Noel News

You can’t go back and change the beginning, but you can start where you are and change the ending.

CS LEWIS

Welcome to our first newsletter of 2021. As always, I am amazed how quickly time flies – next week will be February. But there is still time to think about the year ahead and what you can do to survive it in good shape. There is no doubt there will be surprises, not all pleasant ones. President Biden has just announced restrictions on incoming flights from many countries, which — although being the obvious thing to do – will hit the American economy hard.

It’s unlikely international travel will happen this year, which will make it two years since we will have seen son James, his wife Jenn, and their beautiful daughter Sophie. We do keep in touch closely through FaceTime but it’s not the same. And we are not alone – most of my friends seem to have at least one child living overseas.

According to Finder, the top New Year’s resolutions were to improve fitness and lose weight, save more, spend less, and eat better. When you think about it, they all tie in together. Once you start to improve your eating habits, your weight will drop, you will feel better, and you will be more inclined to go on a fitness program. And cutting out junk food will invariably save money.

According to Finder, the top New Year’s resolutions were to improve fitness and lose weight, save more, spend less, and eat better. When you think about it, they all tie in together. Once you start to improve your eating habits, your weight will drop, you will feel better, and you will be more inclined to go on a fitness program. And cutting out junk food will invariably save money.

Since I started to learn about the importance of microbiome and the gut, our diet has changed, I have lost weight, and have never felt better. A book I recommend is The Clever Guts Diet by Dr Michael Mosley. It’s an easy read, explains the whole concept of the gut, and contains many delicious recipes. An easy way to start is to abolish all soft drinks from your life, switch from white bread to multigrain bread, and minimise sugar. Just those three simple acts can make a huge difference.

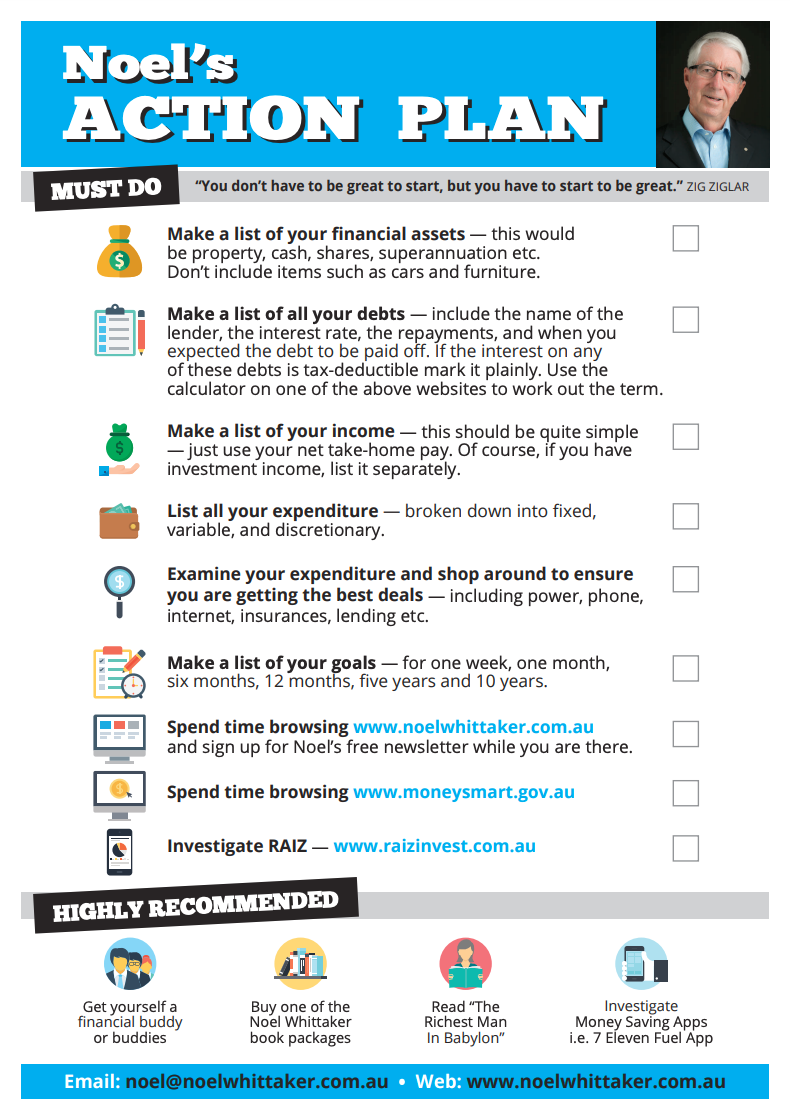

As far as finances go a great way to get moving is to go to my website and download a free copy of the file ‘Noel’s Action Plan’. [For those unable to click on the hyperlink, go to my website: www.noelwhittaker.com.au; then ‘Resources’ followed by ‘Free downloads’ and you’ll see it there.]

While we all have the best of intentions, starting is often the hardest part, and my action plan makes it easy.

I won’t go into too much detail here – the form is self-explanatory and guides you through the process. If you were lost, the best map in the world would be useless if you didn’t know where you were, so the first steps in the action plan are designed to give you a snapshot of your financial position right now.

Once you have that information, you are prompted to write some goals, and then use the information in your financial snapshot to work out what you need to do to achieve those goals.

For example, if you’re 55 now, wish to retire at 65, and still have a mortgage over your home, a major goal should be to become mortgage free by age 65. The best way to achieve this is not to concentrate on getting the mortgage down quickly. It’s better to focus all your efforts on making concessional contributions to super because for most people these lose just 15%, whereas money taken in your pay packet may lose up to 47%. And given your superannuation fund should be achieving something around 7%, and your housing loan should be under 3%, it’s a no-brainer to use superannuation as the great wealth creation device it’s meant to be.

Maybe you’re younger and you want to get off the debt treadmill. Once you have listed all your debts, you can then make a plan, as described in detail in Making Money Made Simple, to attack those debts. This is usually best done by attacking the personal loans first. If you are spending more than you earn, a simple way out is to swap your credit card for a debit card. This will prevent you overspending because all a debit card does is allow you to access money you already have in your bank account.

If you’re over 50, I urge you to get a copy of my new book Retirement Made Simple. As I was explaining to a journalist last week, most people planning for retirement don’t know what they don’t know, and make unnecessary mistakes just due to lack of knowledge. The problem is that mistakes in this area can cost a huge amount of money. I was in a bookstore recently doing a book signing, and a man came up to tell me that my columns had been useful to him in the past. I said, “Well then you need to buy this book”. He replied, “There is no need. At my stage in life I know all I need to know.” I responded, “What about the death tax on super?” His reply was that he had never heard of it.

Think about it – if you have $500,000 in super, and it passes to a non-dependent because you are single, or your partner has died, the death tax could be $85,000. That’s just one of many examples but they all have they one common factor – lack of knowledge that can cost big dollars.

For those who want a comprehensive goal-setting tool, I highly recommend getting a copy of my son James’ Success Plan, which has been used by people all over the world. You can download a free copy here and it will complement the other resources mentioned earlier.

Banks and Lending

Mortgage brokers I speak to tell me that bank approval delays have slowed down considerably, due to accelerated processing times, and increased scrutiny by the lender on the potential borrower’s financial position. This can affect anybody buying property, selling property, or refinancing. Apparently, most of the big banks have outsourced their approval process to India, where it’s become a box-ticking exercise. I am told that delays of three months are normal.

If you are a seller you need to be aware of this, get a substantial deposit from the buyer, then give the buyer all the assistance they need to get their deal approved and settled. It may well take longer than you expect, which could cause you some challenges if you are relying on the proceeds of your home sale to finance the new one. Also make sure if you are changing properties that any contract you sign to buy a new property is conditional on the settlement of the existing one.

If you are a homebuyer, I suggest you do everything you can to get as much of the loan approval process done in advance. This could save costly delays afterwards. And I do think you should use a mortgage broker, as banks have such a wide range of criteria which vary from one to the other. In the new editions of Making Money Made Simple there is a long chapter covering all this, as well as ways to save money my negotiation. One of the young guys in the golf shop told me the chapter on negotiation had saved him $30,000 when he bought his new house.

But what I have written above does not apply only to property transactions. My accountants tell me they are flat out preparing urgent financials for people whose loans have come up for renewal – the bank won’t renew them without up-to-date financial statements. Furthermore, many interest-only loans may be forced to go to P&I (principal and interest) which means much higher monthly repayments. The message is clear – be proactive and get the process going sooner rather than later.

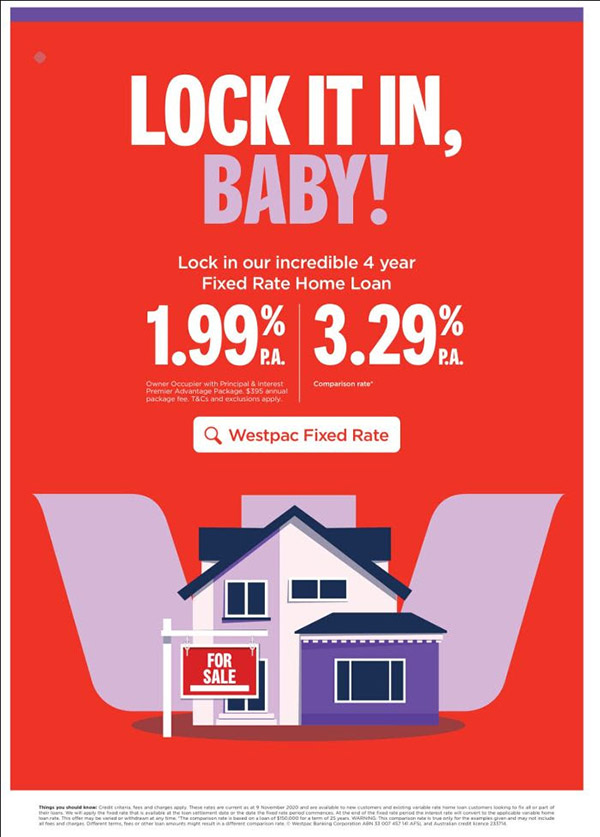

One last thing. Understand the comparison rate, which is the actual rate after all fees and charges are included. Often, but not always, there is a wide difference between the advertised rate and the comparison rate.

A Current Affair

Late last year, I sent out a special bulletin telling you that A Current Affair were keen to do something on my new book but they needed a member of the public to go on TV and talk about a financial challenge they had faced and how they coped with it. One of my subscribers, Gwynne, volunteered and did a wonderful job. We went to air on Friday, January 15. You can look at that interview by clicking here:

It’s one of the biggest television programs in the country with nearly 1 million viewers, and it was great to be part of it.

Since then, I’ve spoken to their producer about another cause celebre of mine which I have been writing about for years. That is the difficulty retirees face when trying to get a credit card. Usually, a couple will have a credit card in the name of the breadwinner, and a supplementary card in the name of the partner. The purpose is to save annual fees, and it works a treat while it’s an income earning family.

But then retirement comes along. If the principal cardholder dies, the supplementary card is automatically cancelled leaving the surviving partner without the ability to get a credit card. I mentioned before how difficult banks have become since the Royal Commission and it seems they take no account of the assets a person may have, or their credit record when assessing loan eligibility. A person may live in a million-dollar house, have $800,000 in super and be drawing a pension of possibly $70,000 a year from their super fund. But because the super pension is tax-free – they have no taxable income and their chance of getting a credit card is almost non-existent. Whenever I write about this, I always get a barrage of emails saying, “This has happened to me – I think it’s terrible”.

What I’m hoping from all of you reading this is that somebody will put their hand up and be prepared to go on A Current Affair and join me in telling the story. It’s discrimination against older people and we need to fight it. Please help me.

Health Matters

Our most precious asset is our health but it can be taken away quickly. One of my golfing mates has been forced to take the last 12 months off golf and have a major shoulder reconstruction because a year ago he decided to do weightlifting when lying on the floor unsupervised. He is paying heavily for that.

I rang another friend of mine, aged 66, last week to catch up for a coffee and he told me he wasn’t at the office very much these days because he was undergoing chemotherapy for bowel cancer. It was discovered after bleeding from the bowel. It is highly likely a colonoscopy a few years ago could have indicated a problem and could have then been simply solved.

Keeping healthy is like keeping your finances in good shape: an ounce of prevention is better than a pound of cure. Please, do as I do, and have the full medical check-up every year.

And Finally

John Travolta tested negative for coronavirus last night. Turns out it was just Saturday night fever.

The World Health Organization has announced that dogs cannot contract Covid-19.

Dogs previously held in quarantine can now be released. To be clear, WHO let the dogs out.

I saw an ad for burial plots, and thought to myself that’s the last thing I need.

Intelligence is like underwear. It is important that you have it, but not necessary that you show it off.

Relationships are a lot like algebra.

Have you ever looked at your X and wondered Y?

A courtroom artist was arrested today for an unknown reason…details are sketchy.

People are making end of the world jokes like there’s no tomorrow.

Whatever you do, always give 100% unless you’re donating blood.

What do you call a sleepwalking nun?

A Roamin’ Catholic.

What did Snow White say when she came out of the photo booth?

“Someday my prints will come! “

I’ve always had an irrational fear of speed bumps but I’m slowly getting over it.

I’ve finally told my suitcases there will be no holiday this year. Now I’m dealing with the emotional baggage.

A girl said she recognized me from her vegetarian club but I’d never met herbivore.

If you’re not supposed to eat at night, why is there a light bulb in the refrigerator?

My dad died when we couldn’t remember his blood type. As he died, he kept insisting “be positive,” …. but it’s hard for me to be positive without him.

Don’t let your worries get the best of you; remember, Moses started out as a basket case.

I hope you have enjoyed the latest edition of Noel News.

Thanks for all your kind comments. Please continue to send feedback through; it’s always appreciated and helps us to improve the newsletter.

And don’t forget you’ll get much more regular communications from me if you follow me on twitter – @NoelWhittaker.

Noel Whittaker