Noel News

The inherent vice of capitalism is the unequal sharing of the blessings. The inherent blessing of socialism is the equal sharing of misery.

WINSTON CHURCHILL

Welcome to our March newsletter

Interest rates were a big topic last week, with the Reserve Bank making a predictable 0.25% increase at its monthly meeting on 7 March. Of course, this garnered the usual doom and gloom headlines on the 6 o’clock news.

However, the tone changed quickly in the next 24 hours when RBA governor Philip Lowe addressed the AFR Business Summit. The speech was seen by some as a change of tune, flagging the likelihood of a ‘pause’ in rate rises next month. Some commentators were euphoric, but more careful reading of the speech could lead to a different interpretation.

Lowe said:

“We are closer to a pause and it’s a matter of logic really, as you increase interest rates you get closer to the point where it is appropriate just to stop for a while and just assess the flow of data … We’ve done a lot in a short period of time and at some point, it’s going to be appropriate to sit still and assess the collective effects of that.”

Lowe said the RBA would carefully assess key economic data to be released ahead of the next board meeting, including monthly employment, inflation, retail spending and business indicators. He added, “If, collectively, they suggest that the right thing is to pause, then we’ll do that. But if they suggest that we need to keep going, then we will do that.”

I reckon that’s code for staying with rate increases until the economy goes into recession.

It’s not as simple as it might seem. The Reserve Bank’s charter is to get inflation down to around 3%. Yet January’s inflation was a whopping 7.4%, down from 7.8% in December. That’s nothing. There will be no return to low inflation without a recession, driving unemployment sky high. The Reserve Bank has backed itself into a corner – if inflation does not fall, which I think is the most realistic outcome, rates will keep going up.

The Americans certainly aren’t talking about a pause. Federal Reserve Chair Jerome Powell’s testimony before the US Senate clearly said that nothing about the data suggests they have tightened monetary policy too much, and that ‘if the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes.’

Yes – you read it right, INCREASE the pace of rate hikes.

That means that if the US jobs data remains strong, and inflation won’t cool down, the Fed will throw the slower-but-higher-rate-hikes strategy out of the window and just take rates up in bigger chunks. US markets are now pricing in a 73% chance for a 50-basis-point rise for their March meeting, with a total of a 100-basis-point hike in the next four meetings.

The victims in all this are mortgage holders, many of whom are families. In Australia at least, the Reserve Bank is relying on just this one group to stall inflation – most of which is beyond anybody’s control for now. Since the rate increases began last May, mortgage repayments on a $500,000 home loan have increased by just over $1,000 a month for owner occupiers. That’s $250 a week in after-tax dollars, at a time when all their costs, especially electricity, are going up. Driving mortgage holders to the edge of insolvency – or over it – seems a very blunt tool for managing economy-wide inflation.

Major superannuation changes

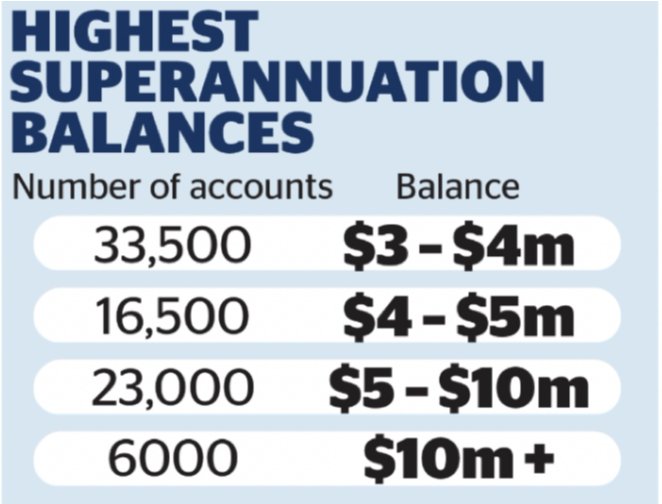

Labor fired the next shot in its war on Self-Managed Super Funds (SMSFs) earlier in the month. Treasurer Jim Chalmers came out with strong hints that a $3 million limit would be placed on the amount a single person could hold in superannuation, but this was quickly replaced by a dramatic announcement. Labor would not limit the amount of money that can be held in superannuation; instead, they would bring in a tax of 30% on some of the earnings of the fund, if the member’s balance is over $3 million.

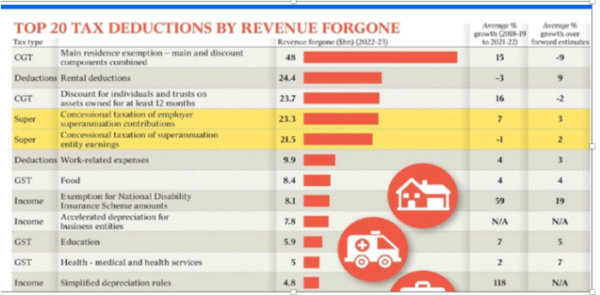

This announcement was accompanied by a table from Treasury showing the high cost of tax concessions on capital gains tax and negative gearing, and no suggestion by Labor that these would not be targets in the future. Notice the family home was top of the list.

Next Chalmers released details of how this extra taxation of super would be implemented. The industry was gobsmacked. The Treasury bulletin stated that – for this purpose – income would not be actual fund earnings. The plan seems to be to tax the difference between the member’s total superannuation balance at the start and end of the financial year, after adjusting for any contributions or withdrawals made during the year. In other words, the tax would apply to unrealised capital gains.My phone went crazy, because a tax like this would be unconscionable. Taxing unrealised capital gains has always been recognised as a no-no.

Capital gain is not certain until the asset is disposed of, at which point the price becomes crystal clear. Once you start to tax unrealised capital gains you are in very dangerous territory indeed. Think of a person holding an investment property as one of the major assets of their self-managed superannuation fund. If there’s a boom, that property may increase in value by $200,000 in 12 months, but no one knows what it will be worth when it is actually sold. And in most cases, people need the money from the sale of the asset to pay the capital gains tax on that sale.

So, if Labor’s capital gains tax became law, as currently described, a superannuation fund could find itself with a big CGT liability and no money to pay for it. But – and here’s the scary part – Labor has already thought of that possibility. The proposed new rules give fund members the option of paying the tax personally or having it deducted from their fund balance.

Leaving property aside, shares are well known for being volatile. A superannuation fund invested mainly in shares could have a drop in their balance of 20% in the months after 30 June, which is balance day. The worst outcome would be for the fund to be forced to sell shares when they’re down, to pay tax on capital gains that never happened.

This example was prepared by BDO:

Warren is 52 with $4 million in super at 30 June 2025.

He makes no contributions or withdrawals. By 30 June 2026, his balance has grown to $4.5 million.

Warren’s earnings are $500,000 ($4.5 million – $4 million). His proportion of earnings corresponding to funds above $3 million is 33% ($4.5m – $3m) ÷ $4.5m.

Therefore, Warren’s additional tax liability for 2025-26 is $24,750 (15% × $500,000 × 33%).

Liberal Senator Simon Birmingham moved a motion requiring the Albanese government to table modelling detailing the estimated impact of this proposal. The motion was passed on Wednesday (8 March) and requires Labor to disclose Treasury analysis by Thursday, 16 March. This comes amid doubt over the Labor government’s initial claims, with opposition and industry stakeholders fearing the changes would have unintended consequences.

Upon announcing its proposed reform, the Albanese government said the changes would impact 0.5% of superannuation balances, or approximately 80,000 Australians. But during question time on Monday (6 March), Minister for Finance Katy Gallagher revealed up to 10% of balances could be hit with a heavier tax burden.

An analysis from the Financial Services Council (FSC) also revealed approximately 500,000 superannuation balances could be affected if the concessional tax rate is not indexed.

There’s no need to panic. It will be a while before the legislation gets to Parliament and it could be a rocky ride. But one thing is certain: if the legislation does get passed in its present form, it would be a brave person indeed who kept their superannuation fund with a balance in excess of $3 million per member.

One thing is clear: Labor hates SMSFs. You may have seen the video where Richard Marles and Peter Dutton are discussing the new tax on the Today show. Three times Karl Stefanovic asked Marles to explain how the new tax would work. His answers were embarrassing. His first reply was that it didn’t affect many people, his second reply was that it only affected SMSFs and finally he admitted that they were still working out the process. The reason the big funds don’t like SMSFs is that the big funds exist on fees they extract from their members. SMSFs hold over $772 million in assets. The big funds would love to get them.

The problem of large balances in super could be simply solved. Right now, people in pension mode must draw a minimum payment each year, but people in accumulation mode have no such requirement. They pay 15% tax on fund earnings instead. All the government needs to do is legislate that once a member reaches say age 70, they must withdraw down on their accumulation fund at the same percentage as they do now on the pension fund. For example, the normal drawdown rate for a person between 75 and 79 is 7%. For somebody over 90 it’s 11%. These rates were halved due to Covid but are expected to return to normal in July.

Speaking in Townsville

Join me for a special event held by My Fortress:

Wednesday, 29th March at 6 pm

I will cover topics that will help you build a lifetime of wealth, such as:

The importance of professional financial advice

The difference between asset classes – cash, property and shares

How to achieve a comfortable retirement

Attendees will also receive a free copy of my new book 10 Simple Steps to Financial Freedom.

Admission is free – Register online now or call 4771 3800.

Default interest

In a previous newsletter, I mentioned default interest whereby banks increase the interest rate for borrowers who get into trouble. I referred this to senior people in government as part of my campaign to stamp it out. I have been told that even though banks have the powers to do this, the banks claim they don’t do it in practice.

I have been assured that action will be taken if I can find any concrete examples of this happening now.

Therefore, my request to you guys is, do you know of anyone who is in arrears in their home loan, and if so, whether they are copping default interest? The trouble is that interest rates are rising every month and a borrower could well think that the default interest was just another rate rise.

I look forward to hearing from you.

Age pension adjustments

The automatic six-monthly pension adjustments will take effect from 20 March. And thanks to inflation the age pension rate will get a boost.

The new rates are already incorporated in the Age Pension Calculator on my website, and the new pension charts are available for download under Resources.

Have a look now and see how much more you might get.

Editorial changes to my columnsMany of you read my Question and Answer columns in the Sydney Morning Herald/Age. Unfortunately, the powers that manage it have decided they need to attract younger readers, and this does not involve the topics I tend to focus on, like superannuation, age pension, capital gains tax and age care.

As a result, my column has been moved from a Wednesday to a Sunday and from weekly to twice a month – this means the most questions I can answer are eight a month. This is disappointing as I’ve been writing that column for over 35 years. I know from the number of questions I receive that the column is important to many people. Therefore, I will now add at least two questions and answers in every newsletter.

Question

My parents are in their mid 70s and retired – their home is worth $900,000 and has a $100,000 mortgage. They are getting a part pension of about $400 a fortnight each based on assessable assets of $605,000 in super and in shares. Their shares are providing total dividends and franking credits of $21,000 which is at 4% return based on their market value.

Since last May 2022 the interest rate on their home loan has increased from 4% ($700 payments per month) to 6% (now $950 per month) and may get to 7% by June 2023.

I believe my parents would be better off by $9,000 per year if they sell their worst performing shares and pay off their home loan because their monthly expenses would decrease and their pension payments would increase significantly which would more than offset any lost dividend earnings. Does this make sense?

Answer

What you propose is a great idea. Right now, that $100,000 of mortgage is costing them $6000 a year in interest, and because the mortgage debt is not offset against their funds, it hits them with an effective cost of $7800 a year in lost pension. That simple act of using $100,000 of their assessable assets to pay off the mortgage would give them an effective return of $13,800 a year.

Question

I am a 67-year-old pensioner with a small amount in super. I also work on a casual basis with the education department earning around $25,000 pa. Can I salary sacrifice money earnt over the allowed $11,800 pa into my super without it affecting my pension? I have tried to speak to the ATO and Centrelink with respect to the matter, but everyone appears to have a different opinion.

Answer

The situation is clear. Income for Centrelink income test purposes includes any deductible, concessional superannuation contributions, including salary sacrificed contributions. Therefore, you cannot reduce your income for income test purposes by making such contributions.

10 Steps to Financial Freedom

My new book is being officially launched this month, so expect to see some good publicity in the newspapers and on various forms of media.

Our accountants bought two boxes as gifts for children of their clients, and three of the responses from recipients are herewith. It’s great to see that sort of feedback. Don’t forget this book can change the life of somebody you care for, so check it out now.

“Thanks so much for the opportunity to read Noel’s new book. I love that the grandfather of solid conservative financial advice is handing young people the keys to a treasure chest. Noel touches on all the fundamentals and keeps it up to date with opportunities for current apps, websites, info on crypto and NFTs. The easy-to-read style is perfect for young people. Well done, Noel, you’ve done it again.”

“I think it’s brilliant. The only thing I feel like was a bit light on was how to set a goal for what you want and then how to plan for it. Beyond that, it’s written really clearly and the strategies (that are not necessarily simple) are made clearly. The summaries at the end of each section help to tie each chapter together. It’s also written in a casual way, which helps lighten the topic.”

“The book was a very well-laid-out and straightforward explanation of finance. The terminology was easy to read and understand. The summaries and actions were especially helpful. I think all books should have Chapter Summaries and Actions at the end of each chapter to help the reader action what they have learnt and then implement. I am looking forward to using some of the suggestions!”

And finally

Isn’t our Language Grand?

Can you read these right the first time?

The bandage was wound around the wound.

The farm was used to produce produce.

There was a row among the oarsmen about how to row.

The dump was so full that it had to refuse more refuse.

We must polish the Polish furniture.

He could lead if he would get the lead out.

The soldier decided to desert his dessert in the desert.

Since there is no time like the present, he thought it was time to present the present.

A bass was painted on the head of the bass drum.

When shot at, the dove dove into the bushes.

I did not object to the object.

The insurance was invalid for the invalid.

They were too close to the door to close it.

The buck does funny things when the does are present.

A seamstress and a sewer fell down into a sewer line.

To help with planting, the farmer taught his sow to sow.

The wind was too strong to wind the sail.

Upon seeing the tear in the painting I shed a tear.

I had to subject the subject to a series of tests.

How can I intimate this to my most intimate friend?

Let’s face it – English is a crazy language.

I hope you have enjoyed the latest edition of Noel News.

Thanks for all your kind comments. Please continue to send feedback through; it’s always appreciated and helps us to improve the newsletter.

And don’t forget you’ll get much more regular communications from me if you follow me on twitter – @NoelWhittaker.

Noel Whittaker