Drill Baby Drill! Uncle Sam’s strategy of elbowing his way to the front of energy markets – By Hemantha Yapa Abeywardena

Source : oilfutures

On October 6, 1973, coalition of Arab countries, comprising Egypt, Syria and Jordan launched a surprise attack on Israel that ultimately developed into a full-blown war between the Jewish state and Arabs.

On October 6, 1973, coalition of Arab countries, comprising Egypt, Syria and Jordan launched a surprise attack on Israel that ultimately developed into a full-blown war between the Jewish state and Arabs.

The war, known as Yom Kippur War or Ramadan war, inadvertently motivated the United States explore ways and means to reach a status of energy independence; the embargo, in this context, was a blessing in disguise, indeed.

Exactly like what it is doing today, the US extended its ‘ironclad’ support to Israel to defend itself from the collective onslaught on the Middle Eastern battle front in 1973. It, however, came at a price – a huge price, to be more accurate.

The Arab members of the OPEC, Organisation of Petroleum Exporting Countries, known as OAPEC, imposed an unprecedented oil embargo on the US and countries that supported Israel to secure its existence in October, 1973; it was a hammer blow as far as the energy needs of the US was concerned, indeed.

Not only did the OAPEC halt the sale of oil to the US, but also drastically curtailed the oil production in order to maximize the impact. Without its own resources to counter the effect, the US paid a heavy price economically that inevitably cascaded into the other developed countries in quick succession; it was disaster with major global ramifications.

The price of oil quadrupled due to the obvious supply shortages and the US suffered acute energy shortages for the first time since the Second World War: long gas queues were a common sight; speed limits were lowered to conserve fuel and the citizens were urged to cut down on fuel consumption to partially address the critical issue.

The oil embargo lasted up until March, 1974. The US and the Arab oil producers finally negotiated a deal to end the war and paving way for the peace talks between warring countries; the Arabs lifted the oil embargo, much to the relief of the whole world.

As far as the US was concerned, the event in 1973 was a case of ‘once bitten twice shy’; the embargo exposed its vulnerability on the energy front, despite its economic and military might; the policymakers turned inwards for inspiration, learn the lessons and move on.

Fast forward 46 years, in 2019, against all odds, the US became energy independent by becoming a net exporter of oil – a monumental achievement in a matter of four decades.

In this context, the Arab oil embargo on the US was a wake-up call; not only did it force the United States to explore the ways and means not to rely on foreign energy sources, but also think strategically to conserve energy in every possible way – perhaps the real beginning of minimizing the impact of fossil fuel on the environment as the secondar goal – to be achieved simultaneously, though.

The United States launched a three-pronged programme to achieve its long-term goal: it accelerated oil and gas production in the country as a matter of urgency while the exploration was being extended to the far away places like Alaska; the US invested heavily in alternate energy sources such as nuclear, wind and the solar; vehicle manufacturers were encouraged to focus on improving the fuel efficiency of new vehicles.

As the moves to achieve the energy independence were fully underway, the national focus on the conservation of energy emerged that shows no sign of losing its momentum to this date.

Meanwhile, in order not to let history repeat itself, the US diversified its oil imports away from the Middle East; it, for instance, turned to Venezuela, the country that boasts the world’s largest proven oil reserves, closer to home, in this regard; it became just one among additional many of oil suppliers in pursuit of energy security.

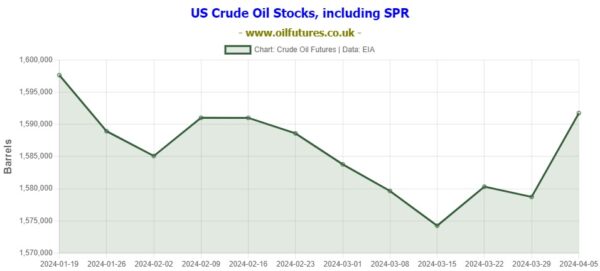

The most significant achievement that emerged from the Arab oil embargo in 1973, as far as the US is concerned, was the establishment of the SPR, Strategic Oil Reserve; it was a giant stockpile of crude oil to be used in a warlike situation or an emergency.

Carved out of salt domes along the Texas and Louisiana Gulf Coasts., It is the largest, underground emergency stockpile in the world that can store up to 714 million barrels.

Not only does it serve as a supplier in an emergency, but also a tool for stabilizing the global oil prices. When the OPEC+ cut down on the oil production in order to boost the price of crude oil in 2022/23, the US sprang into action by releasing oil from the SPR that in turn stabilized the market, despite being criticized at political level for tapping into the emergency supplies.

The move managed to keep the global price of crude oil from skyrocketing at the expense of what is left in the SPR, though.

The US hit the jackpot in the energy markets, thanks to the discovery of shale oil and gas trapped in shale rock formations. While employing a technique called fracking – horizontal drilling coupled with hydraulic fracturing – the US managed to tap into vast reserves and innovative methods managed to keep the cost of doing so to a minimum – finally.

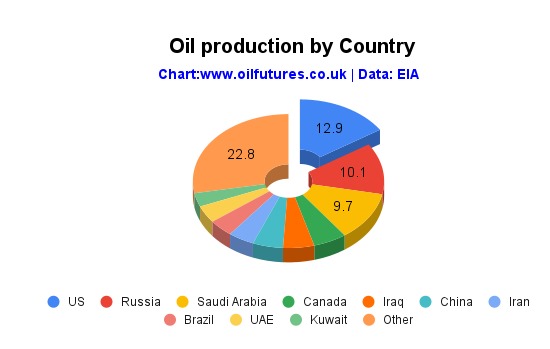

While combining the vision, determination and of course, innovative methods to an enviable effect, the US has become a net exporter of oil and gas. As of 2023, the United States, by far, was the biggest producer of oil and gas in the world, staying way ahead of its potential competitors.

There is no sign of the US becoming deviated from the status-quo, especially, when it is at the core of the political debates – at least, for now.

If you need the latest information and data on oil and gas markets along with impartial analyses, please visit my website at Crude Oil Futures