Noel News

Life moves pretty fast. If you don’t stop and look around once in a while, you could miss it.

FERRIS BUELLER

Good Morning from Perth

Because of the way shipping is calculated, I can give you a small discount as well as free shipping on all book bundles. |

with Making Money Made Simple

$49.99

with Retirement Made Simple

$49.99

with Downsizing Made Simple

$49.99

I also did talk back spots on ABC radio and 6PR and the lines were jammed.

Clearly there’s a great need for advice on estate planning. In the next 20 years over $1 trillion will change hands as the baby boomers die and the best way to dispose of their assets has become a major issue for most retirees.

For my presentations I designed an Estate Planning Prompt Sheet which is a great summary of some of the most important issues canvassed in Wills, death & taxes made simple. It was particularly useful for the hosts when I was doing talkback radio.

Noel News

Life moves pretty fast. If you don’t stop and look around once in a while, you could miss it.

FERRIS BUELLER

Good Morning from Perth

We’ve had a lovely few days here doing book launches at the Crown and in three of the Dymocks shops.

Get the book here

Because of the way shipping is calculated, I can give you a small discount as well as free shipping on all book bundles.

with Making Money Made Simple

$49.99

Get Bundle

with Retirement Made Simple

$49.99

Get Bundle

with Downsizing Made Simple

$49.99

Get Bundle

I also did talk back spots on ABC radio and 6PR and the lines were jammed.

Clearly there’s a great need for advice on estate planning. In the next 20 years over $1 trillion will change hands as the baby boomers die and the best way to dispose of their assets has become a major issue for most retirees.

For my presentations I designed an Estate Planning Prompt Sheet which is a great summary of some of the most important issues canvassed in Wills, death & taxes made simple. It was particularly useful for the hosts when I was doing talkback radio.

You can download a copy here

I told my audiences that it’s now 37 years since Making Money Made Simple was launched and it’s interesting that one of the primary concepts of that book is suddenly having a rebirth. In that book I talked about how much interest could be saved by making your payments fortnightly instead of monthly – now 37 years later this concept is all over the news again and has even been featured on channel 9.

I always love to think about history and I gave the audience snapshot of what life was like back in March 1987.

Home loan rates were 14%

The cash rate was 11%

Inflation was 8%

The average Brisbane house cost $62,000 – 2.6 times the average income of $24,000 a year.

The All Ordinaries index was 1765, it’s now nudging 8,000 and the Dow Jones was 2,418 – it’s now nudging 39,000.

One can only wonder what these numbers will be like in 37 years.

Image by rawpixel.com on Freepik

It’s a shorter newsletter today because I wanted to get it out quickly. 30 June is not far away, and for some people taking action before 30 June will be crucial if they want to adapt the strategies that follow.

A big thank you to all you good people who read my newsletter.

If you were forwarded this newsletter by a friend and you would like to subscribe, you can do so here:

For more Noel News:

You can also find the subscription box in the footer of all website pages.

Superannuation

June 30 is fast approaching, which means it’s time to focus our minds on superannuation. It’s a major asset for most people, and the latest changes provide opportunities to make strategic moves to save tax.

Image by rawpixel.com on Freepik

The biggest change is that the limit on concessional contributions – the tax-deductible ones – is rising from $27,500 to $30,000 on 1 July. This coincides with the changes in the tax rates. For example, if you earn $110,000 a year, a $27,500 tax deduction this year will save you $9,487 in tax and Medicare levy. The same tax deduction after 30 June will save you only $8,800. Obviously, if you have the money available it’s better to make the concessional contribution before 30 June. Just keep in mind that the $27,500 limit includes the employer contribution.

Next you need to think about catch-up concessional contributions. These enable you to make contributions now in excess of the $27,500 limit, which could be particularly effective in reducing capital gains tax. To use the catch-up contribution strategy, your super balance at 30 June 2023 must be less than $500,000. Only unused concessional contributions since the 2019 financial year can be used, and unused contributions for that financial year will expire this coming 30 June. More on this below.

The superannuation guarantee contribution – the employer contribution – will rise from 11% to 11.5% on 1 July, which will boost your superannuation balance in the long-term. But take this opportunity to look at your asset allocation and make sure you are not in a too-conservative mix. This is also a good opportunity to review any salary sacrifice into super arrangements. How much you have when you retire, and therefore how long your superannuation will last, depends mainly on time, and the rate of return your fund can achieve.

Given that a major goal for retirees should be to retire debt-free, you should also check to see whether you are on track for this. If it is in doubt, boost your contributions if you can make the funds available.

Image by Freepik

Non-concessional contributions come from after-tax dollars and are currently limited to $110,000 a year. You can boost them by using the three year bring-forward rule, which means you could contribute $330,000 before 30 June, provided your total super balance at 30 June 2023 is under $1.68 million. If your super balance exceeds $1.9 million, no further non-concessional contributions are allowed.

The $110,000 limit will rise to $120,000 on 1 July, so a person with substantial funds who has not been making any non-concessional contributions could contribute $110,000 before 30 June and then $360,000 in the next financial year.

The preservation age is rising to 60 for everybody from 1 July 2024, which means 59-year-olds will no longer be able to access their super before 60. The good news is that anybody considering a transition to retirement strategy from that age will now be able to draw the income tax-free.

There are no changes to the downsizing contributions – the maximum of $300,000 a person still applies, and you can make only one downsizer contribution in your lifetime. However, a unique feature of these contributions is that you can make them irrespective of your age, or superannuation balance. This means the order in which you make contributions could be crucial. For example, if you had $1.6 million in superannuation and made a $300,000 downsizer contribution you would have reached your $1.9 million limit, and you could not make any more non-concessional contributions. If you made a $300,000 non-concessional contribution first, however, you could still make the downsizer contribution.

The transfer balance cap – the amount you can transfer to pension mode – remains at $1.9 million. But remember the original cap was $1.6 million when all the changes came in, and many people used up their cap then. Once you reach your cap, no more money can be transferred to pension mode, but there is still no limit on how much the money in pension mode can grow, which will happen if the earnings on your fund exceed the mandatory yearly pension withdrawals, and you leave that money to compound.

So take time to consider the changing rules and how best to work with them to optimise your superannuation outcomes, either side of this 30 June

Saving capital gains tax

Nobody likes paying tax, and capital gains tax (CGT) is one of the most disliked, but actually, CGT is the best of taxes. It is not payable until you dispose of the asset and provided you have kept it for at least a year you get a 50% discount to allow for inflation. Furthermore, death does not trigger CGT, it merely passes the liability to the beneficiaries who receive the asset. They will pay CGT only when they dispose of it.

In fact, the only real catch is that capital losses die when you die, so if you have any capital losses, it’s a good strategy to sell some assets that have a capital gain prior to death, to offset the losses and reduce the tax payable.

Image by gpointstudio on Freepik

CGT is relatively easy to minimise with some careful planning. Let’s look at a perfect case study, which involves the strategy of getting a tax deduction by making tax deductible (concessional) contributions to super. Bear in mind that the cap on concessional contributions (CCs) is rising from $27,500 a year to $30,000 a year on 1 July.

CASE STUDY

Jack and Jill have $800,000 and $300,000 in super respectively. They are both aged 66, and have been retired for five years. They wish to sell a property that will carry a capital gain of around $600,000. The first step is to defer signing any contract until after 30 June, when the personal tax rates drop. Then they discover they can make use of catch-up CCs, as they have made no CCs since they retired. You can make CCs until age 75, but if you want to claim a tax deduction for these contributions between ages 67 and 75, you must pass the work test, which only involves working at least 40 hours over 30 consecutive days. That’s an easy one.

To use catch-up CCs their balances must be under $500,000 at 30 June 2024. To become eligible, Jack withdraws $360,000 from his super before 30 June, which reduces the balance to $440,000 at 30 June 2024. They are now both eligible to make catch-up concessional contributions from 1 July 2024.

From 1 July 2024, the maximum period for unused CCs is the five financial years from 2019–20 to 2023–24. As Jack and Jill have not used any of the CC cap in those 5 years, the maximum catch-up CC is actually $132,500. This is in addition to the 2024–25 financial year’s standard $30,000 CC cap. This gives them the potential to make personal super CCs totalling $162,500 each, and claim them as a tax deduction. Just be aware that in any year, you first use up the standard CC cap for the year, and only then can use your catch-up CCs.

In the 2024–25 year they sell the property, which they bought in 2018 for $700,000, for $1.3 million. This creates a taxable capital gain of $600,000, which will be taxed as $300,000 each because the property is owned in joint names. The 50% discount applies, so only $150,000 will be added to each person ‘s taxable income in the current financial year. But in fact, the taxable gain of 150,000 each is wiped out using their standard CC caps of $30,000 for the year, and $120,000 of catch-up CCs. The total tax to pay is just $45,000, which is the 15% contribution tax.

Now I appreciate that not everybody has access to catch-up CCs, but almost everybody who is retired could reduce CGT by making a $30,000 concessional contribution for the year ending 30 June 2025.

As always, take advice for your personal circumstances – good advice doesn’t cost, it saves.

The executor’s cheat sheet

This is taking much longer than we thought due to the complexities that keeps evolving as we progress. But we hope within a week it should be finished. Watch this space.

Ausbiz

When I was in Sydney, I did an interview with Ausbiz about my new book. I thought you may find it interesting.

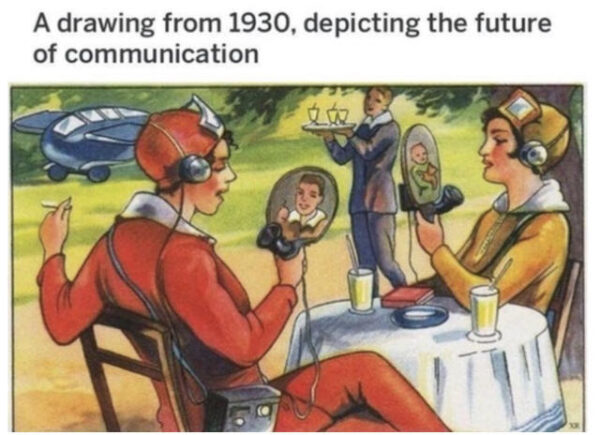

A glimpse into the future. (from 1930)

Scam Watch

I received this email this morning from a woman in Sydney.

“My husband and I are planning our retirement. He will work another ten years and I will work part time as well.

We are looking of purchasing a house and land package in Perth with a self managed super fund. We plan on using $350 of my husbands super ($800) at present and then get a loan of $450 ( against our purchased home). We have been advised under a model of depreciation that we will only be paying $1500 per month to pay of principal due to tax concessions as my husband earns $300,000 per year. “

This has all the hallmarks of a property spruiker. About 15 years ago, they were very active and Neil Jenman and Margaret Lomas and myself had a very public campaign against them because so many people were losing all their money. In the end a couple of spruikers went to jail.

I thought they had ceased their operations but once you see an “investment” “that’s a long way from home and where you are building a new home via a self managed fund it’s obvious to me there’s a problem. As I said to the lady who wrote to me, the key to real estate is to find an undervalued property and add value. How could a person in Sydney do this? Don’t you think the local Perth agents would jump on any bargains as soon as they see them? Anyway, I’ve convinced her to see a financial adviser in Sydney who can guide them on a much more comfortable retirement.

Please let me know if you receive any of these invitations, or know anybody who has. If the spruikers are back, we need to get back on the warpath.

And Finally

SOME WONDERFUL WORDS FROM WILL ROGERS

Don’t squat with your spurs on.

Good judgment comes from experience, and a lot of that comes from bad

judgment.

Lettin’ the cat outta the bag is a whole lot easier ‘n puttin’ it back in.

If you’re ridin’ ahead of the herd, take a look back every now and then to

make sure it’s still there.

If you get to thinkin’ you’re a person of some influence, try orderin’

somebody else’s dog around.

After eating an entire bull, a mountain lion felt so good he started

roaring. He kept it up until a hunter came along and shot him…

The moral: When you’re full of bull, keep your mouth shut.

Never kick a cow chip on a hot day.

There’s two theories to arguin’ with a woman. Neither one works.

If you find yourself in a hole, the first thing to do is stop diggin’.

Never slap a man who’s chewin’ tobacco.

It don’t take a genius to spot a goat in a flock of sheep.

Always drink upstream from the herd.

When you give a lesson in meanness to a critter or a person, don’t be

surprised if they learn their lesson.

When you’re throwin’ your weight around, be ready to have it thrown around

by somebody else.

The quickest way to double your money is to fold it over and put it back in

your pocket.

There are three kinds of men. One that learns by readin. The few who learn

by observation. The rest of them have to pee on the electric fence for

themselves.

Never miss a good chance to shut up.