New tax bill: Sri Lanka’s corporates wary about ‘subtle’ non-deductions-By Sanath Nanayakkare

Source:Island

Say draconian powers drafted to be given to Inland Revenue Chief

Calls for independent body to get a fair hearing

The new tax bill is one that demotivates taxpayers from being compliant and one that restricts existing taxpayers from their legitimate deductions, Nisreen Rehmanjee, head of corporate finance, group tax and social entrepreneurship project, John Keells Group said on Tuesday.

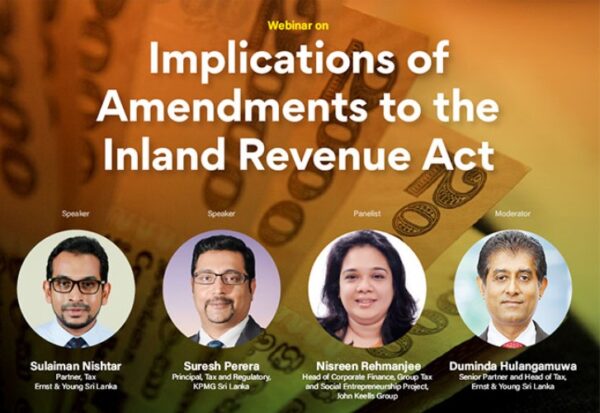

She said so at a webinar hosted by the Ceylon Chamber of Commerce (CCC) titled,” Implications of Amendments to the Inland Revenue Act.”

Predominantly taking a corporate view of the bill, she said,” Considering the financial situation of the country, I think that everyone has to pay more tax. That is a policy issue and I don’t have any problems with that. But we are concerned about proposed provisions on deductions, tax administration and taxpayer rights. The bill is attempting to collect taxes from those who are already paying and deny legitimate deductions that are incurred in the production of income. For example, in terms of new provisions, interest is considered to be a revenue expense and it is not a capital expense because it is basically what you pay for use of money for a year; and so it’s revenue. When it comes to capital assets it bears a condition that it has to be in use. I think that they have actually restricted this because interest is not a capital expense; it is not something you need to capitalize on because the new law recognises it as a revenue expense under section 12 and allows you a deduction. So I think it is a more restrictive deduction than an enabling provision.”

Further speaking she said,” There is a lot of significant uncertainty right now as to how exchange rate gains and losses are taxed. If one had losses why not allow those losses against gains and allow taxes to be paid on a net amount considering the very high rate of tax? The corporates are very concerned about such subtle non-deductions.”

“You should put your effort into actually broad-basing the tax net, but you are going after the people who are paying taxes. Shouldn’t that time and effort be actually spent on looking at people who are not paying taxes and who don’t have files?”

“Going to the Inland revenue Department and getting an estimate is a very judgmental call now. If you are saying that my profits this year are going to be lesser than last year, and therefore, I am estimating lower. If the assessor disputes that and the taxpayer has to go to the Tax Appeals Commission, it is an additional burden on a compliant taxpayer. We are getting crazy kind of assessments which are not defendable. IRD has a period of 30 months to make an assessment, but the tax payer is given only 14 days to analyse it, do the legal consulting and draft the appeal and submit it. That is very unfair. If the process is to be tightened then let’s reduce the time given to IRD to dispute the tax return to 18 months and make it more efficient. I think taxpayers need an independent body where they can go to and get a fair hearing before they go to the Tax Appeals Commission,” she said.

Sulaiman Nisthar, partner-tax, Ernst & Young said that agro farming, agro- processing and agro manufacturing would continue to enjoy tax concessions, but the definitions of these wordings need to be carefully evaluated.

Suresh Perera, principal of the tax and regulatory division of KPMG Sri Lanka said,” A particular provision of the bill gives draconian powers to the Commissioner General of IRD to come up with an estimate and there is no provision for it to be challenged. You have to pay taxes according to that estimate and if you don’t pay, then it is considered non-compliance. You don’t have a holdover relief position. In such a situation, you get only an extension period of six months to pay that amount. This is going to be a methodology for Commissioner General to collect taxes; just make any estimate that he wants which can’t be challenged. This is something that you need to act now and not later on because once this becomes law under article 88(3) of the Constitution, it will be too late to do anything about it.”

Duminda Hulangamuwa, senior partner and head of tax, Ernst Young & Sri Lanka said, “We made representations to the President, the Governor of the Central Bank and the Treasury Secretary on behalf of middle income individuals who are liable to pay high taxes when the new bill becomes law, but the message we got from them was they also didn’t like to increase taxes, but they were left with no other choice given the current economic realities and discussions with the IMF.”