Noel News

“Make the most of yourself, because that is all there is of you.”

RALPH WALDO EMERSON

Welcome to another Newsletter

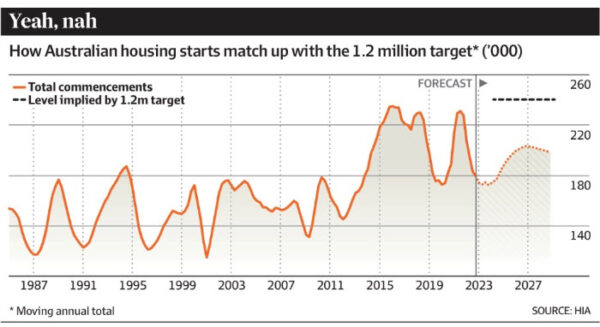

The big news last week was the housing summit, but unfortunately, I can see nothing proposed to solve the alleged housing crisis. There are two basic problems: too much demand and too little supply. The only way to cut demand is to cut immigration, which the government is not prepared to do, and building all these proposed new houses will put further pressure on the building industry, which cannot complete the jobs they have. I would hate to be building or renovating a house right now.

Then of course you have the Greens pushing for a rental freeze, one of the worst ideas imaginable. To increase the supply of rental houses, we need to make becoming a property investor attractive, not unattractive. If they want to freeze rents the government should be prepared to freeze rates, land tax, insurance and interest on the loan. You can’t attract investors by freezing their income at a time when their costs are going sky-high.

A Landlord’s Story

The following is an edited version of an email I received recently from a reader named Bob. I think it’s a perfect summing up of the current situation.

“I am 51 and fully employed. I bought a cottage in Footscray years ago – it has a $350,000 mortgage with an interest-only loan at 5.99%. My strategy has always been to leave the investment property on interest only and focus on repaying the non-deductible debt on my own home. The rental property has shown good growth and is now worth $900,000. The rent is $450 a week or $23,400 a year, which is a yield of 2.6% based on the valuation.

Yes, rents have been rising, but not enough to offset increasing costs. The interest for the year ending June 2022 was $9,600 but became $13,000 for the current year. That’s an increase of 36%. I believe interest for this year will be $21,000, which will be an increase of 62%. In just two years interest has increased by 220%. The increase in interest in those two years is $220 a week while the rent has increased by just $30 a week.

On top of this is an electrical and gas compliance cost of $1500, increased land tax, and large increases in insurance. Based on these assumptions, there will be a loss of $10,000 for the current year with the only silver lining being a tax refund of $4000.

As a strategy to curb inflation higher interest rates are having the opposite effect by putting pressure on landlords to increase rents to keep their own heads above water. Rent is now one of the major influences on domestic inflation.

I would like to get out, but the potential capital gains tax bill of $150,000 makes me hesitate. I now understand why some people invest all their capital in the most expensive home they can afford and live in it well while enjoying its CGT-exempt status. When it comes to pension time, the home is excluded from the assets test – the investment property is not.

Looking at all this in totality, is it any wonder we have generated a rental crisis?”

Interest Rates

Interest rates are always in the news and I’m not convinced there will be a pause at next month’s Reserve Bank meeting on 5 September.

Outgoing Reserve Bank of Australia (RBA) governor Philip Lowe has warned against premature celebrations in the central bank’s ongoing battle against inflation while flagging the possibility of additional monetary policy tightening in the future.

In his final appearance as governor before the House of Representatives standing committee on economics, Dr Lowe said:

‘We’ve made progress here, and things are moving in the right direction, but it’s still too early to declare victory.’ While describing recent data as ‘encouraging’ and consistent with inflation returning to target in the next couple of years, Dr Lowe highlighted two key risks that the RBA is focusing on, including the possibility that services inflation remains at high levels.

‘High services price inflation reflects a combination of factors, including strong demand for services in the wake of the pandemic, stronger growth in nominal wages and incomes, and weak productivity growth – this weak productivity growth is a particular problem for a number of reasons. Amongst these is that, in combination with a high level of aggregate demand, it is adding to the upward pressure on prices.’

The RBA governor noted that the central bank’s forecasts are based on productivity growth returning to near pre-pandemic levels. This, he said, would contribute to a moderation in the growth of unit labour costs and therefore inflation.

His summing up was: ‘Looking forward, it is possible that some further tightening of monetary policy will be required to ensure that inflation returns to target within a reasonable timeframe. Whether or not that’s the case will depend upon the data and the board’s evolving assessment of the outlook and the risks.’

But it’s a worldwide thing.

Minutes released last week from the American Federal Reserve showed that most Federal Reserve officials see ‘significant upside risks to inflation that may require more tightening’. Policymakers cited a range of scenarios that included the rising commodity prices that could lead to ‘more persistent elevated inflation’.

Two of them favoured halting rate hikes, but the minutes showed no official dissenters. The Fed economists also expect a small rise (only) in the jobless rate in the US, but they warned that commercial real estate fundamentals could worsen.

As I was writing this, I got a newsflash from the Wall Street Journal saying the average new mortgage rate in America is now 7.09%, the highest in 20 years. As the paper said, it’s a disincentive for people to buy, and a disincentive for people whose rates are locked in at 2% for 30 years to sell.

Aged Care

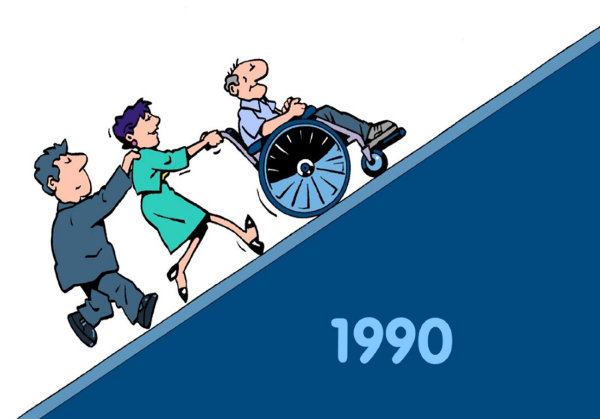

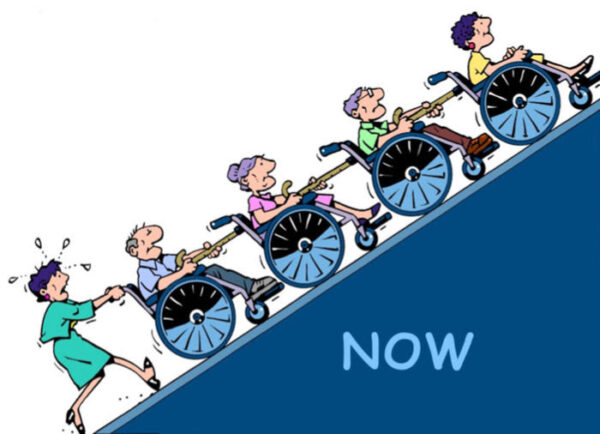

Challenges in the aged care system continue to dominate the news. The facts are not in doubt: people are living longer, and within eight years, the number of people over 75 is expected to increase by 101%. The problem is that the number of people between 15 and 64 – the ones who pay taxes to support older people – is forecast to increase by just 28%.

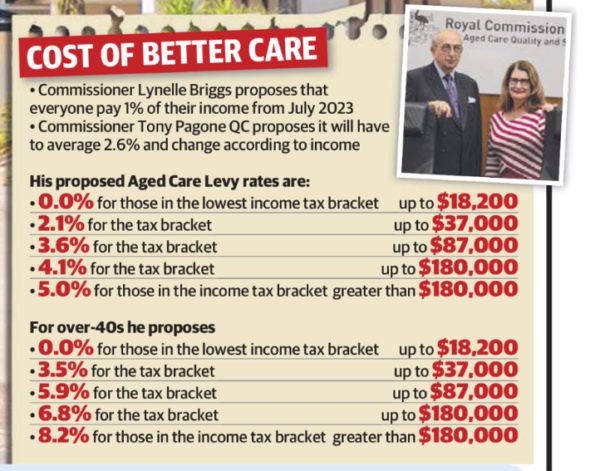

The ageing population is putting an increasing cost on the welfare budget and the big challenge is how to pay for it. It’s been nearly three years since the Royal Commission into aged care proposed a simple solution: charge an aged care levy, like a Medicare levy, on all taxpayers.

The commission recommended a minimum levy of 1%, which would rise with age and with taxable income. For example, people in the second tax bracket would pay an extra 3.6% of their income, while people over 40 in the same tax bracket would pay 6.8% of their income.

The proposition was ludicrous and sank like a stone. Most retirees pay no income tax at all. Imagine the outcry if workers, already slugged with rapidly rising mortgage costs, were slugged with a massive tax on their income while the oldies continued to enjoy a tax-free retirement. It was never going to get traction. Besides, suggesting that the rate of income tax you pay should depend on your age is ridiculous.

Last week ACCPA (Aged Community Care Providers Association) released an issues paper in which they canvassed the problem in depth and pondered ways it could be rectified. They considered ways to plunder people’s superannuation, but they are on dangerous ground here.

For years, the anti-superannuation lobby have focused on the fact that most retirees die with substantial money in superannuation. They see this as proof that they should never have been allowed to accumulate that much money in the first place. Suddenly, there’s been a change of attitude, and now there are suggestions that superannuation should now be earmarked for their aged care.

If you talk to senior Australians, however, you will find they have good reasons for going easy on drawing down their superannuation. They can all relate stories of friends who had sudden and unexpected health issues, which incurred massive costs. As far as they’re concerned, their super is their safety net, and they are not going to fritter it away.

The ACCPA issues paper also mentions an ‘inheritance tax’ for super but gives no details on how such an animal might be created. For starters, there is already a death tax of 17% on super, which applies to that part of the taxable component left to non-dependents. But in any event, because of the way our income tax system works, a retired couple could have financial assets of up to $800,000 in their own name outside super and pay no tax whatsoever.

If the government tried to hit super with an inheritance tax, people would simply cash out their super and opt out of the system. It’s never going to work.

So we are stuck with a situation where it’s not practical to tax existing taxpayers to fund the aged care of senior citizens, and special taxes on superannuation would never work because people would opt out of the system. The only solution available is to raise the GST to 15% with no exemptions. This would not only catch every Australian irrespective of age but would also raise a fortune from the cash economy. Finally, every Australian would be paying their fair share of tax.

There is also a misconception about how much wealthy people pay for age care.

A reader emailed me as follows:

‘What about raising the caps for the means tested fees for wealthy aged care residents?

My mother has a valuable share portfolio and a couple of term deposits and yet her means tested fee as an aged care resident is capped at $29,399 per annum and there is a lifetime cap of $70,559. Seems overly generous to me even if it increases our inheritance.’

Rachel Lane responded:

‘I think it’s important to bear in mind that the means tested care fee is just one component of the cost of aged care. Most residents pay the market price for their accommodation, anywhere between $300,000 and $3mil as a lump sum or a daily amount equivalent to that based on a government-set interest rate (currently 7.9% p.a.). Beyond that, they pay a Basic Daily Fee of $59 per day plus an additional service fee for any services above the prescribed care and services: a choice of meals, a glass of wine with dinner, entertainment, hairdressing, etc.

On top of those fees is the Means Tested Care Fee, which is currently capped at $31,706 p.a. and $76,096 over a lifetime. Uncapping the means tested is unlikely to solve the problem, as around 1/3 of aged care residents are classified as low means and either don’t pay a means tested care fee or pay a very small amount. Of the market price payers, you would still have a significant proportion who don’t have sufficient means to make them liable for the maximum amount. It would pick up the very wealthy, and there is an argument for increasing or removing the caps for that reason, but it wouldn’t solve the issue of how to fund care for everyone.’

Do you want to Win the Day?

If you missed the event that my son James and I were speaking at in Brisbane last month, you’re in luck. James will be the keynote at a free online event with Success Magazine, facilitated by its editor-in-chief, Amy Somerville.

He will be sharing tips on how to think much bigger than your circumstances, achieve your goals, and upgrade your daily routine.

Date: Thursday, 31st August

Start time: 8am (BNE / SYD / MEL)

More than 300 people have registered so far.

If you’d like to attend, all you need to do is click here and add your email address – or click on the image below. You will then receive a calendar invite with the event access link.

It’s a busy week for James because it also coincides with the release of Episode 150 of his Win the Day podcast. He will be interviewing Mark Victor Hansen who is the creator of the Chicken Soup for the Soul book series that sold 500M+ copies worldwide. The theme of the episode is that the size of your questions determines the size of your results.

Many years ago, I was asked to contribute to Chicken Soup for the Teenage Soul, so it’s fascinating to see James and Mark connect for what I’m sure will be a thrilling conversation.

You can subscribe to James’ podcast below:

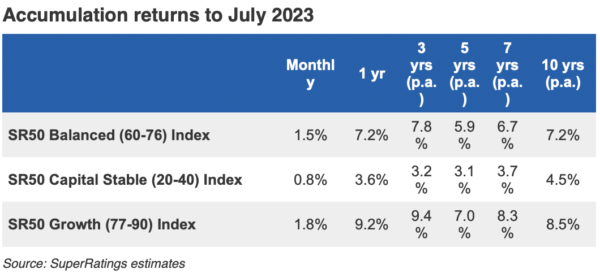

Super Returns

The median balanced option delivered a return of 1.5% in July according to estimates from SuperRatings, with funds continuing to build on the momentum in markets seen over the final quarter of FY23.

The impact of inflation continues to drive markets with most Australian and global equities delivering modest returns, while energy and commodities performed well over July. They expect returns will remain bumpy over the short term, despite the Reserve Bank of Australia taking a wait-and-see approach in both July and August, following indications that the tightening cycle is beginning to have a clearer impact on spending and consumption.

The median growth option rose by an estimated 1.8%, while the median capital stable option delivered a small positive result, with an increase of 0.8%.

Executive Director of SuperRatings Kirby Rappell commented, “Funds have had a strong finish to FY23 with the median balanced fund returning 9.1% over the year to June and it is pleasing to see funds maintaining that momentum into the first month of FY24.”

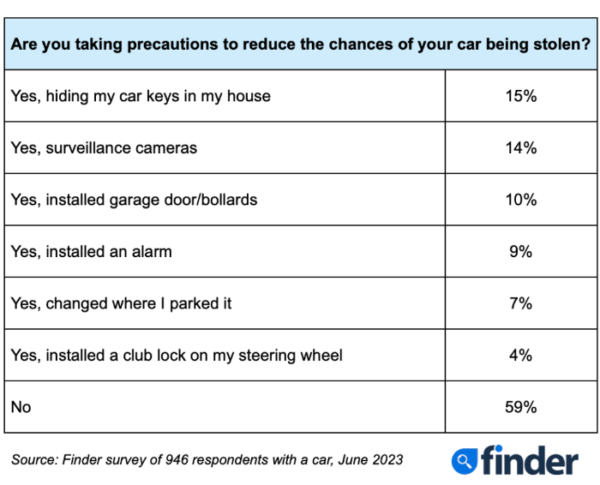

Protect your motor vehicles

Millions of Aussie motorists are taking precautions to reduce the risk of car theft, according to new research by Finder, Australia’s most visited comparison site. A Finder survey of 946 Australian drivers found almost half (41%) – equivalent to 3.5 million households – are taking additional measures to protect their vehicles.

The research found 1 in 6 (15%) are hiding their keys in their house, while installing surveillance cameras to curb car thefts (14%) was the second most popular anti-theft method.

Gary Hunter, car insurance expert at Finder, said, “Certain areas are witnessing a sharp increase in the rate of vehicle thefts, and fed-up owners are doing what they can to deter thieves. There’s a common misconception that car thieves only target new cars – but the statistics show the majority are a decade old or older.”

We live in a good area, but attempted car thefts are common. When we go to bed we turn on an alarm system that triggers the entire house apart from our bedroom. We also leave the side door to the garage unlocked because we figure the first place a thief will look is the garage to see what cars are in there. The moment they open the door the alarm will go off. We also keep our car keys in a safe, and the whole house is surrounded with security lights which come on the moment they are triggered. These deterrents are not hard to do and not expensive. I’m stunned 59% of people still take no precautions.

And finally

Air Traffic Control Gems

Tower: “Delta 351, you have traffic at 10 o’clock, 6 miles…”

Delta 351: “Give us another hint! We have digital watches!”

“TWA 2341, for noise abatement, turn right 45 degrees.”

“Center, we are at 35,000 feet. How much noise can we make up here?”

“Sir, have you ever heard the noise a 747 makes when it hits a 727?”

O’Hare Approach Control to a 747:

“United 239 heavy, your traffic is a Fokker, one o’clock, three miles, Eastbound.”

United 239: “Approach, I’ve always wanted to say this… I’ve got the little Fokker in sight.”

A DC-10 had come in a little fast and thus had an exceedingly long rollout after touching down.

San Jose Tower noted: “American 751, make a hard right turn at the end of the runway, if you are able. If you are not able, take the Guadalupe exit off Highway 101, make a right at the lights and return to the airport.”

A Pan Am 727 flight waiting for start clearance in Munich overheard the following:

Lufthansa (in German): “Ground, what is our start clearance time?”

Ground (in English): “If you want an answer you must speak in English.

Lufthansa (in English): “I am a German, flying a German airplane, in Germany. Why must I speak English?”

Unknown voice from another plane (in a beautiful British accent): “Because you lost the bloody war.”

One day the pilot of a Cherokee 180 was told by the Tower to hold short of the active runway while a DC-8 landed. The DC-8 landed, rolled out, turned around, and taxied back past the Cherokee. Some quick-witted comedian in the DC-8 crew got on the radio and said, “What a cute little plane. Did you make it all by yourself?” The Cherokee pilot, not about to let the insult go by, came back with a real zinger:

“I made it out of DC-8 parts. Another landing like yours and I’ll have enough parts for another one.”

While taxiing at London’s Gatwick Airport, the crew of a US Air flight departing for Fort. Lauderdale made a wrong turn and came nose-to-nose with a United 727.

An irate female ATC ground controller lashed out at the US Air crew, screaming:

“US Air 2771, where the hell are you going? I told you to turn right onto Charlie Taxiway! You turned right on Delta! Stop right there. I know it’s difficult for you to tell the difference between C and D, but get it right!”

Continuing her rage at the embarrassed crew, she was now shouting hysterically:

“God! Now you’ve screwed everything up! It’ll take forever to sort this out! You stay right there and don’t move till I tell you to! You can expect progressive taxi instructions in about half an hour and I want you to go exactly where I tell you, when I tell you, and how I tell you! You got that, US Air 2771?”

“Yes, ma’am,” the humbled crew responded.

Naturally, the ground control communications frequency fell terribly silent after the verbal bashing of US Air 2771. Nobody wanted to chance to engage the irate ground controller in her current state of mind. Tension in every cockpit out around Gatwick was definitely running high. Just then an unknown pilot broke the silence and keyed his microphone, asking:

“Wasn’t I married to you once?”

I hope you have enjoyed the latest edition of Noel News.

Thanks for all your kind comments. Please continue to send feedback through; it’s always appreciated and helps us to improve the newsletter.

And don’t forget you’ll get more regular communications from me if you follow me on twitter – @NoelWhittaker.

Noel Whittaker