Noel News

Faith is a GPS that not only will reroute you when you lose your way, it will take you to a better destination!

DAVID MELTZER

Welcome to our April newsletter

It’s amazing how quickly the year is flying by. The last four weeks have been dominated by proposed superannuation changes, where interest rates may be going, and the state of world markets.

As I have said repeatedly, the way forward is to focus on the things you can control and not to get obsessed with things that are out of your control. Let’s talk about interest rates first…

Interest rates

Last Tuesday our Reserve Bank decided to put rates on hold, which was exactly what many of us thought would happen. However, they also made it clear that more rate rises could be expected. My view is that the cash rate will go to at least 4.25%, and it will be years before we see rates start to drop again.

The situation is rather different in America – late last month the Fed raised rates by another 25 basis points, which was a kind of concession. However, they pointed out that the labour market was still strong, that inflation was not under control and that they would keep raising rates until inflation got down to their target rate of 2%. Those same comments apply here in Australia.

Two property developers, Harry Triguboff and Tim Gurner, were front-page news last Thursday under the headline “Property about to boom – and it’ll be on for young and old.” These guys are serious players in the Australian property market. Triguboff, now aged 90, is celebrating 60 years in the property business, employs 900 people and builds 2000 apartments a year. Gurner is the new kid on the block, celebrating his 10th year in business with $10 billion-worth of apartments underway.

Triguboff claims residential property will boom due to lack of supply, and pent-up demand from buyers and overseas migrants. He said, “You have a situation where there is no supply, immigrants are coming back, and the Chinese are returning. At some point in the next 6 to 18 months there is going to be an almighty boom.”

The rental situation was also the lead story for another major Australian daily. It claimed that over half the rental properties available are over 50 years old, 40% of them have cracks in the walls, 25% have plumbing issues and mould, and more than 10% have roof defects, electrical problems, or sinking foundations.

But almost any house is better than no house. In a nutshell, Australia has massive demand for all types of residential property now, and materials and manpower are as difficult to secure as ever. How on earth will inflation start dropping? Anecdotal evidence suggests that the savage rate rises to date have done nothing to curb inflation. Sure, some kids are now dropping out of school sports and school camps because of affordability, and the press is featuring coffee shop owners who are starting to do it tough as their customers look to spend less. But that’s just a drop of water on the raging fire that is the big inflation picture.

I appreciate there are different viewpoints about the direction of interest rates in Australia, but I go back to JK Galbraith, who famously said: “The only function of economic forecasting is to make astrology look respectable.”

You must do what’s right for your own situation, but I believe that, however you look at it, it is reasonable to conclude that inflation is still rampant and interest rates will keep on rising. If you have a mortgage, your main focus now should be to get ahead in your repayments to create a safety buffer. The last thing anybody wants is to lose their home. And remember there may be a way out for people who are battling with their mortgage payments – they could always rent their house out, which means the interest will become tax-deductible, and find cheap accommodation elsewhere. This may be moving back in with the in-laws, but it’s better than losing a house.

Superannuation

Photo by Diana Parkhouse on Unsplash

An unrealised gain is an increase in value that has not yet been crystallised: the actual gain cannot be determined until the asset has been disposed of. Yet Labor intends to treat a gain that has not yet happened as if it had, using a simple formula. It is based on the difference between value of the fund on 1 July and the following 30 June, less adjustments for withdrawals and contributions. This notional gain will be taxed at up to 15% on any portion of the fund in excess of $3 million. This will create two lots of accounting, because the fund will still need to prepare the normal profit and loss account.

I’d be wary of the “It won’t happen to me” approach, because Labor claims

only 80,000 people have more than $3 million in superannuation. That may be true today, but these proposed changes are three years away, and a superannuation fund with a balance of $2.5 million now could well be nudging $3 million when the new rules start. And don’t forget couples with $3 million between them – the survivor could be over the limit the moment one of them dies.

Remember when all the argy-bargy which led to these changes was going on, there were many people calling for the maximum balance to be $2 million, not $3 million. If Labor is prepared to go out on a limb to tax unrealised capital gains, what is to stop a future government declaring that there are still far too many large superannuation accounts, and reduce the $3 million cap to $2 million?

But it goes much further. Once you start down the road of taxing unrealised capital gains, it becomes a slippery slope. Labor have already flagged capital gains tax and negative gearing as targets, and in Queensland the Labor government has been debating a rent freeze. The fact that a rent freeze is even being considered shows that the government has no idea of the mechanics of the rental market.

Hypothetically, a future government could tighten up the CGT rules by reducing or abolishing the 50% discount. If that happened, landlords may well decide to retain properties, to avoid the CGT that would occur if they sold them. The government of the day could then announce, as they have in super, that there is a fortune locked up in all these unrealised capital gains because landlords won’t sell and announce the extension of a new tax on the unrealised gain rule to apply to rental properties.

Last month, Dr Ken Henry got the ball rolling by claiming the tax system is all wrong, with young people unable to afford a house while wealthy baby boomers enjoy large, concessionally taxed superannuation balances. There are other voices calling for death duties and for the family home to be assessed for age pension purposes. As the population ages and an increasing number of people become dependent on government, this will become a very busy area. Watch this space and keep your guard up.

Banks behaving badly!

A long time ago, the four major Australian banks ran a joint marketing campaign titled “Competition brings out the best in people”. It was designed to show the public that despite being few in numbers, the banks would never act like a cartel and would always put service above all. That was a long time ago – judging by the actions of banks today those aspirations are long forgotten.

The following stories are sadly typical.

A friend of mine has been a customer of Ubank (owned by NAB) for over eight years. His Self-Managed Super Fund has a hefty sum on deposit with UBank, and last September a term deposit came up for renewal. Apparently, Ubank had recently split itself into two banks: the old Ubank and the new Ubank. My friend was told that he had become a customer of the new Ubank, but that no interest would be paid on his matured term deposit until he could re-identify himself by producing the original Trust Deed for his SMSF.

He angrily pointed out that he had been a customer of the bank for nearly 10 years, and surely it was not beyond the resources of the new bank to get identification documents from the old bank. His protests fell on deaf ears. But it’s what happened next that is beyond belief.

New UBank told him he would have to take the original trust deed to a post office to be authenticated, after which he would have to send it to the bank’s head office in Sydney. A Justice of the Peace or a notary public was not acceptable. Neither was a certified copy of the original trust deed. It had to be an original document and only Australia Post could certify it.

My friend is a careful guy and knew where his original deeds were, so he duly queued up, got his trust deed authenticated and sent it express post, with tracking, to head office in Sydney. Three days later, tracking confirmed the bank had received it.

After no communication from Ubank for six weeks, he made enquiries and was told that the bank had no evidence of receiving the package. He was instructed to go through the process again. This is not as easy as it sounds. First, original documents don’t grow on trees. Second, because he had moved house in the intervening period, all his documents were locked away in various boxes. Right now, he hasn’t got time to face the massive job of going through his boxes, but Ubank continue to refuse to pay him interest until he produces the deed.

Another story:

My son who lives in America recently asked me to bank a cheque for him into his Bankwest account in Brisbane. Bankwest has now been taken over by the Commonwealth Bank, which has naturally closed all the Bankwest branches. Logic suggested I take the cheque to the nearest CBA branch to deposit it into his Bankwest account. But no, the CBA no longer accepts Bankwest deposits – it has to be done at the post office!

I don’t know why the post office has become a de facto bank branch. When banks began to withdraw branches from the regions, people still needed to be able to make transactions, which is when the move to using the post office in the absence of a branch began, but when – and why – did they start to push transactions onto Australia Post even when there are related bank branches available? As each bank lowers its standards, the others scramble to follow suit. I reckon the post office is looking for ways to stay relevant, so perhaps it makes sense for everyone except the customers – and who cares about them, these days?

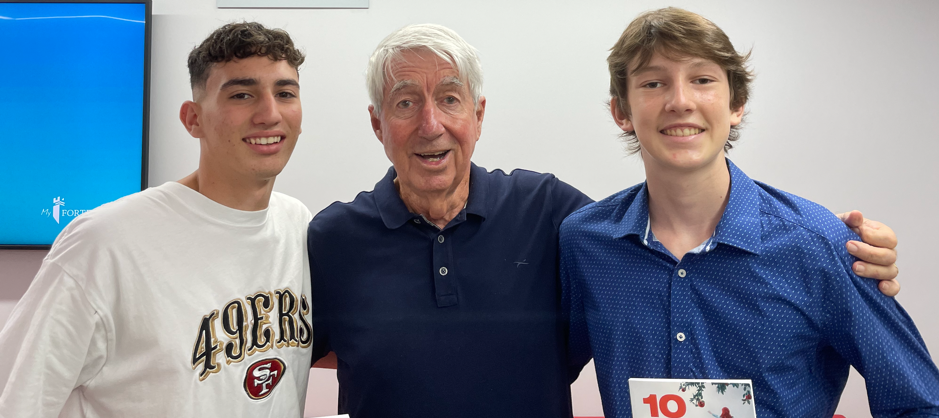

Townsville seminar

The Townsville seminar went very well, and I’ll be giving four more seminars after the budget is handed down on Tuesday, 9 May. These will be in Brisbane, the Gold Coast, Sunshine Coast and Ballina. Full details will be here in due course.

The highlight of the night was meeting two young guys, Connor and Flynn , who had come along just to meet me. They had been given copies of my new book10 Steps to Financial Freedom and told me it had changed their lives. It’s wonderful to get that kind of feedback. As we know, thanks to the miracle of compound interest, learning about money early in life, pays huge dividends down the track.

Travelling north

When it was over, Geraldine and I drove to Port Douglas via Mission Beach. It’s a lovely part of the world where I recommend Castaways Resort & Spa. It’s right on the water with good food and good views. See photo below.

The highlight of the drive from Mission Beach to Port Douglas was stopping at Shaylee Strawberry Farm just outside Atherton. It sells one of the best ice creams I’ve ever had.

We stayed at the Sheraton Port Douglas, which is right on the water, so there was no trouble going from our room to the beach for walks. We had a ground floor room with a ladder from the balcony straight into the pool. I’d never seen that in any hotel before.

A wonderful initiative at Port Douglas is the shuttle service. Many resort towns are short of transport, whether it be cabs or Ubers, but Port Douglas has shuttle buses which drive around the town continuously. Normally it only takes five minutes from when you make the phone call to when they pick you up, either at your hotel or at a restaurant.

Port Douglas is a fun place to visit, and we had wonderful meals at Nautilus, Melaleuca and Salsa. See picture of Nautilus below. Put it on your bucket list. That’s where Bill and Hillary Clinton dined on their last visit to Port Douglas.

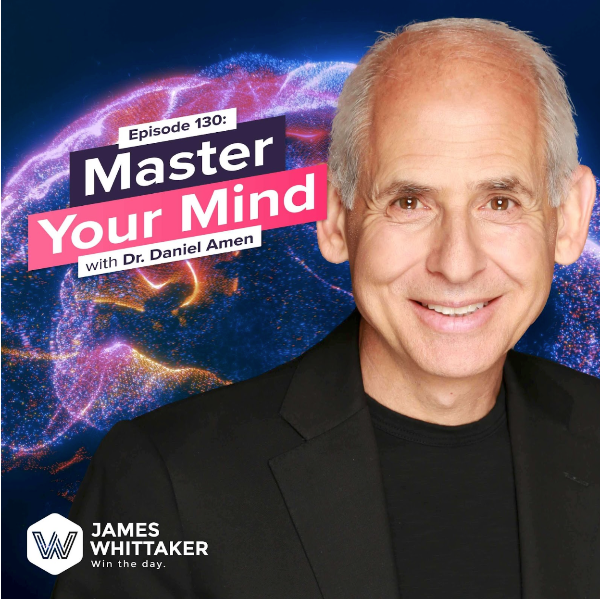

A special podcast for you

Only when you’re sick do you realise that health is the greatest asset you can have. It’s absolutely necessary if you want to enjoy family, stay positive, and make the most of the short time we have.

More and more, I’m reminded that the foundation of health and well-being is, in fact, brain health. It drives everything we do so, of course it should be the #1 thing that we take care of.

Yet, if you look around, the world is filled with people who never think about how they’re damaging their brain. (Which, in my financial career, has been a great source of frustration. l never understood why people would rather be ignorant about their financial path rather than take any meaningful action to correct it.)

Last week, my son James interviewed 12x New York Times bestselling author and brain health expert, Dr. Daniel Amen. It was a fascinating conversation about all aspects of brain health.

Some of the topics covered include:

- where negative thoughts come from and how to manage them;

- the mental rehearsal practice used by the world’s top performers;

- how to stop problematic addiction;

- why some people just aren’t motivated (and what to do about it);

- how to overcome cognitive decline and genetic risks;

- and other tips to improve your brain health.

I could relate to many of the personal anecdotes and appreciated the practical tips and examples that Dr. Amen included.

Click here for the full interview. Feel free to share the episode if you enjoyed it as much as I did — the world needs more of these messages getting through.

(If you’d prefer the audio version, click here.)

|

|

|

Ask Noel |

Question:

My father died recently and I had the onerous task of sorting through his financial affairs. He had a portfolio of CSL shares and we needed to get detailed records to establish the base cost. We contacted Computershare and were told it would cost $1500 for details of her CSL investment. My financial adviser and I thought that was outrageous. Do you think that’s fair?

Answer:

A spokesperson for Computershare tells me that the agent who prepared the quote mistakenly thought that you wanted 22 years of investment history rather than 14. Their standard fees are $380 to find seven years of a customer’s transactional information and $55 per year for any additional years. They apologise for the misunderstanding and as a gesture of goodwill will waive the fees.

Question:

How does Centrelink treat income received in the year of retirement. I received $46,000 in gross income to December 2022 and retired last December aged 75. I will not receive any further payments from this employment. My wife has previously retired. Will these earnings influence our chances of getting a small, aged pension. We have approximately $817,000 in Superannuation and other assets.

Answer:

A Centrelink spokesperson says that employment income, including termination payments, paid before you and/or your partner claim Age Pension are not included in the income test. The income cut-off point for Age Pension for a member of a couple is currently $89,211.20 combined per year or $3,431.20 per fortnight. This figure can be higher with the Work Bonus. The asset cut-off point for a member of a couple who own their home is currently $935,000 in combined assets. In most cases, the family home is not an assessable asset.

Question:

I have a Superannuation Lifetime Pension – the old style one that banks and Life Insurance companies used to have. It is CPI linked with a widows reversionary pension. When I started to fill in the application forms for the CSHC, it specifically mentions the Allocated Pension type of product, but I can find no mention of my type of Super. Your guidance would be appreciated as waiting on the phone to Centrelink for hours got me nowhere.

Answer:

I have good news for you. There is no need to declare details of your lifetime pension / defined benefit pension in the application for the CSHC. Only account based pensions and allocated pensions need to be advised as part of the application (as income is deemed for the CSHC) plus Adjusted Taxable Income based on your most recent Tax Notice of Assessment.

Question:

I am 87, a widower with my own home and in good health. I have $700,000 in shares with unrealised capital gains of $220,000. My son aged 62 is a top rate taxpayer, and my daughter aged 57 is in the second bracket. Both have their own superannuation funds. I am prepared to transfer shares off market to their respective superannuation funds if it helps reduce the capital gains tax situation. Then if I die suddenly it seems to me the children would have the choice of taking the CGT out of my estate or using my cost base and deferring the CGT. Your thoughts would be appreciated.

Answer:

Any disposal of the shares, irrespective of where the money’s goes, will be assessed for CGT unless they are pre CGT shares. In that case the longer they stay in your name the more tax free capital growth you will enjoy. Your heirs will inherit these pre CGT shares with a cost base of market value at the date of your death.

If you want to start the process before you die, you should sit down with your accountant and work out what shares could be sold to minimise your CGT liability each year. There may be shares with losses that can be sold to trigger a loss to offset capital gains. The other option is to leave certain shares to your children in your will, in which case your cost base will pass to them, and no CGT would be payable until they decide to dispose of those assets. This could well be after they stop work. It’s a matter of doing the numbers.

And finally

A sign in a shoe repair store in Vancouver reads:

We will heel you

We will save your sole

We will even dye for you.

A sign on a blinds and curtain truck:

Blind man driving.

Image by Eileen Pan on Unsplash

Sign over a gynaecologist’s office:

Dr Jones, at your cervix.

In a Podiatrist’s office:

Time wounds all heels.

On a septic tank truck:

Yesterday’s Meals on Wheels

At an optometrist’s office:

If you don’t see what you’re looking for, you’ve come to the right place.

On a plumber’s truck:

We repair what your husband fixed.

On another plumber’s truck:

Don’t sleep with a drip. Call your plumber.

At a tyre shop in Milwaukee:

Invite us to your next blowout.

On an electrician’s truck:

Let us remove your shorts.

In a non-smoking area:

If we see smoke, we will assume you are on fire and will take appropriate action.

On a maternity room door

Push. Push. Push.

At a car dealership:

The best way to get back on your feet – miss a car payment.

Outside a muffler shop:

No appointment necessary. We hear you coming.

In a veterinarian’s waiting room:

Be back in 5 minutes. Sit! Stay!

At the electric company:

We would be delighted if you send in your payment on time.

However, if you don’t, YOU will be de-lighted.

In a restaurant window:

Don’t stand there and be hungry; come on in and get fed up.

In the front yard of a funeral home:

Drive carefully. We’ll wait.

At a propane filling station:

Thank heaven for little grills.

In a Chicago radiator shop:

Best place in town to take a leak.

And the best one for last;

Sign on the back of another septic tank truck:

Caution – This truck is full of Political Promises

I hope you have enjoyed the latest edition of Noel News.

Thanks for all your kind comments. Please continue to send feedback through; it’s always appreciated and helps us to improve the newsletter.

And don’t forget you’ll get much more regular communications from me if you follow me on twitter – @NoelWhittaker.

Noel Whittaker