Noel News

Special Bulletin

I’m thrilled to tell you that my new book Wills, Death & Taxes went on the printing presses last Thursday.

The catalyst for writing a book about estate planning was a bulletin from Finder claiming that 12 million Australians did not have a will and 60% have never given a thought to estate planning. That’s a serious situation – and a signal that many people are unaware of the complexities that can arise if proper estate planning is not put in place.

Recently I was having a chat to the guy who takes care of my garden, and I asked him if he had a will. He replied “never got around to it. It all seems too much trouble.” I responded “you’ve been married before haven’t you –and don’t you have any children from that relationship? He said yes to both questions. He got a shock when I told him that according to the laws of intestacy the previous family may get a bigger share of his money than he would like if he dies without a valid will.

Estate planning is a massive topic because it covers such a myriad of issues, many of which are uncertain. It’s not just the interplay of important topics such as tax, superannuation and Centrelink — the estate planning laws differ from state to state.

To this heady mix we add the many facets of human psychology. Many people just don’t get around to making a will, and even if they do, there are the other challenges of choosing an appropriate executor and handling the competing interests of family members. There are further complications due to the number of people living longer and re-partnering later in life, and also the possibility of diminishing mental capacity.

The cost of neglecting your estate planning can be huge – family squabbles, huge legal fees, plus delays and stress for the whole family.

And there’s more — many people I know have children living overseas, and over 50% of Australians were born overseas or have a parent living overseas. This brings the complexity of overseas assets and overseas beneficiaries into play.

Nobody is a specialist in all these areas, and I have been privileged when writing this book to have had invaluable help from experts in their field. The estate planning side was overseen by Kirsty Mackie, a solicitor in private practice who practises in both estate planning and family law; the tax section was co-written with Julia Hartman, a tax specialist in capital gains tax and deceased estates; and my guiding light in the superannuation section was Meg Heffron, one of Australia’s foremost authorities on superannuation.

Here are just a few of the issues you will learn about as you read this book.

What 80% of people fail to do after they’ve made their will. The consequences may be horrendous.

The difference between a superannuation member benefit and a superannuation death benefit. Not understanding this could cost hundreds of thousands of dollars in unnecessary tax.

A common misunderstanding about enduring powers of attorney.

Which assets fall outside the will, and cannot be bequeathed in terms of the will.

The major mistake made by many pensioner couples when they are making their will. Getting it wrong can cost the survivor their entire pension.

How to handle the complexities that occur when you are left a property situated overseas.

Strategies to prevent family squabbles.

What do you need to know if you wish to contest a will.

Why you need to be wary about accepting the role of an executor.

A major problem is we don’t know what we don’t know.

This book will put you on the right track

The best kind of assets to leave to beneficiaries who are overseas residents. The tax treatment is complex.

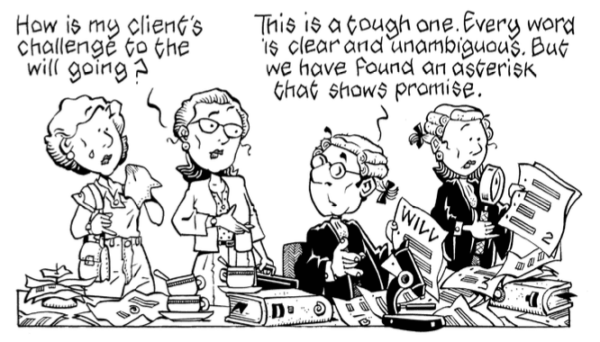

The main reason most wills are challenged, what to do to try to prevent this.

How to use testamentary trusts to prevent your beneficiaries from losing control of the money. This could happen because they are not able to handle money, are in a difficult relationship, or are running their own business.

The investment product that sits outside the will and is safe from challenge.

The importance of using up capital losses before death.

Whether you should have a nomination as part your superannuation fund, and whether it should be binding or non-binding.

A unique feature of the book is the anecdotes from readers.

Remember, last year I asked you to write to me with your experiences in handling estates, and I was overwhelmed by the number of emails I received. It’s okay to read the theory but nothing reinforces that theory better than real life examples. This is why I’ve dedicated the book to all of you.

What follows is just a few the many examples in the book:

“We had been living on my husband’s account-based pension; when he died, the executor told the fund of his demise straightaway. The fund stopped my pension immediately and it took them six months to restore it. The lesson here is that the executor should not have been so fast in advising the fund about the death of the fund member.”

“You will need lots of documents to be certified at multiple stages of the process. In the ACT there is a Justice of the Peace rostered on at each police station and they don’t charge for their services. You may have to go through a lot of possessions and paperwork in a short time if you are cleaning out a house. Check, check, and check again before you dispose of any paperwork. I got my piles mixed up and ended up throwing away some things I should have kept for capital gains tax purposes. There was no way of getting those back. It wasn’t the end of the world, but had I kept them, the estate would have saved a few thousand dollars in tax.”

“If you are cleaning out a dwelling, check everything for stashes. My grandmother had quite a bit of cash hidden in various places. We made a bit of a game of it, with the whole family going through everything and putting the money in a box in the lounge room. I was amazed to find that it totalled thousands of dollars. She had been through the wars and had learnt to save. It was pretty good going for someone on the pension.”

We can learn from our own mistakes which can be costly, or take advantage of learning from the experiences of others.

“We cancelled my father’s internet account soon after he moved into care, as my mother sold their apartment to fund his RAD and move closer to me. She did not use the internet or emails. We didn’t realise that closing his account would deny access to my father’s emails. There may have been emails that required attention, but we had to hope such a sender would get in contact by other means, such as mail. Fortunately, we had the password to my father’s computer — it would have been very difficult without it. We backed up all his files onto my computer and many of these files have come in handy in the years since his death.”

“All property should be protected (locked up) to stop looters — especially relatives who just walk-in and clean out whole areas without permission. The sheds on my uncle’s property were cleaned out by his brother-in-law of very expensive heavy machinery, and no one did a thing about it.”

“I was one of four executors for my mother’s estate, and we were appointed as joint executors. Because we all lived in different cities, when documents were to be signed, we had to use snail mail to each person in a round-robin arrangement to sign off each form as required. This was a real timewaster. One executor appointed at a time is more than sufficient. I suggest people appoint one main executor, with a couple for backup. Also, the executor’s permission should be obtained before the will is made.”

“My parents had joint bank accounts. When the bank was advised of my father’s death, access was denied for a week or so – I recommend withdrawing sufficient funds before advising the bank.”

“When my father had terminal cancer he changed his will. He wanted to make donations to a couple of cancer charities and, having a good knowledge of his financial position, nominated generous donations in his will. At the time the solicitor questioned his decision, suggesting that his wife could donate to the charities later, in her will. My father refused, saying that the charities needed the money now. Dad passed away a few weeks later and my mother started the lengthy process of applying for probate. During this period, the UK stock market (where my father had invested his wealth) took a dive and Mum sold all his shares to honour his legacy, but it left her with very little.

We appreciate Dad had honourable intentions, but he wouldn’t have wanted

my mother to end up like she did. My message is never to put fixed monetary amounts in a will, unless that money is not subject to possible decline. It’s better to allot using percentages or allocate on an asset basis.”

“Arranging a funeral after the death of a close family member such as a husband, wife, mother, father or child is incredibly traumatic. On top of the grief, you are expected to be on top of all of the required paperwork and also make detailed arrangements for the funeral. You are often left with no time to grieve as you are consumed with the “death administration”. Consider asking a sis-ter- or brother-in-law, close friend, or relative who’s not so directly impacted by the death to either assist or take over the funeral arrangements. My father died very suddenly and my sister-in-law stepped in and took over these arrangements. It was such a gift to us all to then be able to grieve rather than organise.”

Availability

The official launch date is 9 June to give time for the books to get from the printers to Simon & Schuster and then to the retail outlets.

However, as subscribers to my newsletter, you get priority access.

The retail price will be $34.95.

For pre-orders to subscribers it will be $29.95. Order now and you should have your books within four weeks.

And don’t forget it’s always cheaper to buy in bundles. It costs us about $11 to post just one book, but for the same price we can post four books. This is why all bundles include free postage.

Sending books overseas

I’m getting more and more orders for international orders and we now have a system to handle them. If you want to send a book to an overseas address just email me direct at noel@noelwhittaker.com.au and tell me what you want to buy.

I will then get a firm price from the post office and confirm with you before we finalise the transaction. Then all you need to do is deposit the money into my bank account.

Just two weeks ago a woman wanted to send a bundle to a family in Columbus, Ohio. Express shipping was $57 – it was there in four days.

I hope you have enjoyed the latest edition of Noel News.

Thanks for all your kind comments. Please continue to send feedback through; it’s always appreciated and helps us to improve the newsletter.

And don’t forget you’ll get more regular communications from me if you follow me on X – @NoelWhittaker.

Noel Whittaker