Noel News

Every new beginning comes from some other beginning’s end.

SENECA THE ELDER

Welcome to our first newsletter of 2023

No doubt it will be another challenging and interesting year, but I’ll do my best to keep you up to date on the important things that happen along the way.

First, a big thank you to all you kind folk out there who sent me such lovely emails when I wrote that I had fallen and broken my ankle. It was most appreciated. Now seven weeks have passed and I hope to be out of the moon boot this time next week.

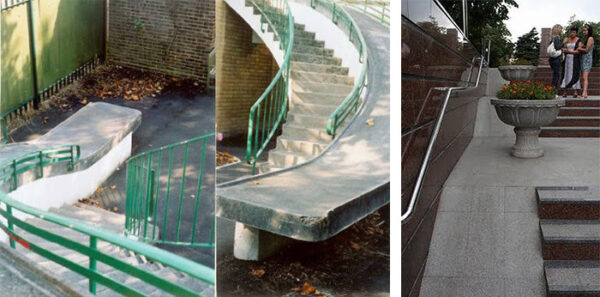

It’s been a challenging journey but also a time for reflection, which made me so conscious of the difficulties faced by people with disabilities. I didn’t realise how a small step would be enough to stop a wheelchair going into a restaurant.

I also had time to reflect on the role that money plays in our wellbeing. As I said to my friend one day: ‘If I was a billionaire, I’d still be in a moon boot and unable to drive or walk.’ It’s not always about the money.

An annus horribilis

It’s been a horrendous year for markets, but I think it’s important to put it in context because the last three years have been unique. I’ve written a brief summary here for you to see why shares have fallen so much.

The Australian share market has been one of the best performers. The Stock Market calculator on my website shows us that $100,000 invested in December 2021 would be worth $97,000 on December 31, 2022. The reason the drop is just 3% is that the index pays a franked dividend of around 4.5% – if dividends had not been reinvested it would be down 7%. As I’ve said repeatedly, index funds are the favoured horses in my stable – four times a year they pay a dividend which is automatically reinvested. That same $100,000 invested in December 2020 would now be worth $114,000 which is a gain of 6.77% per annum including dividends. Better than money in the bank.

The problems started with the reprehensible behaviour of governments and central banks thinking that every problem could be solved by endlessly printing money and dropping interest rates to below zero. By the end of 2019, 40% of European government bonds had a negative interest rate. In Denmark, even housing loans had a negative rate, which means borrowers got paid monthly payments.

The party really got going in March 2020 when Covid hit, stock markets around the world crashed, and governments decided that something serious had to be done. The US Federal Open Market Committee (FOMC), also known as the Fed, dropped its benchmark interest rate to zero and committed itself to buying $700 billion worth of bonds. In just six months the Fed’s balance sheet doubled from $4 trillion to $8 trillion – governments around the world followed suit.

This flood of money had the predictable effect. Prices of every conceivable asset roared, and by the end of the year there were $18 trillion of bonds yielding less than zero on issue. The American government kept pumping stimulus checks into the economy – much of this money was lapped up by gamblers to punt on shares and crypto. They were encouraged by brokerage firms such as Robinhood Markets which offered zero commission on trading and used AI techniques developed in Las Vegas to keep the gamers involved. By April 2021 the market capitalisation of Bitcoin exceeded $1 trillion and Dogecoin, which was conceived as a spoof on Bitcoin, rose 150 times!!

Last year at this time, we were about to see Apple become the world’s first $3 trillion company. The S&P500 and Nasdaq were running from record to record, and no one imagined how bad the hangover would be.

Then the whole world changed.

Last January, it wasn’t clear when (or if) the Fed would do anything about the rising inflation. A Russian attack on Ukraine wasn’t yet a big factor. It was feared and discussed, but various European leaders were talking to Putin, hoping to ease tensions. Then after the invasion, another big surprise: the NATO countries and other democracies united to impose harsh sanctions on Russia, despite the near certainty of negative effects on their own economies. Energy prices spiked, aggravating the already rising inflation trend.

Fed officials finally woke up in March and have raised rates at every meeting since then.

The effect on share prices was horrific. Apple lost a third of its value, Amazon lost half its value since the start of the year and was the first big company to lose over $1 trillion in value. Netflix lost up to 75% of its value compared to November 2021 and Facebook lost 77% of its value since September 2021. Nvidia, a chipmaker, lost half its value because of slowing demand and a ban on exports to China. Tesla lost almost half its value since the start of the year and the share price has fallen by more than 70% since November 2021. Elon Musk, the CEO of Tesla, has had a bad year because of Twitter.

But energy stocks had a great year. Exxon Mobil, Chevron, BP and Shell did so great that the desperate Western governments, watching inflation cause a huge cost of living crisis, decided to impose windfall taxes on these companies who announced jaw-dropping earnings throughout the year. Exxon ended up suing the EU for this decision just a couple of days ago.

While all this was happening, the US’ national debt went above the $30 trillion mark.

Our Reserve Bank hiked rates by 25 basis points in May and has been hiking almost monthly ever since. Asset prices which had skyrocketed now started going south. The worry spread – anybody with a mortgage faced increasing pressure on their budget with mortgage rates increasing every month, while retirees got a battering as their superannuation had one of the worst years on record.

So where to from here? I’m an optimist about the long-term future of the world, but I think the next twelve months will be challenging. Managing your own cash flow should be top of your priorities. If you have a mortgage, work to a budget and where possible spend only on essentials. If you are retired, make sure you have enough money in the cash area to see you through planned future expenditure.

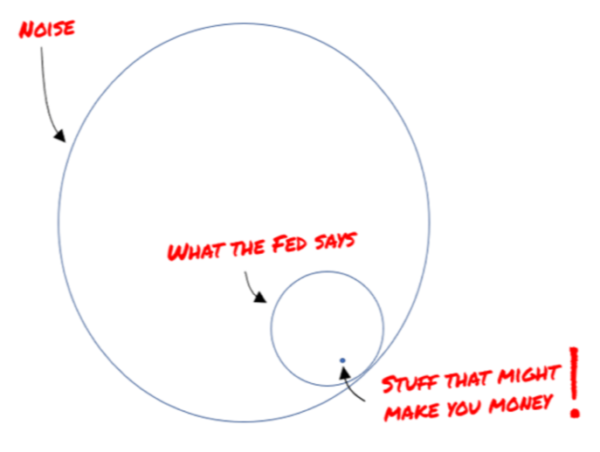

In last month’s newsletter, I mentioned a quote from Money Guru Keith Fitzgerald. The quote that follows is from his latest newsletter. It’s brilliant:

They say a picture is worth a thousand words, but as an investor, I like to think that’s $1,000. Perhaps more.

Let me show you what I mean.

People waste hours trying to figure out the noise when what they should be doing is concentrating on what it’s gonna take to make ’em profitable. Especially when it comes to the Fed.

The majority of people get absorbed in watching the daily news, and over events they can’t control. As a result, they neglect important things they can control. Make this the year you take charge of your finances and ignore the noise.

Are you clueless about retirement?

A major article in the Australian Financial Review earlier this month caught my attention. It made the extraordinary statement that retirees are ‘clueless’ about how superannuation income works and were ill-prepared for their retirement even before the latest inflationary surge put pressure on their household budgets. Over the next ten years an estimated 3.6 million Australians will move from the accumulation phase to the retirement age in superannuation and are ill-prepared for it. To make it worse, the number of financial advisors has dropped by half in the last five years.

Keep in mind that a major finding of the Retirement Income Review handed down in November 2020 was that retirees are confused by the complexity of the interaction between the tax system, the pension system and the aged care system.

Help is available. My book Retirement Made Simple has over 420 words explaining the entire retirement system including shares, superannuation, the aged pension, estate planning, handling risk and capital gains tax. It also has a large section at the end on how to have a healthier, happy retirement. It’s easy to understand and full of case studies.

Furthermore, if you do read the book and feel you need specific advice and don’t have an advisor, I’m happy to suggest some who may be useful to you.

The big issue here is that most retirees don’t know what they don’t know and as a result often fall into traps that could be easily avoided. And remember, the calculators on my website have been specifically designed to help retirees battle the maze. Some of the most popular are the Age Pension Calculator, the Deeming Calculator, the Stock Market Calculator, the Super Contributions Calculator and the Retirement Drawdown Calculator.

Health Matters

Professor John Hawley has spent four decades observing how people try and fail – often repeatedly – to lose weight. In new research he has discovered that a potent combo of two on-trend powerhouses of the wellness world – time-restricted eating and high-intensity interval training – is better at blasting fat than any other approach he has come across.

Independently, TRE (which involves consuming all your daily calories within a predefined eating window) and HIIT (which involves brief, high-effort activity interspersed with set recovery breathers) have been shown in studies to reduce internal visceral fat, high levels of which are associated with insulin resistance and type 2 diabetes, as well as to lower blood pressure, boost mood and enhance sleep. They have each become success stories in their own right: research shows that in terms of weight loss and health gains, the time-deprived and exercise-reluctant can get as good a return from doing short, intense HIIT workouts as from lengthy cardio sessions, while TRE is a more stress-free route to shedding pounds than the more fashionable but less sustainable diets.

Why it works is intriguing. By its nature TRE tends to lead to fewer calories consumed inadvertently each day just because you can’t fit them in. When you are restricted to eating within a defined window, that late-night chocolate, bag of crisps or glass of wine – what Hawley refers to as the dietary ‘biggies’ – are automatically off the agenda. It is, he says, these sorts of ‘subtle changes and omissions that can make a big difference over time’.

Ultimately the combo works for weight loss because it is as effortless a strategy as you are going to get if you want results. Hawley believes the TRE-HIIT combo is ‘the brightest thing that we’ve had on the horizon’ in terms of weight loss and health.

The beauty of the TRE-HIIT combination is that the stress of thinking about what to eat is removed. There are no rules about how much of what food to eat or avoid; and in the study participants barely changed the ratio of fats, carbs and proteins they consumed. In theory this appeals because you can eat what you like – chocolate, crisps and a glass of wine are permitted, provided you consume them within your window. You may find that your eating habits change for the better simply because weight is falling off and you feel healthier.

Although Hawley did not specify what foods to eat, there are known strategies that might help to cement your progress. In their trial, hunger was noticeable in the first week of switching to a ten-hour eating window – although it was not an issue later on – so selecting nourishing foods that will fill you up is particularly important at the outset. ‘Plenty of nuts, seeds and lots of fresh fruit and vegetables contain fibre that is filling and nourishing for the gut microbiome,’ says Alex Ruani, a researcher in nutrition science at University College London and chief science educator at the Health Sciences Academy. ‘Fibre aids digestion and actually helps to reduce overall calorie absorption by the body compared with sugary processed foods from which calories are rapidly absorbed.’

From the mailbox

I get a stack of emails every day with questions many of which I answer in the newspapers I write for all around Australia. One of the most common is about capital gains tax – the question below is typical. It’s really not difficult, but there is a perception if you just put money into super you can reduce or eliminate CGT. It’s not quite that simple.

Question

I have an investment property that I would like to sell. Is it possible to transfer some of the capital gains into my self-managed super fund, to minimise the tax payable? I am 66 years of age and employed full-time in the workforce.

Answer

CGT is assessed by calculating the net capital gain which is the difference between the base cost including acquisition costs, plus money spent on capital items such as renovations, and interest in some cases, and the net sale price. If you have had the asset for over twelve months you get the benefit of a 50% discount.

The gain so calculated is added to your taxable income in the year the sales contract is signed, so obviously a major issue is the amount of income you have in that year. For example, if your income was $180,000 the entire gain would be taxed at the highest marginal rate. However, if you are in lower tax brackets, a reduction in your taxable income could stop you moving that gain into a higher bracket.

The two main ways to get a tax deduction are to make a tax-deductible concessional contribution to super or to make a tax-deductible donation to an approved charity. So yes, in some circumstances you can reduce CGT by making it a tax-deductible donation to super but such contributions are limited to $27,500 a year and that includes the employer compulsory contributions. If you’re on $100,000 a year and the employer is paying $10,500 in super, the maximum tax deduction you could claim would be $17,000.

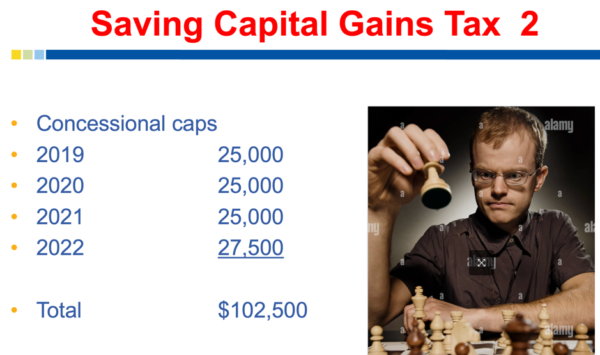

A way around it if appropriate is to defer selling until you stop work when your income could be as low as zero. Another way is to use catch-up contributions. The side below is from the presentation I gave in Toowoomba in November, which some of you attended.

If your superannuation was less than $500,000 at June 30 last year, and you haven’t used your full $27,500 allowance, you could use those unused contributions as catch-up contributions and claim a bigger tax deduction.

In the example, I talked about a couple who jointly had a total of $900,000 in super which was split $600,000 to him and $300,000 to her. They were aged 66 and had not worked for six years. They withdraw $150,000 from his superannuation and contribute it to hers. As a result, both balances are now $450,000 and they both qualify for catch-up contributions.

They sell a jointly property which produces a capital gain of $400,000 which reduces to $100,000 each after the 50% discount. They then make catch-up contributions totalling $100,000 and wipe out the entire capital gain.

This is just an example to alert you to what may be possible. It’s discussed in depth in Retirement Made Simple. CGT is tricky and you should always take advice before you contemplate selling any asset that has an inherent CGT liability.

And finally

Can you believe the Penguin Macquarie Dictionary lists 63 different ways of using UP!

There is a word that has more meanings than any other two-letter word, and that is UP.

It’s easy to understand UP, meaning toward the sky or at the top of the list, but when we awaken in the morning, why do we wake UP?

At a meeting, why does a topic come UP? Why do we speak UP and why are the officers UP for election and why is it UP to the secretary to write UP a report?

We call UP our friends and we use it to brighten UP a room, polish UP the silver.

We warm UP the leftovers and clean UP the kitchen.

We lock UP the house and some guys fix UP the old car.

At other times the little word has real special meaning.

People stir UP trouble, line UP for tickets, work UP an appetite, and think UP excuses.

To be dressed is one thing but to be dressed UP is special.

And this UP is confusing:

A drain must be opened UP because it is stopped UP.

We open UP a store in the morning but we close it UP at night. We seem to be pretty mixed UP about UP!

To be knowledgeable about the proper uses of UP, look the word UP in the dictionary. In a desk-sized dictionary, it takes UP almost 1/4th of the page and can add UP to about thirty definitions.

If you are UP to it, you might try building UP a list of the many ways UP is used. It will take UP a lot of your time, but if you don’t give UP, you may wind UP with a hundred or more.

When it threatens to rain, we say it is clouding UP. When the sun comes out we say it is clearing UP. When it rains, it wets UP the earth.

When it doesn’t rain for a while, things dry UP.

One could go on and on, but I’ll wrap it UP,

for now my time is UP, so………….

Time to shut up…..!

I hope you have enjoyed the latest edition of Noel News.

Thanks for all your kind comments. Please continue to send feedback through; it’s always appreciated and helps us to improve the newsletter.

And don’t forget you’ll get much more regular communications from me if you follow me on twitter – @NoelWhittaker.

Noel Whittaker