NOEL NEWS

He is terribly afraid of dying because he hasn’t yet lived.

FRANZ KAFKA

Welcome to our April newsletter.

First of all, let me thank you for your overwhelming support of my new book. Orders have been coming in non-stop, and I’m humbled by your confidence in me by buying a product yet unseen. It’s a fairly big book – 350 pages – with a wealth of information. Friends who have read the proofs have all been very impressed and particularly like the simple language and how well the book is set out.

The printing process has been much quicker than we thought and the books have now arrived at our distribution centre in Brisbane for posting.This means you should have your orders within 14 days, but let’s plan on 30 April to allow for delays in the post. If you haven’t received it by that date, just email me on noel@noelwhittaker.com.au and I’ll look up the tracking.

E-books

I’ve had many queries asking if there’ll be an e-book for Wills death and taxes.The answer is yes but it may be a couple of weeks. I’ll let you know in our next newsletter.

Estate Planning

I’m going to focus on estate planning for the next few newsletters and as part of this, I’ll further explain the questions I asked in the special bulletin. Here are the first four questions and their answers.

Image by Johnny Cohen on Unsplash

1. What 80% of people fail to do after they’ve made their will. The consequences may be horrendous

Less than 50% of Australians have a will, and research shows that most people leave it to their late 40s before getting around to making a will. What they fail to understand is that life is a dynamic journey and circumstances change. As a result, they never review and update their will, which may be inappropriate if major events have happened since it was made. These major events could include death, relationship breakdowns, children, changing jobs and moving house. In the book, we stress the importance of regularly reviewing the will. Think about a couple in their mid-40s with teenage children and parents in their 70s. Their family dynamics will be different in just 10 years. The children may be in relationships and have children of their own, and the parents may be contemplating a move to age care.

2. The difference between a superannuation member benefit and a superannuation death benefit. Not understanding this could cost hundreds of thousands of dollars in unnecessary tax.

A superannuation member benefit is paid to somebody who is alive and it’s usually tax-free. A death benefit means what it says: it’s paid on death. What you need to be aware of is that the taxable component of a death benefit paid to a non-dependent attracts a tax of between 15% and 17% depending on whether it goes directly to the person or via the estate. A recontribution strategy can reduce the taxable component, but the simplest way is to withdraw the whole balance before the member dies and place the money in the member’s bank account.

Just don’t get caught – there is an increasing number of cases being written about members who are very close to death and have instructed their people to lodge a withdrawal notice with the fund. Then they die after signing the documentation but before it’s received by the fund. That becomes a challenging situation, especially because the tax office is now taking a harder line and is less likely to treat the payment as a member benefit.

Image by Nicolas Gonzalez on Unsplash

3. A common misunderstanding about enduring powers of attorney.

A power of attorney document allows another person to act on your behalf – this is particularly important as people age and they may lose capacity. Once, a power of attorney lapsed if the donor (the person who gives the power) became incapacitated. The enduring power of attorney came into being to stop this happening, because so often the power of attorney is most needed when the donor is incapacitated. This is why it is called an enduring power of attorney. Unfortunately, many people wrongly believe it endures after the donor dies.

During our research for the book, we came across many cases of widows going to their bank to use the power of attorney because they thought it would last after their husbands died.

4. Which assets fall outside the will, and cannot be bequeathed in terms of the will.

The most common example is properties held as joint tenants whereby the property passes to the survivor, irrespective of the terms of the will. This can cause problems for age pensioners who hold shares and managed funds in joint names. We recommend they write their will to divide the assets so that the survivor can still keep the age pension when the partner dies. However, jointly-owned assets don’t have this flexibility. Other assets are insurance bonds which sit outside the terms of the will, superannuation where it’s the trustee who has the final say and any assets owned by a family trust or a family company.

| |

When I asked my accountant what are the main issues that caused hold-ups in finalising estates, she told me they were lack of record keeping and family squabbles. That’s why there is a big section on record keeping in Wills, death and taxes. I even added an appendix that explains a simple record keeping system. In those nine pages, I offer tips such as keeping separate folders for your home, investment properties and insurance. If you need a more comprehensive approach, there’s also a link to Julia Hartman’s Excel spreadsheet collection – and you get a discount if you buy it through that link.

|

Image by Sweet Life on Unsplash

But there’s more – we’re inventing an executors’ and attorneys’ cheat sheet to make available on my website. You’ll be able to download a fillable PDF form in which we’ve tried to include the things that apply to most people, and to prompt for the other many things that may be relevant to your situation. So it includes items such as the location of your will, contact details of your executors and relatives, and the whereabouts of the trust deed, if you have a self-managed superannuation fund.

It’s currently 41 pages long, but there’s no requirement to fill in anything at all – you can enter information as it comes to hand, or simply use it to check your existing records don’t have any major gaps. And there are handy ‘skip to’ links that help you jump past sections that are not relevant to you.

This unique document will be something you can save to your computer, retrieve and amend when you wish, and also print a copy to leave with your other estate planning documents.

We’d hoped to have the cheat sheet working at the time the book was launched, but it’s been a far bigger task than we imagined. So right now we have a PDF that you can look at on the computer, and download and print out, but at this early stage you cannot make any entries to it on the computer. It is not interactive. That’s our next goal.

| |

| When I asked my accountant what are the main issues that caused hold-ups in finalising estates, she told me they were lack of record keeping and family squabbles. That’s why there is a big section on record keeping in Wills, death and taxes. I even added an appendix that explains a simple record keeping system. In those nine pages, I offer tips such as keeping separate folders for your home, investment properties and insurance. If you need a more comprehensive approach, there’s also a link to Julia Hartman’s Excel spreadsheet collection – and you get a discount if you buy it through that link.

| |

| Image by Sweet Life on Unsplash

But there’s more – we’re inventing an executors’ and attorneys’ cheat sheet to make available on my website. You’ll be able to download a fillable PDF form in which we’ve tried to include the things that apply to most people, and to prompt for the other many things that may be relevant to your situation. So it includes items such as the location of your will, contact details of your executors and relatives, and the whereabouts of the trust deed, if you have a self-managed superannuation fund.

It’s currently 41 pages long, but there’s no requirement to fill in anything at all – you can enter information as it comes to hand, or simply use it to check your existing records don’t have any major gaps. And there are handy ‘skip to’ links that help you jump past sections that are not relevant to you.

This unique document will be something you can save to your computer, retrieve and amend when you wish, and also print a copy to leave with your other estate planning documents.

We’d hoped to have the cheat sheet working at the time the book was launched, but it’s been a far bigger task than we imagined. So right now we have a PDF that you can look at on the computer, and download and print out, but at this early stage you cannot make any entries to it on the computer. It is not interactive. That’s our next goal. | |

| |

We would love some of you to download this cheat sheet, print a copy and jot some notes on it — this will help you see what information you may need to track down. Then let me know if there’s anything about the form you think should be improved before we launch the interactive version. Maybe some parts are confusing, or redundant, or an important area has been missed… As always, it’s you — my readers — who make my work its best. The beauty of this web-based resource is that we can update it as needed. And this is why I’m asking for your help: we need people to try this out and send us feedback. |

| |

Whenever I give a presentation about investing, I ask the audience how much they know about franked dividends. It doesn’t matter whether they’re working or retired, the response is always the same: they know nothing. |

|

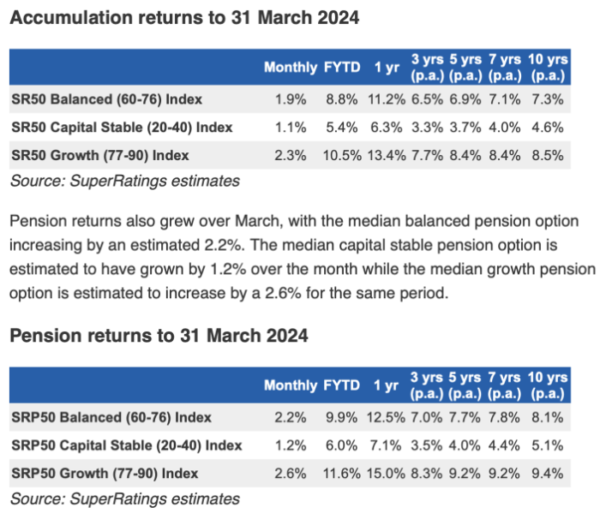

Superannuation

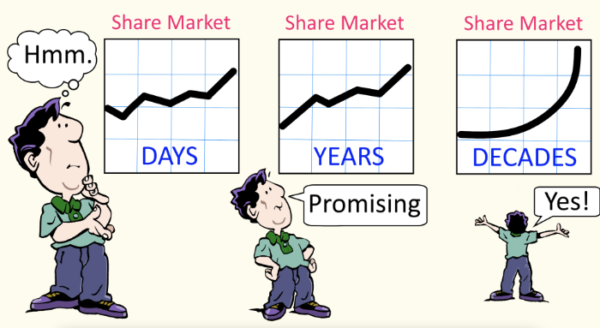

It’s been another great month for superannuation funds, and the returns for the three months ended 31 March have been very good for nearly all investments. But realistically, I don’t see good returns for the month of April. Markets are driven by what happens in America and the hoped for interest rate cuts have not happened because the economy is going better than forecast. Just keep in mind that markets do fluctuate and don’t get spooked by the normal short term volatility.

Noel’s Next Gigs

The first one is on Thursday 16 May at the Currumbin RSL on the Gold Coast.

View the invitation with all of the event details here:

The event has been capped at 190 pax and all attendees need to register.

The second one is on Wednesday 22nd of May in Townsville at 6 pm.

It’s been put on by the financial planning firm My Fortress I’ll be talking about the budget, the state of the economy and all the things you need to know for successful estate planning. Attendees, will be given a free copy of my new book Wills death and taxes made simple.

Looking forward to seeing you there!

| |

There are many trees around our home, which make it a haven for mosquitoes during the wet season. I’m a gadget freak, and over the years I’ve tried many gadgets that are supposed to keep the mozzies away and have had no success with any of them. Yes, you can use Aerogard but it stinks and I don’t like rubbing it into my skin.

Our daughter and her outdoor-loving husband have four children under 10 and have recently taken up camping. A few weeks ago she came over with a gift for us: a mosquito-repellent device that she said worked perfectly. I was highly sceptical given my experience with these types of gadgets, but we tried it and have been 100% satisfied from day one. |

| |

| There are many trees around our home, which make it a haven for mosquitoes during the wet season. I’m a gadget freak, and over the years I’ve tried many gadgets that are supposed to keep the mozzies away and have had no success with any of them. Yes, you can use Aerogard but it stinks and I don’t like rubbing it into my skin.

Our daughter and her outdoor-loving husband have four children under 10 and have recently taken up camping. A few weeks ago she came over with a gift for us: a mosquito-repellent device that she said worked perfectly. I was highly sceptical given my experience with these types of gadgets, but we tried it and have been 100% satisfied from day one. | |

| Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy eirmod tempor invidunt ut labore et dolore magna aliquyam erat, sed diam voluptua. At vero eos et accusam et justo duo dolores et ea rebum. | |

| It’s a Thermacell EX90 Rechargeable Mosquito Repeller Unit which retails for $99.99 at Bunnings and is about the size of a big mango. It is rechargeable, but the battery seems to last for a long time. All you have to do is put it near you when you are sitting around or eating. When you switch it on it emits an invisible and odourless vapour that keeps the mozzies away. I just wish we had found it years ago. |

| |

| |

The first person out of the starting gates when the book was released was Mary. I emailed her to congratulate her on being the number one purchaser. This was her response: “I should have mentioned that I read your book, Making Money Made Simple when I was a young teenage girl (I’m 59 now!) – such a great gift to give a young person the ability to understand the power of their own money!

I’ve ‘unofficially retired’ and manage my own SMSF as well as a number of investment properties (inside and out of super) and also have a lovely home. I’m keen to get your new books and hear your tips on how to navigate this stage and also understand super a bit more, including when is the right time to TTR. |

Anyhow, I essentially just wanted to say a big thank-you to you for being on my journey. As a financially secure single mother (since my kids were 3 and 5 years old), it’s made a huge difference having money and making independent and confident decisions throughout my life. I do hope one day my boys – now aged 18 and 20 – will also read your book and take the same interest in their financial well-being as I did! “

And Finally

I thought this was most appropriate in the current political world.

The Post turtle

While suturing a cut on the hand of a 75-year-old rancher, whose hand was caught in the gate while working cattle, the doctor struck up a conversation with the old man. Eventually, the topic got around to one of the political candidates.

The old rancher said, “Well, ya know, that candidate is a ‘Post Turtle’.”

Not being familiar with the term, the doctor asked him what a ‘post turtle’ was.

The old rancher said, “When you’re driving down a country road you come across a fence post with a turtle balanced on top, that’s a ‘post turtle’.”

The old rancher saw the puzzled look on the doctor’s face so he continued to explain.

“You know they didn’t get up there by themselves,

they don’t belong up there,

they don’t know what to do while they’re up there,

and you just wonder what kind of dumb ass put them up there to begin with.”

I hope you have enjoyed the latest edition of Noel News.

I hope you have enjoyed the latest edition of Noel News.

Thanks for all your kind comments. Please continue to send feedback through; it’s always appreciated and helps us to improve the newsletter.

And don’t forget you’ll get more regular communications from me if you follow me on X – @NoelWhittaker.

Noel Whittaker