Macroeconomic indicator – Balance of Payments – By Dr. Gnana Sankaralingam

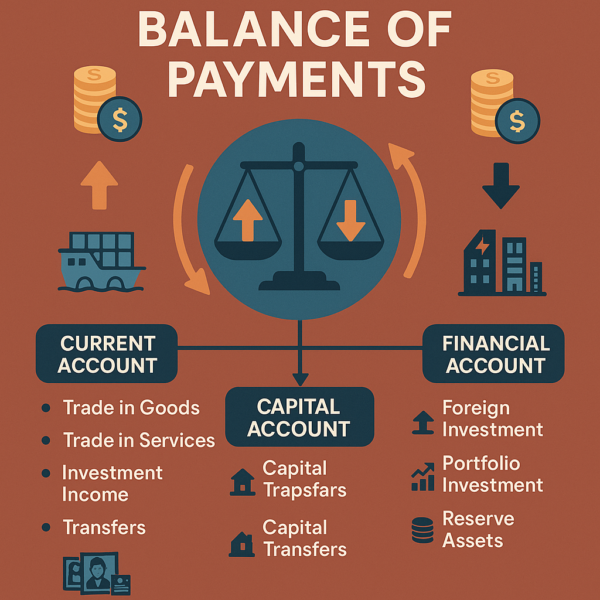

Balance of Payments (BOP) is a record of all economic transactions between a country and the rest of the world over specific period of time, typically an year or a quarter. It essentially tracks the flow of money and assets in and out of a country. BOP is the method used by countries to monitor all international monetary transactions within a certain period. It reflects the difference between money flowing into the country and money flowing out to the rest of the world. All trades conducted by both public and private sectors are accounted for in the BOP to determine the money flow. BOP can indicate if a country has a surplus or a deficit and from which sector of the economy the discrepencies are stemming. BOP is made up of three main records: currrent account, capital account and financial account.

Balance of Payments (BOP) is a record of all economic transactions between a country and the rest of the world over specific period of time, typically an year or a quarter. It essentially tracks the flow of money and assets in and out of a country. BOP is the method used by countries to monitor all international monetary transactions within a certain period. It reflects the difference between money flowing into the country and money flowing out to the rest of the world. All trades conducted by both public and private sectors are accounted for in the BOP to determine the money flow. BOP can indicate if a country has a surplus or a deficit and from which sector of the economy the discrepencies are stemming. BOP is made up of three main records: currrent account, capital account and financial account.

Current account is used to mark the inflow and outflow of goods and services in a country. It has four sectors: Trade in goods which measures the imports and exports of visible goods such as machinery and clothing; Trade in services which measures the imports and exports of services such as tourism; Investment and employment income such as from profits earned from businesses and salaries remitted by workers abroad; and Transfers of monies between countries such as payments made to family members by relatives abroad. It includes a goods and services account, a primary income account and a secondary income account. Capital account is where every international capital transfers of non-monetary and fixed assets mainly of migrants are recorded. Financial account involves of movement of all financial assets such as foreign direct investments, portfolio investments such as shares in overseas companies and financial contracts whose value is based on the value of a foreign currency and reserves held by the central bank. Income from financial account eg: interest, is recorded in capital account. There are both long term and short term capital and financial flows. Long term flows are due to ones such as FDI and portfolio investment and short term flows are based on speculation and people or firms trying to make money through changes in currency exchange rates. Ideally current account should balance with sum of capital and financial accounts, but mostly it does not happen, so a balancing figure is needed.

There are many causes of BOP surplus or deficit. If the interest rate is high, it would cause more saving than spending with fall in demand for imports leading to surplus, while if the interest rate is low there will be less saving and high level of spending and due to economic growth consumers buy more imports causing a deficit. If the currency value is low, it will make exports cheaper and imports expensive leading to surplus, but if the value of currency rises, it will make goods expensive for foreign buyers and make imports cheap leading to deficit. Similarly if inflation rises exports will be expensive and imports be cheap leading to deficit, but if there is recession where producers will struggle to sell to domestic consumers, they may focus on international markets increasing exports, leading to surplus. When countries struggle to compete internationally due to increase in costs of production more than in competing countries caused by higher labour cost, inefficiency in production and fall in labour productivity, it makes exports to be expensive leading to deficit. BOP surplus could show that an economy is competitive. However if a country has a surplus for a prolonged period of time eg: Japan, it will experience stagnation. Due to low domestic demand, it will experience loss or even negative economic growth which also has the potential to lead to other problems such as unemployment. A large surplus on the current account may also be a result of over reliance on exports. If a surplus is created by a country having an undervalued currency, it will create inflationary pressures leading to rise in price of imported components used in production causing an increase in costs of goods produced thereby an increase in price level. BOP deficit could mean that an economy is not competitive. It is not always a bad position as it might mean that people in that country are wealthy enough to be able to afford lots of imports. Deficit may also allow people to enjoy higher standard of living as they are importing the things that they need and want. But long term deficit is likely to cause problems. Consequence of deficit include fall in the value of a currency leading to higher prices of imports in the short run and an increase in inflation. It may also lead to job losses domestically as due to the increase in imported goods domestic production of goods could drop leading to increase in the level of unemployment.

Government might try correct BOP surplus by raising the value of its currency which will reduce the demand for exports and increase the demand for imports. However it is likely to result in reduction in output and has the potential to cause rise in unemployment. Government might try to correct BOP deficit by using policies to reduce the prices of goods which should increase exports and reduce imports. It can impose restrictions on imports by slapping tariffs on imports to make them relatively more expensive than domestic goods. It might cause inflation if demand for imports is too price inelastic. It may also devalue (fixed exchange rate) or depreciate (floating exchange rate) which may make exports cheaper and inports more expensive. It may also use fiscal or monetary policies to reduce spending in the economy as well as reduce imports which is likely to reduce domestic demand and harm the economic growth. When government tries to correct imbalances in its BOP, it could have an international impact either increase in world trade or lowering of global efficiency.

BOP equilibrium occurs when the demand and supply of any foreign currency in a country in a given time period is equal. Deficit on current account is balanced by surplus on financial account. Sometimes the objectives of the government for low inflation and BOP equilibrium will be compatible but at other times they will conflict. If inflation is low exports will increase and imports will drop leading to BOP surplus. Often low inflation is maintained by high interest rates which increases currency value causing a drop in exports and increase in imports leading to BOP deficit. Achievement of stability in the current account facilitates long term economic growth. In some circumstances conflict can arise between achieving of economic growth and attaining BOP equilibrium. Increase of economic growth resulting in higher real incomes could lead to increase in imports and any deficit in current account has to be met by foreign exchange reserves, which on the long run may limit growth prospects. Very large BOP deficit may reach a point where the borrowers in these countries no longer be able to repay the loans leading to ecomomic crisis and sudden large fall in GDP.