase of $15,000) and he has to pay the maximum fee of $37.70 a day towards his care.

Residential aged care uses a combination of your assets and your income to calculate your care fees. Just like with home care, deeming is applied to your investments to calculate your income. That means many part-pensioners and self-funded retirees will see their contributions rise.

Take Judy, a self-funded retiree who moved into an aged care home earlier this year, paying a refundable accommodation deposit of $500,000. She has $1.4 million in financial assets. Under the old rates, she was deemed to earn $30,216 a year. From September, that has increased to $37,216. Before, Judy was paying almost $86 a day – $31,357 a year – as a means-tested care fee. After the deeming increase, her fee has risen to just over $90 a day, or close to $33,000 a year.

A small rise in deeming rates may sound minor, but for older Australians in aged care it can mean thousands more in fees. Many self-funded retirees will feel the effect, and some may hit the maximum. It’s a timely reminder that aged care fees don’t depend on what you actually earn but on what the government deems you to earn.

Aged care is one of the most complicated areas in the financial services sector. That’s why it’s so important to seek quality advice to optimise your affairs. There are now specialist investment products available, designed specifically for people like John and Judy in the case studies above, which can significantly reduce the pain. And, of course, the earlier you act and get the right advice, the easier it is to protect your wealth and manage the costs of aged care effectively.

Retirement Made Simple

As life keeps changing, so must our knowledge. Don’t forget there is

now a brand new a brand-new edition of Retirement Made Simple—

updated with all the latest superannuation thresholds and rules that

took effect on 30 June 2025. It’s available now from my website, and

as always, the best value is in the bundle deals—because we pay the

postage when you buy more than one.

Grab a Bundle & Save!

FREE SHIPPING ON ORDERS OVER $35 IN AUSTRALIA

A Heavenly Local Call

A traveller is touring the world to write a book about famous churches.

In a church in the United States, he sees a golden telephone with a sign underneath that says: “Direct line to Heaven. Cost: $10,000 per call.” The priest confirms it’s a direct line to talk to God, but it’s an international, long-distance charge.

The traveller sees the same golden telephone and the same $10,000 sign in various other countries, including Canada, the UK, and Europe.

Finally, he arrives in Australia and enters a church. He sees the very same golden telephone, but the sign underneath reads: “Direct line to Heaven. Cost: 40 cents per call.”

The traveller is stunned and asks the priest, “Father, I’ve travelled all over the world and everywhere the call to Heaven costs $10,000! Why is it so cheap here in Australia?”

The priest smiles and replies,

“You’re in Australia now, mate. It’s a local call.”

And finally

I tried to come up with a carpentry pun that woodwork. I think I nailed it but nobody saw it.

My wife called to tell me she saw a fox on the way to work. I asked her how she knew it was on its way to work. She hung up on me.

A lumberjack went into a magic forest to cut a tree. Upon arrival he started to swing at the tree when he shouted, “Wait! I’m a talking tree!” The lumberjack grinned and said: “And you will dialogue.”

I once dated a girl with a lazy eye. I always thought she was seeing someone on the side.

I accidentally passed my wife a glue stick instead of a chap stick. She’s still not talking to me…

A friend said she didn’t understand cloning. I told her that makes two of us.

A husband said to his wife, “The guys at the club said that our mailman has slept with every woman on our street except one…” Wife replies, “I bet it’s Paula.”

There was a big paddle sale at the boat store. It was quite an oar deal.

Yesterday I saw an ad that said “Radio for sale, $1, volume stuck on full.” I thought, “I can’t turn that down.”

A slice of apple pie in Jamaica is $2.00. It is $2.50 in the Bahamas. These are the pie rates of the Caribbean.

What’s Irish and stays outside all year? Patty O’Furniture.

What do you call a bulletproof Irishman? Rick O’Shea.

What do you call a magician who has lost his magic? Ian.

A big thank you to all you good people who read my newsletter.

If you were forwarded this newsletter by a friend and you would like to subscribe, you can do so here:

” target=”_blank” rel=”noopener noreferrer”>Subscribe to Noel News

You can also find the subscription box in the footer of all website pages.

For more Noel News:

Download recent Noel News as a PDF

I hope you have enjoyed the latest edition of Noel News.

Thanks for all your kind comments. Please continue to send feedback through; it’s always appreciated and helps us to improve the newsletter.

And don’t forget you’ll get more regular communications from me if you follow me on X – @NoelWhittaker.

Noel Whittaker